Happy Friday: Couponing Millionaire

Sent from a reader who has asked to remain anonymous:

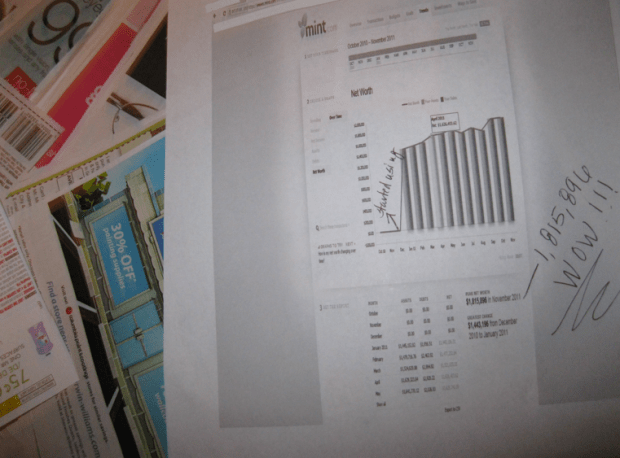

I’ve debated whether or not to send you this picture as it may be controversial to your site, but worth a discussion. I’m a couponing millionaire!!! Something that I’m proud of because I come from a working class family, worked my way through college and married one amazing man, a person with value and work ethic that grew up poor and worked himself through college as well. This picture shows you a statement of the value of our savings and investments, $1.8 million – placed upon a stack of my coupons. (The statement is a screen shot from mint.com).

We earned our money through conservative saving principles, hard work and some lucrative stock options. We’ve never forgotten our values along the way. This money is our future, the future of our kids and charitable causes that we deem worthy. I follow your site religiously and believe that every dollar I save is money towards my philanthropic goal. I’m proud to say my kids don’t know we have money, and instead know that we shop off the clearance rack with coupons in hand.

Please share my story and my hope that your readers would all continue their frugal lifestyle no matter what their situation is; it’s a lesson in life and a hope for our future.

HAPPY FRIDAY! 😀

Do you have a funny, “Hip”, or unique photo to share?! Email us at happyfriday@hip2save(dot)com. Every Friday, I will post one photo, submitted by you and/or another Hip2Save reader, that gives us a glimpse into your frugal lifestyle or simply makes us smile. If your photo is published on Hip2Save, we’ll email you a $10 Amazon e-card!

** Check out all the previous Happy Friday pictures here.

I Love it,,, I praise anyone that can rise above. I have been couponing for 8 months and am enjoying the fact that we can actually make it to “Payday” right now…. I dont see millions in my future, but it sure is nice to not worry about if I will have $5 bucks for gas the day before pay day… My kids SEE my achievments and have joined on that band-wagon… they KNOW if its not on sale or if there is no coupon for it.. WE WAIT… My goal after this year (too much going on right now) is to crack down on my debt, I plan on using my savings from couponing to do so.. who know maybe one day i will see my million !!! Best wishes to ya… Great Job

Wonderful, Jonette!! Congrats on your hard work paying off! 🙂

Great job! I’m in the same boat. I’ve been couponing for almost a year now, and I finally have a nice stockpile built so I only have to pick up a few things here and there. It feels great not to have to run out anytime we’re out of something. I’ve been able to save that money and pay off credit cards, and I just paid off my car!! I’m so happy. And thanks to Collin for making that possible. 🙂

This is how millionaires become (and STAY) millionaires!!

AMAZING!!!! What an inspiration.

wow

i m on my way to be millionaire!!

thanks for sharing the story

My grandfather was a millionaire several times over. He was more than frugal, most of us would say cheap, but he grew up poor and when he made good money I think he was scared of losing it. He was the type to stop on the freeway to pick up popcans and 5 gallon buckets, wear his 12 dollar kmart jeans until the pockets were so holy that his wallet was near falling out, and split a cheeseburger with you at a restaurant to avoid buying 2 meals. I was his little squirt and he never denied me my blueberry pancakes or ice cream (he would tell my brothers blueberries were 75c extra so they had to get plain haha). He helped me save popcans to buy my first bicycle. Over the years, he lent me money a few times but always expected repayment included the stamp to mail the loan or the fee for getting a money order or whatever it may be. Unfortunately in the end, he suffered greatly and I worry that maybe he didn’t enjoy enough of life. I know now he would be disappointed in the financial state I am in, and the road my spending has taken. This year, I am going to work hard to turn back to his wisdom, though not as drastic:) So two points is kudos to you, it’s an amazing thing to look at your financial status and feel no stress. And second, remember to enjoy life, there are things worth splurging on, do not think about only the future because there might come a time when it’s too late to go on those vacations or help your kid with a new car or college. Be frugal, but live life!

