I’ve Saved Over $700 in Just One Year with Acorns!

Savings are just an app away. 💰

There’s an app for just about everything these days, but what if I told you there’s an app that can get you investing all of your spare change and building your dream retirement fund in less than 5 minutes? The best part about it all… the app is free to download and you’ll only be paying as little as $1 a month or up to $5 for your entire family to grow your oak! 🙌

I’ve been using the Acorns app for one year & between my savings and investments – my account value is over $700! My only regret is not starting sooner!

I am by no means an investing or savings expert.

However, I was looking for an incredibly easy way to invest and boost my monthly savings even more, so when I found out about Acorns and the simplicity of getting started, it was a no-brainer for me! It’s been very eye-opening to what I’m capable of achieving on my own and has me so excited about my future!

Read on for my honest review of the Acorns investing app!

Helpful tip: If you finish reading this post and have questions about Acorns, investing, retirement, or finances in general, we recommend speaking with a finance professional to help guide you. We know you work hard for your money, and while we love helping you save it, there are other individuals out there who can help you make it grow!

What is Acorns?

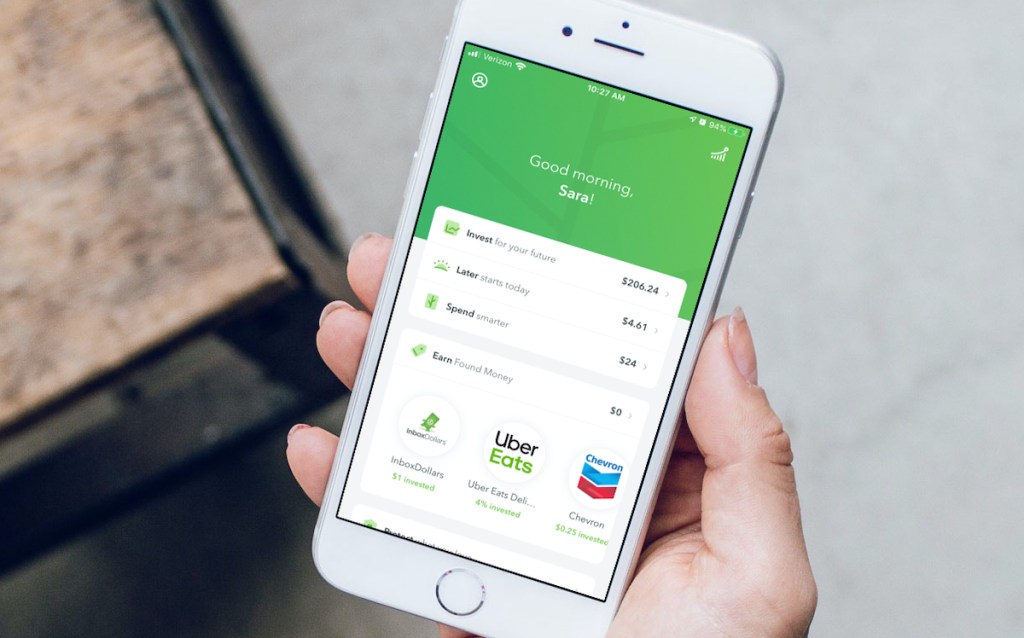

Acorns is a full financial wellness system right at your fingertips! It’s truly the easiest and most low-stress way to start saving and investing for your future with tools to meet all your financial goals. In fact, their goal at Acorns is to make it so simple, that investing and growing your “oak” can truly be for anyone!

Here’s how I got started on Acorns in under 5 minutes:

To get started with my very own all-digital banking system (AKA: Acorns) all I needed was my email and a password to make an account. Then I linked my regular checking account, which was also super easy.

They just asked me a few security questions and some personal information, like my address, legal name, etc. They also had me answer some security questions so my new Acorns account is protected.

Once I was in, I created my profile, which allowed me to elaborate on what I was looking to get out of Acorns. They help you determine how aggressive (or not so aggressive) you want to be with your investing and the great part is that you can always make changes down the road! Above, you can see 3 of the options I was provided.

