Make The Most Of Your Money With 5 FREE Budgeting Apps That WORK

How do YOU budget?

We’d all like to be a little bit better with our money, right? But between the holidays to unexpected expenses, that goal can start to slip out of reach. Here are some awesome apps available to help you take control of your financial wellness… and the best part? They’re FREE!

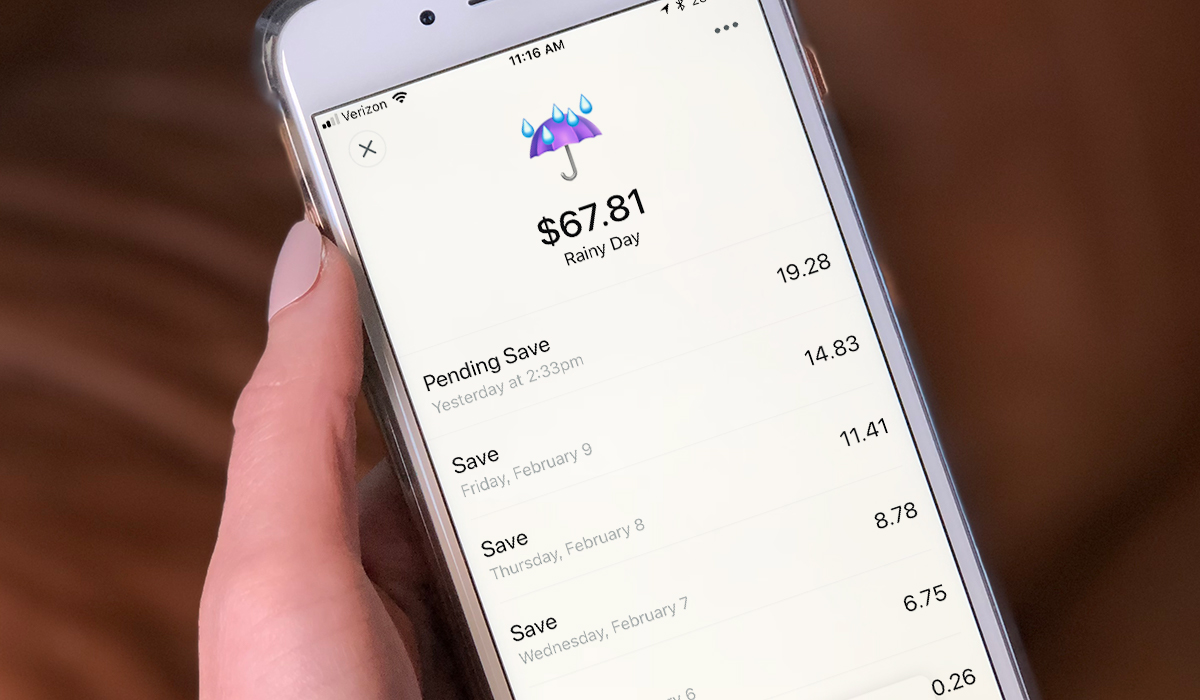

Digit

For those looking to save more money

Website | iOS | Android

FREE for 100 days, then $2.99 per month after the trial ends

This is probably the easiest setup of all the apps mentioned in this post. After logging in, you connect your checking account… and that’s it! You can set your own goals, but you’re given a “Rainy Day” account by default – and in my opinion, one general account is really all you need. After analyzing your income and spending habits, the app secretly transfers bits of money from your checking account to your Digit account.

While I like the “out of sight, out of mind” mentality of this app, I was slightly worried at first how these savings transfers would affect my bank account. Thankfully, Digit has a policy of unlimited withdrawals and a no-overdraft guarantee, making this app perfect for anyone looking to save money without having to think about it.

Mint

User-friendly, engaging visuals, all-encompassing

Mint is my budgeting app of choice and I’ve been using it for around 8 years now! Just sync all of your financial accounts in the app (whether they’re checking accounts, credit cards, mortgages, auto loans, investments, etc.), and Mint streamlines them in one visible space. You can create budgets, set goals, monitor spending, view transactions, and review vital spending information in easy to use breakdowns and charts.

Hip Tip: With SO much information available at a glance, access account overviews on the website instead of your tiny mobile screen for a clear view of everything.

