**7 of the Best FREE Online Tax Filing Options

Looking for free online tax filing options? Here they are!

Tax season is coming! Check out 7 of the best FREE online tax filing options available!

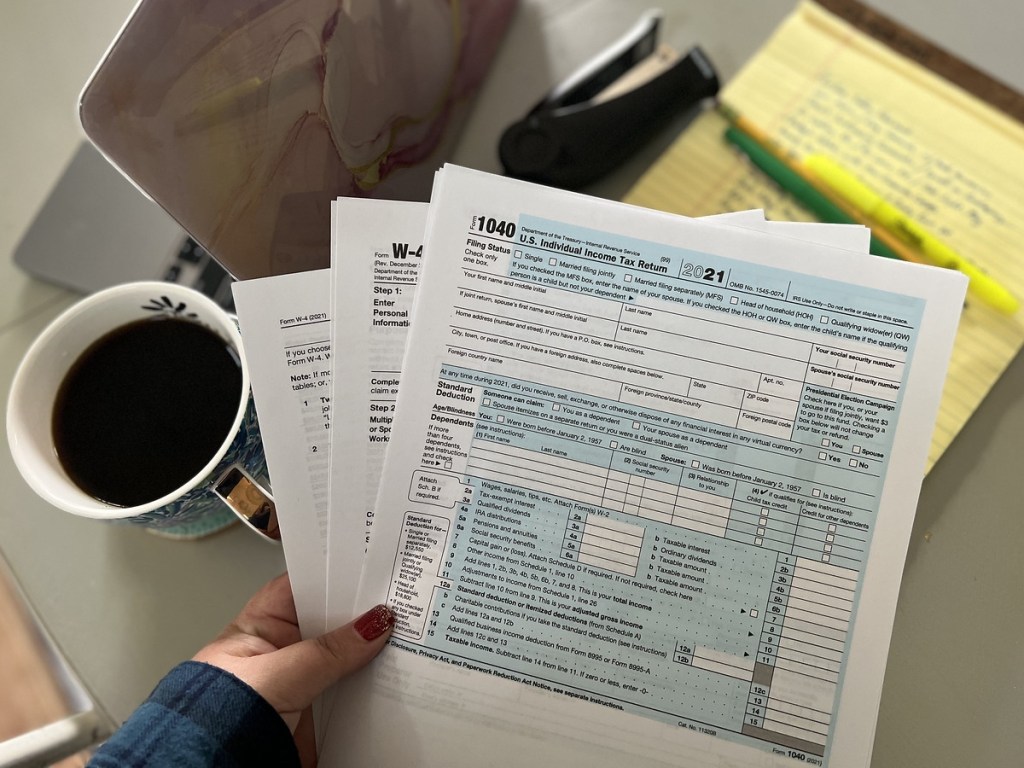

The Internal Revenue Service is expected to begin accepting 2021 tax returns at the end of January of 2022, so now is the time to start planning how you’ll file your 2021 federal income tax return. Planning ahead can help you file an accurate return and avoid processing delays that can slow your tax refund.

With COVID-19 still a concern and new stimulus payments to consider, this tax season won’t be a complete return to “normal,” but 2022 is expected to bring us more of a typical tax season than either 2020 or 2021 were, which both had extended filing deadlines due to widespread closures of IRS offices, tax courts, and filing services.

At this point, there is no indication that the filing deadline will be extended in 2022, so it’s a good idea to be ready to have your taxes (or an automatic extension) filed by Monday, April 18, 2022. So don’t wait! This year, the IRS is urging taxpayers to file electronically with direct deposit as soon as they have the information they need.

Below, we’re sharing a list of FREE electronic tax filing programs that are quick and easy to use, so you can check income tax filing off your to-do list in the most painless way possible!

Hip Tip: Although the IRS typically issues more than 90% of federal tax refunds within 21 days of accepting them, sometimes it can take longer than that to receive your money.