You can also choose when you’d like to be able to access your investments based on your needs. There are options to access your money within the next 5 years if you want to purchase your first house or you can hoard all your earnings for 20+ years for retirement.

You do have to set up recurring deposits with an existing bank account when starting your account, but they can be as low as you want and they can be turned off at any time. Just remember, you’re account won’t reach its full potential without these recurring deposits.

If you’re feeling flush with cash from time to time, you can even make one time deposits for any amount you’d like and reach your savings goals even quicker!

Since starting my Acorns account, I’ve managed to DOUBLE my weekly deposits.

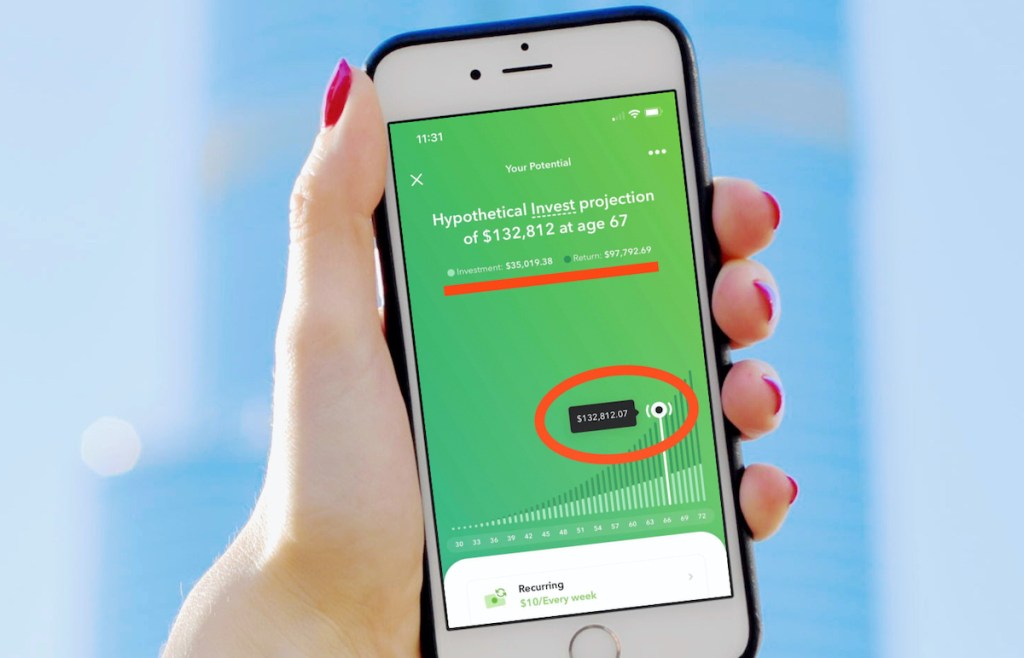

When I started Acorns, I was depositing $5 per week and now I’m comfortably doing $10 a week. I figure I drop more than $40 a month on sushi so why not invest AT LEAST that into my future?! 🙃

It doesn’t seem like much but even just a little bit makes such a huge difference in the long haul and at my current rate, I’m projected to have over $130,000 by retirement. Not bad for something I don’t even realize is growing every day. 😏

There are also additional ways to grow your Acorns account:

1. Found money:

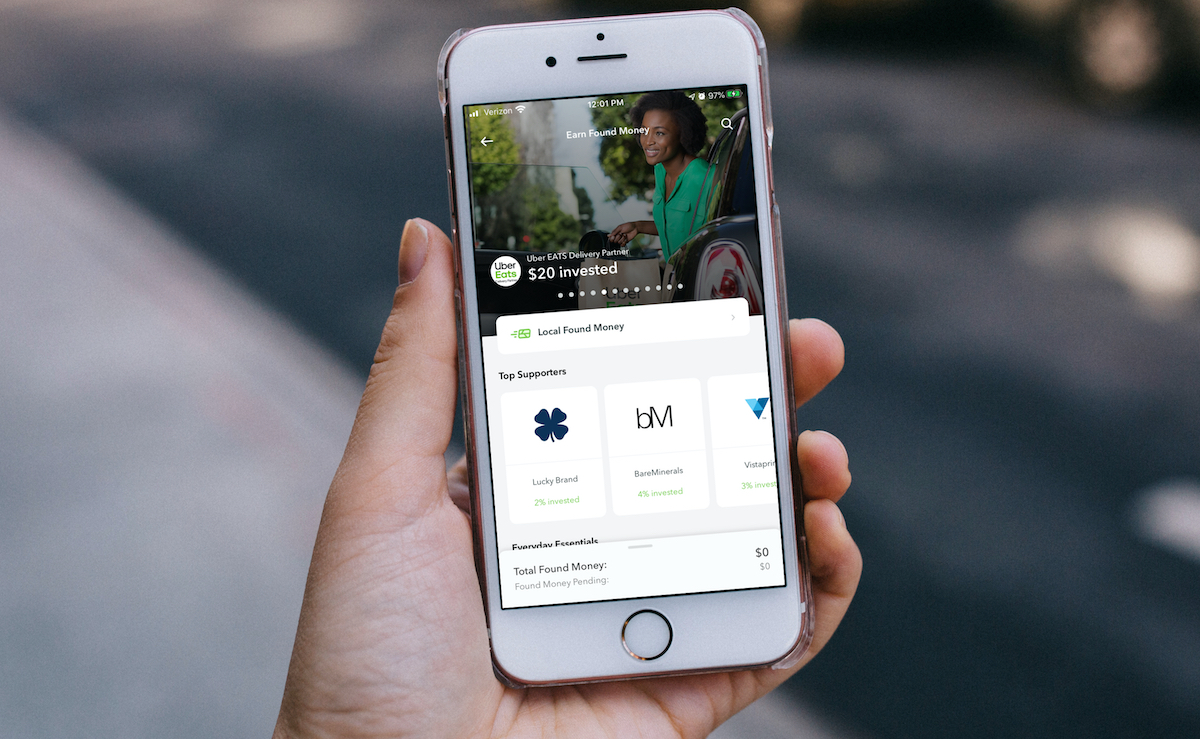

More than 300 major brands, like Nike, Grubhub, and so much more, have partnered with Acorns, so now every time you make a purchase with any of these brands, they’ll invest a percentage into your growing account.

There are two ways you can earn found money with your new Acorns account:

1. Found Money section (in the app).

This is how most brand partners allow you to invest. They just require you to make your purchase after tapping on the brand’s link in the Found Money section of the app. They even offer Local Found Money when shopping small! Just be sure to complete the purchase in the same session.

2. Simply Spend

For brands marked Simply Spend, just use your linked card or Spend Card (I’ll talk about this more below) to your Acorns account when you make a purchase.

2. Round-ups:

Every time I make a purchase, like coffee at Starbucks or fill up with gas, it will be rounded up to the next dollar and put into my new Acorns account for any cards that you have linked. For instance, if I buy a fancy coffee for $6.10 then my Acorns account will round up $.90 for me to invest.

Just note that these round-ups do come from your own linked account, but I have found these small round-ups to be insignificant and it’s so much easier to balance my checkbook when everything is an even dollar! 🙌

In the last month, I’ve had $36.99 just in round-ups & the best part is I didn’t even notice!

To activate the round-up feature, all you have to do is link your most used debit (or credit) cards and they’ll take it from there! Easy peasy! In fact, immediately after linking my cards, it listed all my recent purchases so I could choose to start investing right away – which of course I did!

Even purchases that are an even dollar will round up to the next dollar and be added to your Acorns account. After you reach $5 in round-ups with your linked cards, it will be deducted from the checking account you have linked and go directly into your Acorns account. Unless you get their sleek new Acorns Spend card…

And yes, I totally recommend getting this card! Plus, it’s another easy way to save & invest!