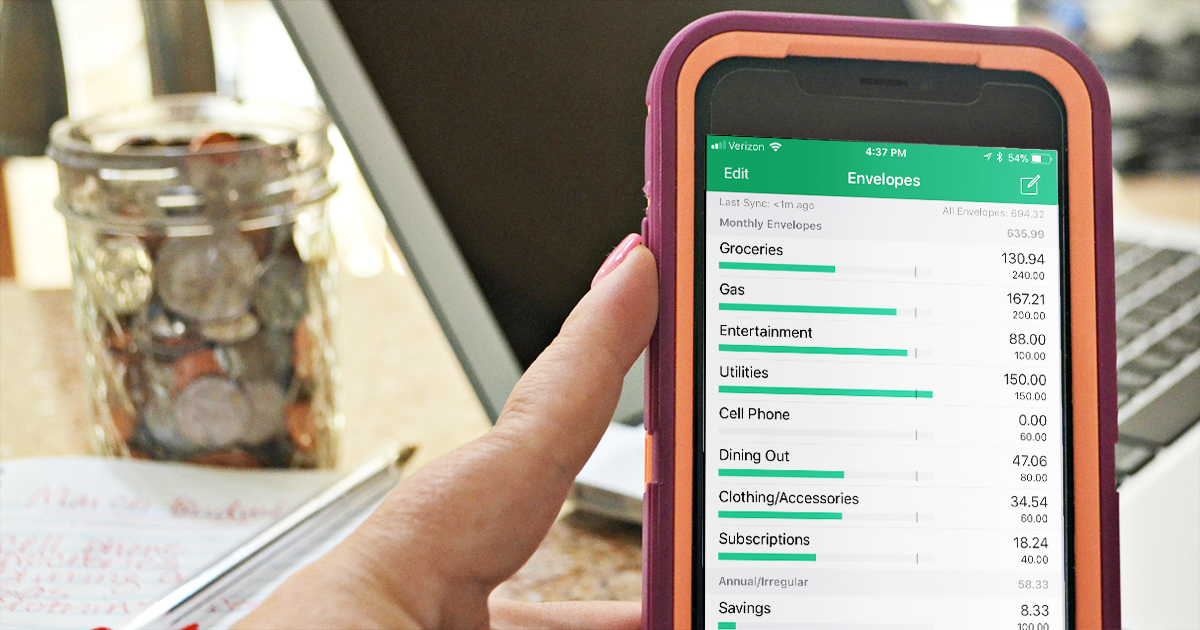

GoodBudget

Based on the envelope budgeting method

Website | iOS | Android

FREE | GoodBudget Plus option for $5.99/month to add more envelopes and budgets

What’s so good about GoodBudget is that it’s a virtual envelope system and it doesn’t require you to actually sync up your financial accounts. Having a digital envelope system is great for people who tend to make more purchases with credit cards rather than cash.

You simply open the app, create your envelopes (some example envelopes are pre-installed), and add transactions as they occur. You can also control when the envelopes are “refilled”. With your free account, you have 10 monthly envelopes for budgets like groceries, gas, and bills, along with 10 annual envelopes (great for vacation savings or holiday gifts). Adding the transactions is pretty simple, and you can even split the transaction between multiple envelopes. Once you log your transactions, you can view the breakdown of your spending with colorful, easy to read charts.

