Get Ready for These 2018 Tax Free Shopping Dates [By State]

Mark your calendars for these 2018 tax-free shopping dates!

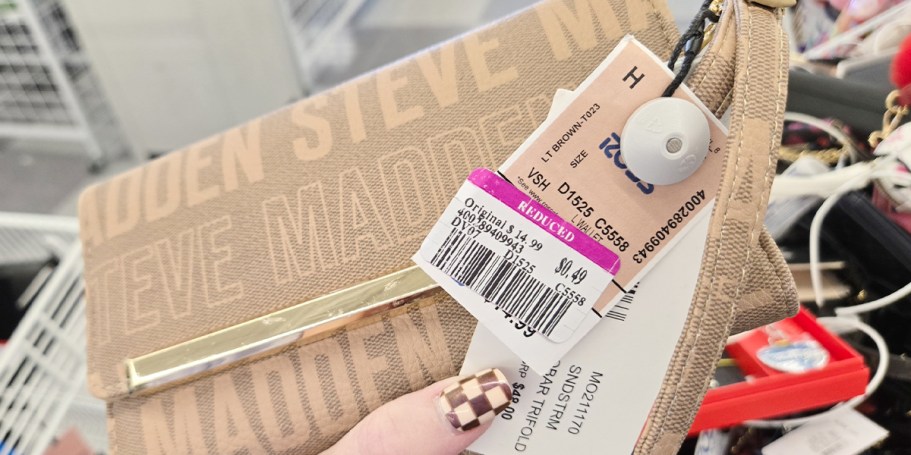

In just a few weeks, select states (shared below) will once again host Tax-Free Weekends, where you can purchase clothing, footwear, school supplies, computers, and other items without paying sales tax.

Shopping online? Many large online retailers such as Amazon, Walmart, and Target should be participating in Tax-Free Weekend, which means that you can shop without paying tax!

Here is the list of participating states:

Alabama:

- Dates: July 20th-22nd

- Save on: Clothing (up to $100), Computers (up to $750), School supplies (up to $50), Books (up to $30)

- State Website

Arkansas:

- Dates: August 4th-5th

- Save on: Clothing (up to $100), School supplies

- State Website

Connecticut:

- Dates: August 19th-20th

- Save on: Clothing and footwear (up to $100)

- State Website

Florida:

- Dates: August 3rd-5th

- Save on: Clothing (up to $60), School supplies (up to $15)

- State Website

Iowa:

- Dates: August 3rd-4th

- Save on: Clothing (up to $100)

- State Website

Louisiana:

- Dates: August 3rd-4th

- Save on: Tangible Personal Property (3% tax rate up to $2,500)

- State Website

Maryland:

- Dates: August 12th-18th

- Save on: Clothing & footwear (up to $100)

- State Website

Mississippi:

- Dates: July 27th-28th

- Save on: Clothing & footwear (up to $100)

- State Website

Missouri:

- Dates: August 3rd-5th

- Save on: Clothing (up to $100), Computers (up to $1,500), School supplies (up to $50)

- State Website

New Mexico:

- Dates: August 3rd-5th

- Save on: Clothing (up to $100), Computers (up to $1,000), Computer equipment (up to $500), School supplies (up to $30)

- State Website

Ohio:

- Dates: August 3rd-5th

- Save on: Clothing (up to $75), School supplies (up to $20)

- State Website

Oklahoma:

- Dates: August 3rd-5th

- Save on: Clothing (up to $100)

- State Website

South Carolina:

- Dates: August 3rd-5th

- Save on: Clothing, School supplies, Computers, & other

- State Website

Tennessee:

- Dates: July 27th-29th

- Save on: Clothing (up to $100), School supplies (up to $100), Computers (up to $1,500)

- State Website

Texas:

- Dates: August 10th-12th

- Save on: Clothing, backpacks, and school supplies (up to $100)

- State Website

Virginia:

- Dates: August 3rd-5th

- Save on: Clothing (up to $100, School supplies (up to $20), Energy Star products (up to $2,500)

- State Website

Wisconsin:

- Dates: August 1st-5th

- Save on: Clothing and supplies (up to $75), Computer supplies (up to $250), Computers (up to $750)

- State Website

Thanks!! We always love tax free weekend! When will sales on school supplies be released?

You’re welcome! Many sales have started!

https://hip2save.com/2018/06/26/cra-z-art-crayons-just-25%c2%a2-markers-only-50%c2%a2-at-walmart-in-store-online/

https://hip2save.com/2018/06/25/9-school-supplies-only-5-at-staples-23-value/

https://hip2save.com/2018/06/22/got-5-dont-miss-these-upcoming-school-supply-deals-at-staples-office-depot-officemax/

Why am I NOT surprised MN isn’t participating in this? 😩

My thoughts exactly….

Same…

I agree! They never give us a break!

But I love that there is never tax on food or clothing. I grew up in MO where everything had sales tax!

I LOVE tax free weekend, but ever since Georgia stopped doing it last year I’ve been kind of jealous at the other states that participate!

I looked on my state’s tax rules (OH), and it talks about shoes but I’m unclear if shoes fall under clothing or not?

It does. From OH’s website:

4. What items of clothing qualify?

“Clothing” is defined as all human wearing apparel suitable for general use. “Clothing” includes, but is not limited to, shirts; blouses; sweaters; pants; shorts; skirts; dresses; uniforms (athletic and nonathletic); shoes and shoe laces; insoles for shoes; sneakers; sandals; boots; overshoes; slippers; steel-toed shoes; underwear; socks and stockings; hosiery; pantyhose; footlets; coats and jackets; rainwear; gloves and mittens for general use; hats and caps; ear muffs; belts and suspenders; neckties; scarves; aprons (household and shop); lab coats; athletic supporters; bathing suits and caps; beach capes and coats; costumes; baby receiving blankets; diapers, children and adult, including disposable diapers; rubber pants; garters and garter belts; girdles; formal wear; and wedding apparel.

Thanks! I read the wrong #, guess I didn’t have enough coffee!

The way Illinois is so corrupt that if Illinois ever does tax-free I think I’ll have a heart attack! LOL

totally with you on that point Ben! illinois is just the worst. if it weren’t for all our extended family living here, we would move😭

Such a short list of states… should be all states as they now want to tax for online buys.

Hi SL! Some states, like Pennsylvania, offer tax free shopping on clothing and other items year round. Hope that helps!

New Jersey also has no tax on clothing all-year round and if you live within an Urban Enterprise Zone, like I do, we have a reduced tax-rate of only 3.3125%!!!!

Oh awesome! Thanks for sharing!

Shocker no California. Highest state taxes with the most debt.

I was thinking the same thing.. never on a good list!

NY is not great either… We are moving in a few years too much money wasted living here

No California :’ (

Do you have to live in the state? I live in Illinois but could easily shop in Wisconsin. what it still work for me or do I need to be a Wisconsin resident? I don’t see anything on the website about this.

Nope! In my experience, you can travel to a tax free state and enjoy this shopping perk! 😉

No we do both Texas and new Mexico

No AZ..bummer!!

MN has tax free shopping on clothing year round. Be happy for that gem.

No Indiana? 😔

I can hop to South Carolina or Virginia. Thanks for posting!

Awesome! You’re so welcome!

Darn, Washington is not on the list! Not really too surprising though.

Not surprised Michigan isn’t on here…

Very short list considering our elected leaders are so “interested and concerned ” about education and the children.

some stores still charge me tax on school supplies/office supplies. beware

No NY 👛 👛 👛

No Idaho , either?! Bummer. 🙁