The Acorns Spend card was free to apply for and it’s linked directly to my checking account. It’s also made of tungsten so it’s heavy-duty, built to last, and unlike any other card you probably have sitting in your wallet! I’m telling you… it is SO worth it and I feel super fancy when using it. LOL!

In order to receive your Acorns Visa Debit Card, you’ll need to upload a valid photo to verify your name and address. This can include a utility bill, phone bill, or standard forms that your local DMV would accept.

After snapping a photo, you’ll just have to wait a few business days for it to be approved. After approval, it will take a few weeks to receive your flashy new card, so make sure to apply for it sooner rather than later. Also, it does appear that recently Capital One opted out of being able to link their cards, so in the case, you’re a frequent Capital One user, all the more reason to get an Acorns Spend card. 😉

The Spend card isn’t just pretty, it also comes with tons of additional, amazing benefits:

1. Real-time round-ups: Real-time round-ups are an awesome feature. This allows you to invest round-ups instantly with every transaction you make as opposed to waiting to reach $5 through the app every time.

2. No overdraft fees or minimum balance requirements: Enough said!

3. Reimburses any ATM fees: Yay!

4. A 3rd way to earn Found Money: Now you’ll not just have access to found-money, but you can also earn local offers from many local restaurants and retailers like when you stock up with Walmart Grocery, order food on Grubhub, and spoil your pets with Bark Box subscriptions. Some will invest up to 10% back when you shop with them.

5. Peace of mind: Your card and account are FDIC-insured up to $250,000 so you can freeze your card from the app if it’s ever lost or stolen.

6. Access to Acorns Grow: This is basically a blog in the Acorns app to help you along the way with any questions you have or the best strategies to get the most out of all your accounts.

Plus, some companies give you cash bonuses just for making a purchase!

I’ve seen up to $30 being offered from various companies, like Uber Eats, just for completing a purchase through the Acorns app! So, if you’re already planning to make a purchase, it’s literally like free money in your pocket! Sweet!

Just note it can take up to 120 days to see these contributions into your account. But hey, we’re in this for the long haul, so it likely won’t make much of a difference.

There are 2 other Acorns accounts you can have once you start your Investment account:

While I don’t currently have them, I’m going to share a little about them both to help grow your knowledge.

1. Acorns Early (investment account for kids)

This is a new feature that came out since I started my Acorns investment account! Acorns Early is a convenient custodial brokerage account that lets you invest for your kiddos since they can’t technically do it on their own until they’re 18 or 21 (depending on the state you live in).

It’s $5 a month which not only includes the ability for multiple kid’s accounts, but also includes your Invest, Retirement, and Spend accounts too!

Here are the benefits to starting an Acorns Early account:

- Your money is able to compound over time. Meaning starting your kids early can mean early returns may lead to even greater returns later – i.e. more money for their future!

- It can be used much more broadly. 529 plans only allow your children to use toward educational expenses, whereas Acorns Early can be used for anything they need once they receive the funds.

- They have access to the same investments as Invest and Later accounts. Kids will have the opportunity to have an aggressive portfolio since their young age allows them more opportunity to accept more risk and seek greater rewards over time. (Historically, the stock market has recovered and grown significantly after each of its short term dips.)

2. Acorns Later (AKA, your future retirement fund).

Also, just $5 a month (which includes all the above accounts I’ve already discussed), Acorns Later is a retirement account that also gets linked from your checking or savings account.

It’s recommended to do this if you don’t already have a retirement account unless, of course, you don’t mind having your money in more than one place.

If you already have a 401K with your employer, Acorns Later still might be a great option, because no one ever complained about having a little extra money set aside. 😉

They will offer customized portfolios based on your age, income, and other factors you’ll want to consider when starting your nest egg. Plus, they manage your portfolio for you by doing all of the balancings and necessary adjustments to reflect your account’s aggressiveness.

Acorns Later offers Traditional IRA, Roth IRA, and SEP IRA’s:

Acorns Later Traditional IRA: This is the most common type of IRA. You can make tax-deductible contributions and your earnings won’t be taxed until you withdraw them in retirement, which the IRS says is 59 1/2 years old. If you need to withdraw before you’re 59 1/2, you’ll probably owe a 10% penalty, as well as taxes.