My grandfather was just as frugal (oh, the stories from his children!) yet despite working nearly his entire life, he did not die leaving millions. I think he was a somewhat conservative investor and frankly, a million saved today will be worth much less at the end of a working life due to inflation-so I’d say what was a good deal of money saved/invested in his early years just did not keep pace with inflation. The blessing is that he never suffered long illness or bad health.

He always thought others were spending too much money no matter what they bought or their financial circumstances. He would not eat out..EVER, not even a fast food hamburger. I think all this stemmed from growing up during the Depression. I don’t think he would have thought a billion dollars was enough.

As I speak though, his stepchild is spending every penny (probably already gone) he left–left to his wife who has dementia and whose daughter has the power to spend the money.

in our case, his 2nd wife. she lived in a seperate house from him for 14 years, she abandoned him for arizona when his cancer was at it’s worst, and she let him live in filth with infectious wounds. We know she mentally and verbally abused him and we believe she physically abused him, and he left her every single solitary penny, and gave her boyfriend a house before he died.

God will take care of this person on his own. Don’t you worry.

My mother in law has always said “there are no pockets in shrouds” meaning we can’t take $ with us to Heaven, so money is only material. It is here to keep us safe and sane while on earth, but it is not needed in Heaven.

In other words, ‘don’t forget the blueberries along the way’ . . . love that! Thank you so much for sharing.

…..

Good for them! I have an aunt that is a millionaire a few times over (mostly oil royalties) and she still rinses out her ziploc baggies to use again. I can’t wait to get there myself. “Live like no else today, so you can live like no else tomorrow,” -Dave Ramsey

Live like no else? I’m not familiar with that phrasing. What does that mean?

In this quote, it means don’t be like the average American who lives and accepts debt like everyone else (instead, live frugally and pay cash for everything), and the benefit will be that you will have a future that is different from everyone else (you’ll be financial secure while the average American struggles with debt and retirement).

“If you will live like no one else, later you can live like no one else.” One of my favorite quotes!!

Whoo-hoo! Dave Ramsey, baby:-)

My granny always rinsed out her ziplocs too – I found myself doing this as well (the ones that really were still pretty clean anyway) after I got on the Dave Ramsey plan almost 3 years ago. I’m a Dave fan and ‘I’M A SINGLE MOM AND DEBT FREE’ because of it. God is good!!!

Thank you for sharing your story, you should be proud, what a great accomplishment!

To get where you have takes a lot hard work & sacrifice, which a lot of these readers can relate to, no matter how far away or close we are to our own financial goals. I had to laugh at the negative posts, but I’m glad there were some, because the responses were GREAT! I’m glad there are so many diverse, articulate, & intelligent frugal readers here!

I wish I could get my husband to focus on money and have goals.

He too grew up very poor- no electicity, no running water and a dirt floor. His dad was given a loan by family members and built a sucessful business and was able to turn things around. They have had set backs and lost the business. They now have a modest stardard of living but still spend like there is no tomorrow.

My husband’s whole family is horrible with money. They take out loans to pay loans to pay loans and live day to day. They have maxed out several credit cards several times.

I guess my point is – how does hard work and financial struggles make some people cautious and save and others like my husband and his family spend spend spend?

My biggest fights with my husband are over money. His motto is just put it on the credit card. My motto is savings, bills and if money is left over buy it with cash.

? there are places in usa where people dont have electricty or running water?

many, even today. just in my school district, in one city, there are 430 homeless STUDENTS, these do not include the thousands of adults. Poverty is across this country, and it saddens and shocks me that people do not realize it.

and as far as no water, electricity, there are cities across the country with poverty ridden areas that have neither. there are cities where the entire population is ill or has rotted out teeth. There are states where education standards are so low mostly due to poverty and millions upon millions of people in this country that can’t read. I’ll get off my soap box now, and I’m all for helping around the world, I just wish we all did more for our own neighbors.

Im all for making your neighborhood your mission field. There are so many people close to home that are struggling. I visited a lady a few weeks ago that stayed up all night ironing cause they were turning off her elect the next day. She wanted her kids to look neat.

AMEN!!!!

In my experience, if you don’t pay your electricity bill, you don’t have electricity.

There are places which do not have access to municipal water. Therefore people must dig a well and access their water from it.

Appalachia comes to mind.

Yes there are – especially in our rural areas. My MIL grew up without such & it still exists for many. My aunt has a small cabin which only has an outhouse for toilet & either the lake or a barrel hanging from a tree for bathing/showerng (ironically, this is her vacation home she stays in over the summer).