Learn how to check the status of your federal income tax return here.

1. File simple federal and state tax returns for FREE with TurboTax by March 31, 2022.

For as long as we can remember, TurboTax has been one of the easiest tax filing options to do from the comfort of your home. Unfortunately, Intuit has chosen not to renew its participation in the IRS Free File Program for the 2022 tax season, and it will no longer offer the IRS Free File Program delivered by TurboTax.

The good news is that TurboTax will still allow taxpayers to file simple federal and state tax returns completely FREE with TurboTax Live Basic. Taxpayers must file by March 31, 2022 to be eligible for this offer.

2. FREE online tax filing with H&R Block – even with select deductions.

Head over to H&R Block where you can file your taxes online for FREE! Their free online tax filing includes deductions for student tuition, payments, and loan interest.

3. Enjoy advanced features at no extra cost with FreeTax USA.

Consider using FreeTaxUSA.com to e-file your Federal return directly with the IRS, and you can choose from their Basic, Advanced, Premium, or Self-Employed filing programs – all for free! Add a state return for just $14.99.

Hip Tip: This site has been highly recommended by our Hip2Save readers for its easy-to-use platform and no-nonsense pricing!

4. Surprise filing fees? Not with Cash App Taxes.

Filing with Cash App Taxes (formerly Credit Karma Tax) is as FREE as it gets! Head on over to Cash App Taxes to get started with your free federal AND state return. And if you filed with Credit Karma Tax last year, you can file even faster by importing your past returns from Credit Karma Tax.

Hip Tip: Don’t fear an audit! Cash App Taxes guarantees 100% accurate calculations, and you’re covered by their 100% FREE Audit Defense.

5. eSmart Tax features simple and FREE online filing for Form 1040 EZ.

A free edition of eSmart Tax is available from Liberty Tax, although you can’t easily see this option from the company’s pricing page. Instead, you can start the filing process, and if you meet the requirements for free filing with Form 1040 EZ, you won’t be charged.

eSmart Tax ensures that you get your highest possible refund with a simple, step-by-step Q&A preparation. They also offer support via chat, email, social media, and in-person at 2,500+ offices.

6. Get a maximum refund guarantee with TaxAct.

Head over to TaxACT where you can file a simple federal tax return for FREE!

If you used a different service last year, it’s easy to switch to TaxAct from your previous online tax provider by uploading a PDF of your previous year’s return. Then, you’ll be able to prepare, print, and electronically file your tax return for free!

7. File your federal & state taxes FREE with Tax Slayer.

File your federal and state return for FREE online when you use the TaxSlayer Simply Free plan. You can also get low pricing on their advanced filing software.

More Hip tips for finding free online tax filing options:

- If your income is $72,000 or less, you can head directly to IRS.gov and file your federal taxes for free!

- Check the daily deal sites. Groupon has offered up significantly reduced vouchers for online tax preparation products in the past, and they will likely have similar offers throughout the 2022 tax season.

- Ask your local college or university. One reader reported that the accounting students at her local college will complete tax returns for free. They’re then reviewed by the professor to ensure accuracy.

- The AARP Foundation Tax-Aide offers free help for older taxpayers and people with limited incomes. Find an AARP Foundation Tax-Aide site in your community by visiting the AARP website.

- If you’re in the military, check out Military One Source for more information about the different tax filing resources available.

- Check for Volunteer Income Tax Assistance (VITA) or Tax Counseling for the Elderly (TCE) sites near you. Those who generally make less than $57,000 per year, persons with disabilities, limited English speaking taxpayers, and the elderly may qualify for assistance through the VITA and TCE Programs. IRS-certified volunteers provide free basic income tax return preparation with electronic filing to qualified individuals. Find a VITA Volunteer site in your community by visiting the IRS tax prep website.

The easiest way to save & invest your money for $3 or less a month!