Acorns Later Roth IRA: To qualify, you must make under $135,000 individually, or under $199,000 as a couple. Your money grows tax-free until retirement (59 1/2 years old says the IRS) but your contributions aren’t tax-deductible. You can withdraw from your contributions before you’re 59 1/2 without tax penalties, but your gains may be taxed.

Acorns Later SEP IRA: This is a variation of a Traditional IRA, but is for self-employed persons. Contributions are tax-deductible, and your money won’t be taxed until retirement. You can contribute up to 25% of your total compensation or $55,000 a year.

To learn more about each Acorns Later retirement option, click here.

Feeling a bit lost? Don’t panic. Acorns will ask you questions and help you determine which retirement account will be best for your future.

Having both a regular investment account (Acorns Invest) and a retirement account (Acorns Later) can help by allowing you to put away money for retirement and money for all of your short term goals in the decades before.

The process has truly never been more seamless or easy, until now! 🙌

Still not convinced? Read some of the amazing Hip2Save reader feedback we received:

“I’ve also been using Acorns for a year now and I can honestly say I love it! My money goes out every Monday and I currently have a moderately conservative portfolio. I like that I still have access to the money and when I have needed some of it on a rainy day, I have had no problems withdrawing from it. I love that it feels like hidden money and everything happens automatically!” – Hip2Save reader, Marie

“I love my Acorns a lot! I use it for long term investment. You choose the level of risk. Higher risk is the potential for a greater reward. I’m in moderately risky, and while I’ve already experienced drops it’s presently up more than it ever has been!” – Hip2Save reader, Janette

“I can honestly say that as a family who’s been using Acorns for just over a year- it really is amazing how quickly your spare change & round-ups happen! We are looking to spend our funds on an upcoming vacation. I know it was our money all along, however, it just feels like free money since we saved pennies a little at a time.” – Hip2Save reader, Matthew

I would so appreciate if someone could use my link to sign up thank you.

Start investing with Acorns today! Get $5 when you use my invite link: 5MTL6N https://acorns.com/invite/5MTL6N

SM. I will use your referral link!!!

Are there penalties for using the money now, if it was needed?

On the invest account the only penalties are possible tax liabilities and that it my take 3-6 days to get the funds. It is just like selling off any stock. I also have a Roth IRA with them which would have penalties for taking out funds. Hope that helps!

Thanks so much!

Hi Polly! Here is what I found on that –

“Can I Withdraw Whenever I Want?

-You can transfer funds from your Acorns Spend account to an external checking or savings account any time without penalty.”

You can always contact customer support for any further details on that.

Awesome, thanks!

You’re very welcome!

I want to download the acorn app and there are two different ones. Which one should I download?

Hi there! Be sure to grab the app link above that works for your device. The name is “Acorns – Invest Spare Change”. Hope this helps!

Been using this app for 5 plus years . We are able to take a tropical family vacation every year . Plus have extra cash!

Wow! That’s awesome to hear! Thanks for taking a moment to comment!

I use it as a slightly different way of saving. I add $10 a week and just let it build up. We usually take a vacation every year, sometimes big, sometimes small but we usually use the acorns money as a little extra fun money. We don’t put anything on credit cards so it’s nice to have some meals and fun stuff paid for without having to really think about it.

I have used Acorns for years and LOVE it. You don’t even notice the money accumulating.

If anyone would like to use my referral link I would really appreciate it. Thank you!!!

https://www.acorns.com/invite/LAYUT6

For those using this app to save for a vacation, do you find that he return on investment is higher than the interest earned on high interest saving accounts? Since they invest your money, if you’re saving for a house, what would happen if the market suddenly crashes? I assume you’d not only lose any interest by also the initial investment.