Yes, there are. We had electricity when I was growing up, but we did not have running water. We lived in a rural area. My parents worked very hard as farmers, but we were always poor. Growing up in this setting made me very thankful for the blessings my family has today.

Michelle, my story is/was very similar to yours. Then I bought the book “First Comes Love, Then Comes Money”. It is Fantastic and saved my young marriage. I told me husband the only thing I wanted for my birthday was for him to read this book. It has really helped with our understanding of the other’s views on money. I can’t recommend it enough for couples who have different opinions about how money should be handled. Worth every penny! https://www.amazon.com/First-Comes-Love-Then-Money/dp/B002XUM2JW/ref=sr_1_1?ie=UTF8&qid=1330142496&sr=8-1

My situation is a little tricky. My husband wants to save and get out of debt buthe wont stick to the budget. When I send him with lunch he stills goes out to eat. And I’m not making him a crappy lunch either. He gets breakfast for his coworkersan eventhough I make coffee for him to go and breakfast for him. I still see he spends money on something in the cafe at work.

Give him a set amount he can spend each week on frivolous stuff and hand him the cash. Then let him decide where it goes. This worked for my husband and he sometimes just hid an extra $20 in his tool chest for later spending. Then one night he took me out to a nice dinner with his savings. My husband is FAR from perfect with spending, but this freedom w/ $ made him feel more in control and helped me live on a budget.

My girlfriend took away her husbands ATM card after too many drinks w/ the boys after work each week.

good luck. 🙂

I have not kept track of our total assets, but I feel very much like Anonymous. I coupon because I don’t like to spend more than necessary. The book “The Millionare Next Door” suggests that you would not be able to spot a millionaire because they are everyday people who did it through frugal living!

Yeah, in reality….a dollar here, a dollar there…I know I will never see this. You have to take every dollar and invest, etc. If you have one dollar, and are able to turn it into $2, that gets you some free milk. Other than that, unless you have some big bucks to invest in big markets are you going to get millions…unless of course you don’t actually LIVE! I like to let my family live…when we get a few “extra” bucks, we go to the movies. I can’t see telling my kids, “No, that’s for your college and/or future.” I enjoy the life we have NOW. Hate to be the “downer” in all this, but guess I’m more realistic.

I don’t think what you said is a downer, but I do think it is very sad that you see life this way. If you don’t save money for college or retirement, that just means there will be no college or retirement.

And though I don’t have quite the assets of Anonymous, mine are considerable (equal to about 4x our yearly income, and I’m 32). None of this came from “big bucks in big markets,” but from small savings that grew over time. If you don’t start with the small step of saving a dollar here or there, you’ll always be broke.

Yeah, but if you learn to say “no” to your kids (and yourself) once in a while. You’ll be able to say “yes” WAY more down the road. Not saying you shouldn’t splurge (or be a tight wad) but, make sure you are providing a better life for your kids not just today…but tomorrow and the next and 30yrs from now 🙂

There’s a well known science experiment where kids are placed in a room and offered a marshmallow. They can either eat it now, or wait a fixed period of time, and then get two marshmallows instead of one as a reward for waiting. The kids who waited for the two marshmallows were then tracked and disproportionately end up being the kind of people who max out their 401(k) plans and end up accumulating wealth. The kids who preferred the instant gratification were likely to end up poorer over their lifetimes than kids who fell into the other group. The exact same patterns play out as adults. People who are not predisposed to be savers have a really hard time seeing why they should bother and giving up any pleasure right now.

Nancy, it’s an absolute fallacy that investing small amounts of savings doesn’t work. It’s just flat-out wrong–it grossly misunderstands how compounded returns work to your advantage. Here’s a simple example: say you have $100 left over in your bank account at the end of each month from couponing, and you invest that along with an additional $100 per month every month — no “big money” here, just a teenie amount, but you do it regularly by setting up your bank account to automatically transfer $100 to your brokerage account at the end of the month. Let’s say you pick a no-load S&P index fund that earns an average return of 8% per year over 25 years, and every month you add a another $100 to it. You’d end up with $80,000 — from a measly $100/mo investment, starting from zero! (That’s assuming no dividends reinvested, and in fact ignoring the dividends entirely. If you reinvest them, your return would be significantly higher.) Steady, compounded annual returns over many years, and reinvested dividends are powerful. Don’t know how to invest? Read any of Jack Bogle’s books about index fund-investing (which is incredibly easy, even as a small investor). Or, if you still don’t believe “small” investing works, start with *The Latte Factor*, available at your public library.