It is that dreaded time of year, again…lol. I really appreciate your site for providing helping information that we can use in the long run. 😀 This has been Godsend and such a permanent solution for me…Before I was using TurboTax (free edition), but always would get charged every year. 🤔 Then I saw the article last year and filed with Credit Karma and it was free! Not only that, I received my return much sooner.

SO glad this has been helpful, Jessie! Thanks for the feedback!

Anyone have personal experience with FreeTaxUSA.com? Typically I use TurboTax Deluxe. How does this compare?

MCouzens….I used FreeTaxUSA for over 5 years where I only paid for my State return. I always got a 10% discount code from retailmenot.com. I had no issues using them and highly recommend them. Last year I went with Credit Karma at my sister’s recommendation because it was free for both federal and state. I think using either is a win-win! Take care!

I’ve used FreeTaxUSA for years and never, not once thought about looking for a coupon code. Whatever was I thinking. *smacks forehead* Every penny counts around here.

We have used freetaxusa.com for years and love it! So easy to use for me being tech challenged lol!

I use freetaxUSA every year and I’m satisfied. I also worked in tax prep for about 8 years, so I’m familiar with most forms.

That’s what we’ve used for years. Federal is always free but my state has a charge. I was satisfied until 2019 when nobody let me know that our state taxes were never received and I lost out on a state stimulus check AND had to pay a larger amount because of penalties. 🤨

Thank you so much for posting about these options! I usually go with an accountant each year but that’s very expensive (especially for mine which are very simple and definitely should be straightforward enough for me to easily do), so now I have no excuse not to do it myself — for free! 😊

You are welcome! I’m so glad you found this helpful.

I’ve done mine for free on H&R Block online for years but it got a bit complicated this year because I sold a house out of state. Anyway I went into the office and was able to apply a $25 off code from Retailmenot so it wasn’t too bad!

You may get lucky and get the debit card rather than a direct deposit. That’s what my son got this time even though he got direct deposit for the last one.

Can you chat with Turbo Tax Online to get help?

With the qualifier I am not an accountant so can’t give expert advice, you could also try the IRS website and see if there is somewhere to update your banking information. Make sure you’re at the right site (irs dot gov) to avoid a fraudulent site. Or make a $20 (or more) payment to the IRS online and use your current bank’s information to do it so it’s in the system?

I’ve used Turbo Tax for my teens’ returns. Free and it works great.

Ours are a bit more complicated so we have to use an accountant.

If you have to file 1099 forms (for if you hire independent contractors/nanny/etc. over $600), I have used Yearli dot com for years. You don’t need to go to Office Depot and buy 50 paper forms when you only need 2. I think the cost is under $10 for them to file both the 1099 and the 1096 forms. So much cheaper than having your accountant do it for you!

https://www.irs.gov/businesses/online-ordering-for-information-returns-and-employer-returns

order tax forms for free directly from the IRS

And I checked Raukuten and found there is also cash back for Turbotax Premier. Combining the Raukuten and Chase cash back offers widdles the overall end out of pocket fee down quite a bit! That is a great way to start a new week! Thank you.

You are welcome!

I like turbo tax, if you notify them when you change your bank account, you would not have a problem. Insurance always seems to know when you change your bank account.

I pay the last minute, if I owe.

No thanks, Aarp cancelled a week before last years tax appointments! I had to scramble around and finally found turbo tax.

Do not blame them for not wanting to catch covid, but they could have offered remote appointments.

Never will use again,was happy with them.

They will not get $s from me.

#8 Get a free CPA on Freecycle. That is how I got mine. LOL With my brothers and grandkids and the house not sure if I would know how to do it. And then working from home for a year etc….

Go on your states tax revenue website and most states have a list of free file tax sites with links to them. Usually you do have to make under a certain AGI though, with most under $65000 I think.HR block is not on our state SC website as free any longer. You can file for free but with limited help, you have to fill in all of the information it does not automatically fill in information, even if you have used them previously and they do not store a copy of your taxes for you with the free file.