The rate of return on my account right now is a bit over 30%, so much higher than a savings account. It is the stock market, so you can take a hit when the market dips, including on your initial investment. This is only a problem if you need to remove money during a low time. So I just put money in my account that I know I won’t need for any imminent thing. My account took a hit in the beginning of Covid but is back up to higher than before right now.

How much do they charge monthly to keep these accounts open?

Depends on the one you choose. $1-$5

I love big acorns, but there’s one issue I have with it and wanted to pass along info. Please understand that it does not take your round ups immediately. Sometimes it can take up to 7 to 10 days for them to take them out and they take them out in one big chunk. Meaning they’re not taking out $.42 they are saving it up until a week has passed and sometimes might take out $28 in one shot. So, just be prepared for that.

wow thanks for heads up!!

You’re welcome

Hey Jadie, I just wanted to make sure you had accurate information about the round-ups. You can set them to come out as low as $5 with your external cards and with the Spend Card they come out automatically after every transaction. I hope this makes sense.

Thanks so much for the helpful comment!

You’re welcome 😉

I have been using it for a long time. When you hit $5 in roundups then they take the money out. I have never had something like $28 taken out.

It says it in the information about the round ups that once you reach $5 in roundups they take $5 out. You should check to see if you have a multiplier on it where your round ups are multiplied by 2x, 3x, or 10x. You might also have a certain amount take out of your checking each week or month? The roundups don’t take that much at a time.

Hi there, Crustycat! You can actually go into your account and customize the dollar amount for your round-ups you want to reach before it’s taken out of your account. I have mine set to come out once my round-ups reach $5 each time so it sounds like your external cards are set too high for you. This is also another reason I love using the Acorns Spend card because when you make purchases with it, round-ups are automatically taken out with every transaction and therefore much less noticeable. I hope this helps!

My money has growth much more since i started using this a year ago. I would appreciate if anyone use my link to Start investing with Acorns today! Get $5 when you use my invite link: https://acorns.com/invite/8HZM93

Hi! I used someone else’s referral link so I would be grateful if someone would use mine 🙂 https://www.acorns.com/invite/C7CPMC

I just signed up after reading some of the comments! Here is my referral link to anyone else as well!

https://www.acorns.com/invite/VHPVHJ

Please use my referral link! You will get $5 for signing up! Just copy and paste the link!

https://www.acorns.com/invite/C7CPMC

Can you still have an Acorn later account if you deposit maximum allowable amount in your 401k every year?

You can have more than one retirement account, Jen! That’s up to you, but if you want it all in one place, I would stick with the 401k you already have. 🙂

The stock market DOW and Nasdaq are pushing all time highs again so if you got in anytime last year let’s say mid March when the market crashed and anytime up to September before it made a decent comeback than you probably have had a pretty good return with Acorns. I prefer investing on my own in the stock market, I use eTrade. If you set up your account today your are going to be sitting on the peak so more than likely you will see your account drop before it makes a comeback somehwere down the road. I think the market is due to a correction with the very high valuations of companies when COVID is still upsetting the economy. Just my thoughts! Good luck to all!

I’d love for someone to use my referral link! I love Acorns!!

Start investing with Acorns today! Get $5 when you use my invite link: https://www.acorns.com/invite/TJ5NQJ

I just used Whitney’s Link. I would love for someone to use my referral link. you will get $5

https://www.acorns.com/invite/

Thank you!

Sorry, the link didn’t copy the first time.

Get $5 by using this link.

https://www.acorns.com/invite/SHK9WL

When I bring up the Acorn app, there are 2 of them. So which one should I download?

Hi Mollie! You can grab it through the app link above that works best for your device. The name is “Acorns – Invest Spare Change”. Hope that helps!

Please use my referral link! You get $5 just for signing up! https;//acorns.com/invite/D5VB6B

Start investing with Acorns today! Get $5 when you use my invite link: https://acorns.com/invite/D5VB6B

A couple tips! They often have promotions for getting friends to join. A great way to get some extra investments! Also if you register with a student email address you can qualify for a free subscription.

Use my referral link and get $5 free in your account! https://www.acorns.com/invite/M9ZXNV