As for worrying about “saying no” to your kids to plan for their college, here’s a real life response: my mom was a single-mom on a public school salary who scrimped and saved to send me to an outstanding private school for high school that was far outside the reach of her lower-middle class salary, and then she somehow managed to come up with the money to send me to one of the best colleges in the nation because education *mattered* in our house. I eventually married a man with a similar educational background and similar dreams. We earn well into the six-figures and have a great life. All that happened only because my mom valued education and did whatever it took to get me the best one she could.

When I was growing up, there were nights I remember we had to look for loose change for the treat to be able to out to buy a fast-food hamburger with a coupon–because there was *no* money left, over due to saving for school. I can’t tell you how grateful I am to my mother for doing that for me. I have the life I do now because she was willing to be frugal for a lot of years. My mom is, and will always be, my financial hero.

Had my mom taken me to more movies, gone out to eat more, and said “yes” to more splurges, I wouldn’t have had the education that I did. I also wouldn’t have my dream job. A few years of austerity enabled me to follow my dreams. She couldn’t have been a better mom!

Thank you!!!!! I love your post. Thank you for taking the time to share with us.

I am so impressed and happy that this reader chose to share her story. Although my husband and I have been saving for years, couponing enabled me to realize more clearly exactly how I was “wasting” money. Now we save, but I now put back 1 1/2 more than before. I may never be a millionaire, but I’m okay with that. My prayer has always simply been to live comfortably and have the ability to help my family and others when they’re in need.

Good for her! It just proves that being frugal pays off. And I love that fact that her kids are not aware of the money they have, this will teach them to work hard!

OMG!!!!!! HOW AMAZING IS THAT, GOOD 4 U!!!!!!!! THAT ONLY MAKES ME WANT 2 WORK SOOOOOO MUCH HARDER AT MY COUPONING!!!!!!!! HOW GREAT THAT U CHOOSE 2 SHARE THIS THANKX!!!!!! ALSO GOOD 4 U & UR HUBBY 4 ALL THE RESTRAINT IT MUST OF TOOK 2 SAVE ALL THAT $$$$$.

It’s not from couponing alone….remember that. It’s from stocking away every penny they can…and not LIVING!

Just b/c the person is frugal doesn’t mean that they don’t LIVE! you should not jump to conclusions like that. How do you know that this person doesn’t take her family on a big international family vacation once a year? Me personally I would rather pinch pennies on a day to day basis, not get a starbucks coffee daily, etc and use it on a big trip somewhere with a nice beach 🙂

The person who shared this story is trying to be inspirational and help others along their journey; you don’t need to judge her or her choice to live frugally.

Yes, Jaime. I am frugal, eat out, and am heading to St Thomas for a week. I am living plenty.

I wanted to share my experience so that you might see that there are ways to make frugal decisions that lead to extraordinary results. My husband was in the military and I was teaching in a private school 20 years ago. We made less than $30,000 as a couple. We made conservative choices with our money, but we still ate one meal out a week and saw one movie in the theater each week. We saved for both of us to go to graduate school (not enough). We graduated with six figures of debt; we researched before hand that top programs were expensive but had a great return. It was not so scary because we had the previous experience of saving lots with our small salaries. We work hard and save/spend smart. Ten years out of grad school and we have paid off both student loans, we have very healthy savings and retirements, and we have no debt. We still have two date nights a week. We took three months off this summer to travel to National Parks and a Disney Cruise to Alaska with our kids. Our kids may not go to the movies and eat ridiculously priced popcorn, but instead they we have movie night at home and they have traveled to over half the states in the county. We never say “no” to something we want; we only say “not now”. Then we save towards it and make it happen.

We ARE living and having a blast.

We buy used cars and keep them for ages. I have only the jewry that I wear everyday. We do not fill our closets with lots of clothes. We use coupons all the time; I am not afraid to pull out a restaurant.com gift certificate at a high-end restaurant. I have found the “good” Goodwills where I have slowly found great antiques pieces of furniture for our house. We use the library each week for books and movies. We read all the free ebooks at Barnes and Nobles Free Fridays. With each salary increase in the last fifteen years, we have increased more our savings rate than we have increased our standard of living. We have lived well below our means for twenty years, but we live better than we ever imagined.

Where did you read that she doesnt live? I didnt read that in the post. You’re making huge assumptions that are negative at best. Are you sure you’re not jealous of what they’ve worked at accomplishing because you sure seem like you are with your negative tone.

I <3 it. And for those of you who say you can't do it, well read how my husband and I do it, of course this won't work for everyone, but we REALLY REALLY want it:

We make about $60,000 a year.

~$18,000 a year goes to school.