Since it said free my daughter started hers; because we have used HR block the last 4 years and they kept the information on file, but this year it stated out as free and half way through would not let her continue without paying. It said $29.99 so my daughter was going to just pay that but it added an additional fee to do the state return when she did this, which would have made the cost over the amount of the credit she was receiving for the non-free form. It would not let her just remove the credit that she would have received either. It changed from free because she qualified for a savers credit for her 401k, which is not free to file.

She just started over on Turbo Tax which was completely free, easier and faster to use.

Just so no one is surprised if they start HR block and then it comes up a fee half way through.

I used FREETAXUSA.COM and just got my refund direct deposit on Saturday.

That was fast.

I have been using them for the last 2 years.

I’ve used turbo tax free edition for 5 years now and it’s very easy, as long as you have a simple return. This year I was eligible for an education credit, but it would require a different form so I had to upgrade to premium, it only cost $40 and got me an extra 1,000 back in my refund. Oh, and I had multiple forms, from unemployment, a w-2 from work, a tax form from my school and social security income and it was still a breeze to do. Also like someone else mentioned if you make under $60,000 you can get them prepared for free there are links on the irs website.

Has anyone used these to file with an irrevocable trust? Tried last year but had problems.

I have a friend who has many stock market trades and is having trouble finding software this year. Any recommendation oh and her income is under 75000

Pat, I know your comment is from May 2021, but still a valid question. We have used TurboTax Premier as we are in the same situation your friend is (stocks, etc). The key to a good tax program is simply knowing which program you need to file with (as then you are not hit with an “upgrade” fee because of the situation you find yourself in. Trust me, I know from experience. Thought we only needed the TurboTax Deluxe version (this was years and years ago) and ended up paying MORE for the Premier version because of it. Again, we’ve been with TurboTax for decades now and never regret it but always NEVER pay full price for it and watch for great deals. This year ended up paying $44 for both federal and state. Know as well that at least with TurboTax, you can file up to 5 federal returns (only can file one state though), so we share ours with our son but he’ll just end up having to pay for his state returns.

Just an FYI, the federal deadline is April 18th, 2022 to file and pay (or request extension). In short, Emancipation Day is April 16th but since that’s on Saturday, it’s recognized on Friday, making the 15th a holiday.

Thanks so much for mentioning that, Lorissa! Good to know! 🙌💖

FYI: I received an email after using the free option on TurboTax for years that Intuit TurboTax has decided not to participate in the Free File Program this year and to check for other IRS Free File Offers at http://www.irs.gov if adjusted gross income is $73,000 or less.

Thanks for sharing, Laura! 🤗I do still find it to be free to file through TurboTax for “simple tax returns only”. Hoping this is helpful! 💖

This is the time of year I’m really glad to have an account uncle who does my taxes for free lol

I received an email from Turbo Tax that they’re no longer providing free tax service.

I do still see it advertised free on their site. I wonder if it’s your unique tax situation?

Actually, starting this year, TurboTax will no longer offer their fully free tax service.

Until February 15 you can file your Federal taxes for free -simple returns only!- but State taxes will carry a fee.

We have used freetaxusa for several years and we have had no issues ever. Far better than what we have used in previous years.

So bad one here… I know I don’t owe but I haven’t filed my 2020 taxes. Does any of the stimulus money get counted as income? Anything else different besides that part?

The stimulus was a “gift” (not taxed), but you really should do your taxes because you never know if you could get any (more) back. I mean, they’re probably gonna find you anyway (eventually).

I just tried to get started on Credit Karma. They wanted me to download an app on my phone (why?). I googled it, and I found that Credit Karma sold this product and is no longer free for people who have used it in the past because we were “sold” to another company when they purchased the tax arm of Credit Karma. I am going to try itemizing this year because I refinanced and paid points. That’s not free either. Time to find another product!

Filed my simple standard deduction taxes with H&R electronically for FREE! Thank You! 😊

Yay! You’re very welcome, Marie!