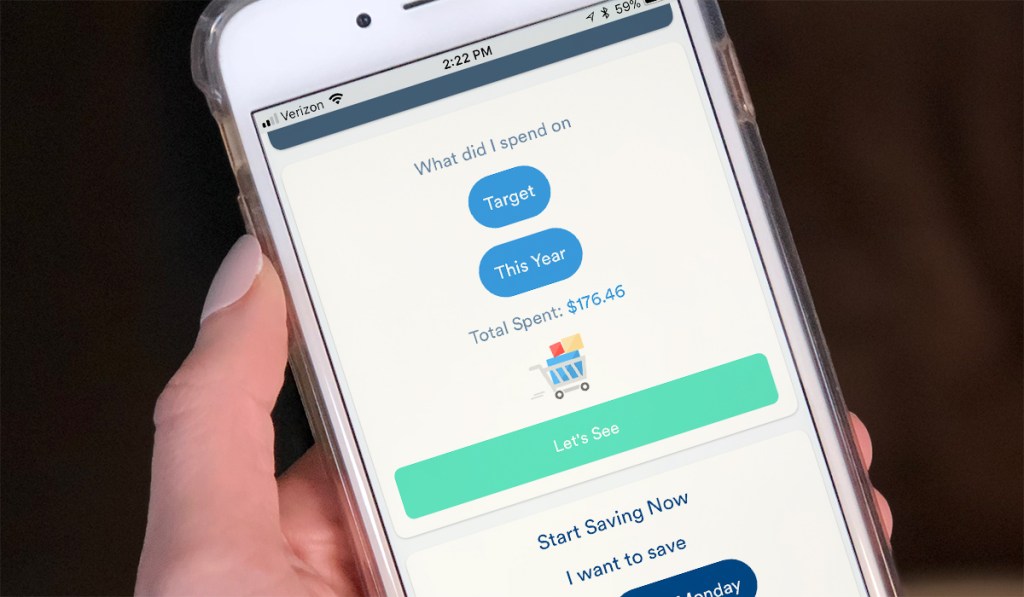

Clarity Money

Aims to reduce subscription spending and expenses

Similar to Mint, Clarity Money gives you the full picture of what’s happening between all of your financial accounts. After downloading the app, you create an account and sync in your financials. From there, the main screen is a clear overview of your cash, debt, and recent transactions. Clarity Money also gives you your location’s weather right at the top – not really helpful when it comes to financial wellness, but it is convenient.

My favorite feature (and most guilt-ridden) is the “What did I spend on” block. You pick the store and the time frame that you want to analyze, and then you can view the total amount spent along with a breakdown of the transactions. This app’s real claim to fame is the helpful advice on how to rid users of wasteful spending, lower bills, and find better deals on credit cards and other services. The app even has a live chat feature should you need any assistance navigating the interface.

PocketGuard

Simple budgeting with a clean interface

Website | iOS | Android

FREE | PocketGuard Plus available for $3.99/month to add cash account and additional features

Treat your cash like, well, cash! PocketGuard takes the information from your synced financial accounts to give you the scenario of what “cash” would be in your pocket. Like the rest of the apps, adding financial accounts is pretty easy. Once added, PocketGuard helps determine which transactions are reoccurring so you can easily identify bills and subscriptions.

This app is pretty no-nonsense and straightforward, and I really like that you can categorize transactions with #hashtags to group spending that may not fall into a typical monthly budget. For example, you can use #DisneyTrip to categorize expenses for an upcoming vacation or #ChristmasGifts for higher-than-usual spending around the holidays. The basic version of the app is free (and really has all you need), but you can upgrade to add in a “Cash” account for any money you don’t have tied to an online banking system.

Do you find budgeting apps helpful? How do you manage your money?

Every Dollar is an app developed by Dave Ramsey, and is so easy and user friendly!

I love Every Dollar. You have to set it up on a PC first, but then it’s smooth sailing from there.

I was able to set everything up in my phone.

While I’m sure you can do everything from your phone, I found it much easier to do on a pc. I should have worded it differently I guess.

I’ll have to check that out, Amanda! Thanks for sharing!

Has anyone used digit? I’m wondering if it worth the monthly cost?

Hi Mari, I’ve been using it for a couple weeks now and I really love it! I’m going to wait out my free trial until I have to start paying the monthly fee to decide whether I’ll continue using the app – but so far I definitely think it’s worth it. A free alternative might be to set up a reoccurring auto-transfer within your online banking account, but I know some banks change a fee after a certain amount of transfers though.

Can anyone recommend a mobile app that would be comparable to quicken’s or another check registry type program???

I use balance and I love it. When something clears I place a check mark on it.

The only problem I have encountered is when making a mistake on the the amount and using backspace the amount gets entered wrong. I just hit the back arrow and redo it.

I use “Checkbook App (Pro)” from the Google store (I think the pro was $2.99). It is absolutely bare bones and minimal, and I love it. I keep track of every penny with my debit card, so I have accounts set up for checking, savings, and HSA. Then I just manually enter the transaction in and my totals are updated. Once I see that it cleared in my bank account, there’s a checkbox in the corner. I really wanted a simple app that mimicked a checkbook and this is exactly it. There is also a spot for entering check numbers.

I’ve used digit for about 3 years. It is really good. It monitors your account and saves based on your activities and balance patterns. Some sort of algorithm. But just make sure to monitor because my account has almost gone into overdraft when it withdrew money and nothing was in there.

Oh and you get daily updates by text with account balance and funny messages. You can text back and it will respond. Easy to withdraw money and should hit your account between 24-48 hrs

The daily updates are my favorite part! The messaging portion of the app is so interactive. I’ll definitely keep an eye on my account though to make sure it doesn’t take my checking balance down too far. Thanks for sharing!

YNAB (You Need A Budget) – this app is NOT free but worth every penny to me. We have been using this budgeting system for over four years and it is the number one reason we were able to pay off our mortgage early. It forces you to be intentional with your money.

You go, Jill! 🎉 What an amazing accomplishment! I’ll have to look into that app for sure!

CO-SIGNED.

I love YNAB. I’m the kind of person who HAS to think about money and bills in terms of separate pockets or envelopes, and this is basically an ear-marking system. It makes it really easy to put money toward yearly bills so you aren’t panicking at the last minute and trying to cover car insurance or organization dues all at once.

I’ve got the old desktop software version 4. They’ve gone toward a cloud-based in-browser only system that involves a monthly/yearly payment to access. It has a small learning curve, but if you commit to the mindset and really use it, it can be very useful.

YNAB is a lifesaver. I am currently on a one year free trial for students, but it will be one yearly payment that I will pay with a smile.

YNAB offers a year free if you are a student.

I have to add that I LOVE YNAB, too! I’ve tried other budgeting programs and never lasted very long on them. YNAB clicked for me and I have been using it for 20+ months. If all goes as planned, we should have all our debt paid off (except mortgage) by the end of this year. There is a learning curve, so a little “trial and error” the first month or so, but you can start a fresh budget at any time, as you make refinements along the way. I love that YNAB holds the money in your budget from month to month, so you don’t have surprises when those semi-annual/annual payments come along. (This was always an issue when I did it with paper and pencil–keeping track of $ set aside for later.) When I first signed up you could pay monthly or yearly for the service, but they have since gone to a yearly fee only—which kind of disappointed me, since many people that need YNAB can’t afford the annual price up front. They do offer a 34 day free trial and if you Google YNAB, you might begin to see some ads/popups for 2 months free. Anyway, just my 2 cents, but YNAB rocks!

They will give you an extra month or 2 in the trial if you ask for it. I was t ready to make a decision after the trial period was up and ask for 2 more months to tiral it before I bought it and they agreed. That was 2 years ago and we are still going strong on it!!!!

Love, love YNAB too! I’ve had it for about 2 years, I think (still have the old version) and it has truly saved me from so much stress about money. We haven’t paid off our mortgage or anything that amazing but I no longer have to wonder where the money will come from to pay off bills that are twice a year, etc. It just really is a clever way of thinking about how you spend money you have vs. money you will have. It can take a little while to learn but they have amazing tutorials online and it truly has been a blessing to our family.

I used to use mint but after there last update it doesn’t link to any of my accounts so I no longer use it

That’s good to know. I was leaning toward that one but that was the biggest complaint I saw about it.

We use Mint but find it kind of glitchy – a lot of manually inputting charges and a lot of duplicates that we have to delete or re-categorize. Excited to try some of these suggestions. YNAB was too complicated for us in our opinion. I probably should give Every Dollar a valid go because my husband and I teach FPU consistently. 🙃

Two suggestions. The more you use a debit or credit card the less you’ll have to categorize manual. Only time I enter anything manually is when I purchase something for cash. Also make sure you use the rules option. Once set up, it reduces most of the recatorigation and deletions. It is also a great way to combine all your transactions to download to your personal excel file.

I’ve been using Mint for years and had problems a while ago with accounts syncing, but everything seems to be fixed now (at least for all of my accounts). I absolutely love Mint! If you dedicate the time to teach it what categories your purchases belong to, it’s well worth it.

I’ve been on Mint for 7 months. I keep it updated with the latest versions. I’ve never had a problem with links. I highly recommend this app.

We use every dollar and love it – also free.

I use bills monitor. It doesn’t require and monthly or yearly fee and also doesn’t require for you to give them any account info. It takes a while to enter the name amount and frequency but once the info is in it places them all on a calendar and shows when they’re due.

We’ve used Every Dollar for 2 years. LOVE it. Syncs with phone, online, wherever you have it installed. If both you and spouse use it, it updates when either party enters their purchase/spending, so you always know where you are at in the budget.

I’m wokring on saving my $$. While I LOVE free stuff, especially apps that can help me save/earn $$. I find it hard to even consider spending $2.99 or $3.99/month to do so – I would be spending $35.88 or $47.88 per yr – which, in some case could be a minimum of 2 gallons of gas, twelve to 15 pounds of beef roasts, etc. I’ll stick to my head, coupon file and bank acct/cc accts. I always try to consider all of the angles. My take on it is that I, myself won’t spend $$ to save $$ – because, my spending to save is costing me 🙁

I agree. I think everyone should do what works best for them, for sure. I’m still just such a pencil and paper kind of person. I keep track of our budget on paper, track every expense, balance my checkbook the old fashioned way… I do track our yearly expenses by adding our monthly budget breakdowns to an Excel spreadsheet, but that’s as tech-y as I get. Even if my system is more complex than it needs to be therse days, it works for us. 27 year old stay at home mom with two young kids and our only income is my husband’s paychecks and my coupon hustle 😉 and our only debt is our mortgage.

YNAB is the best!