$5000 goes into our Roth IRA.

$4,800 goes to rent.

~$2640 goes to water and electric.

$1728 goes to our cell phones

$816 to our internet (only bc I'm in school, we're dropping it after that).

~$2400 goes to the grocery store. This includes toiletries, etc. We eat almost all organic and I homemake the majority of our food (bread, etc).

~$96 goes to Netflix (no cable/Dish for us).

~$2000 goes to auto insurance.

~$3600 goes to gas.

~$2000 for various medical/dental expenses for us and our dogs.

~$500 grooming expenses for our dogs.

We budget $2400 for entertainment (movies, etc). We are young, we have the money and we work hard, we deserve it.

We both own trucks that are fully paid for. We shop garage sales and cragislist (though CL has really been ticking me off lately, why are there soooo many people who are just morons selling on there!!!? I mean come on, show up for our meeting times!) for things like cookware, DVDs, clothes. We wait for sales and coupons when we need new things like jeans. I mend things instead of throwing them away and buying new (dog toys, my husband’s shirts and underwear seem to need it a lot too). We hate plastics effect on the Earth so we hardly ever buy new things anyway. I make my own cleaning solutions and laundry detergent. I resist the temptation to buy cool new things that Collin posts on here, even at a deeply discounted price (I LOVE babylegs, they are so cute, but even at $3 a pair or whatever, that's still $3 spent) unless I REALLY need it. Anyway, that leaves us with a little over $14,000 to stash away for our future house and children. We have a fully funded emergency fund ($1000) and 6months worth of bills/income stashed away in case something happens. Everything else goes into another savings account. It is all about discipline.

My fully funded roth is going to be so nice by the time I'm old enough to cash it in. Once I'm graduated and working full time again we'll be able to fully fund my husband's roth as well. That, along with whatever investments we do between now and the time we retire (we plan on investing more in a few years, for now though we want to save for a house) will lead to a nice cushy retirement. I just met with my investment guy (who by the way, is free, go talk to one!) again the other day and he smiled and me and said "you know, if you keep doing what you're doing, you’ll be a millionaire by the time you’re 30.”

Don't get discouraged if you don't make much money. Go out and get you a few finacial books from the free library and get to work!

And yes, sometimes it is a bit hard. For instance: if I have been eyeing the Robeez Collin posted earlier (the Fire truck and Police car ones)…I super want to buy them, but would I rather save that money for a date night with the husband, or spend it on some shoes that I may find at a Garage sale or Goodwill later? I also had my eye on that Harry Potter DVD set she posted a weekish ago. I’d rather save the money and spend it when the Bluray set comes out with all the movies though, so I’ll wait (It’s what I’ll ask for for my birthday or Christmas, depending on when it comes out).

There are countless investment calculators on the Internet.

I assume you are in your early 20’s.

With that said, “if you keep doing what you’re doing” means you are putting $5,000 a year into a ROTH IRA. This is the current limit for a ROTH IRA. The ROTH can be invested in just about anything, so you might be able to assume an 8 percent return–that’s a historical average, even given great years and not-so-good years. In other words, it’s not likely you would earn higher over the long-term than 8 percent–and that’s what we’re talking about–the long term.

So, if you are 25 now and keep putting in $5,000 a year at 8 percent, you will have about $1.4 million when you are 65. Combined with your husband’s fully funded ROTH and assuming he invests for the same length of time–you would have twice that. So yes, that is decent money to retire on, but not a decade long venture by any stretch of the imagination at that rate.

I do agree that folks should consult with a financial planner. They should do it several times–when they are buying homes, having children, etc.

And I have to say, if folks make $60,000 a year with or without kids, I hope to goodness they are saving at LEAST $5,000 per year.

The best thing I see in your favor is that you basically pay your bills on one income.

Don’t spend a penny of the second income. Invest it ALL.

And just to make some clarifications to others—if you make over $173,000 as a couple, you start to get phased out and over $183,000 jointly, you can’t contribute anymore. That seems like a high income limit, but anymore it’s not with 2 college educated people earning money. It’s highly doubtful those 2 people would be low earners for 40 years.

Nice feature–The ROTH is tax-free, so basically you are getting the use of 1.4 million as opposed to 1 million in the above example.

The one I’m investing in avgs. 12%, historically (it goes back 70 years). What he meant by saying that is with the money we’re planning on investing in the near future with my full second income (he makes 50, I make between 10 and 20, I will make 60 starting Dec.) we’ll be millionaires. I say that’s pretty darn good for a 22 year old, seeing as how most people I know have a good 30,000 in debt. I wish I would have started when I was 18 though!

Without getting into some very extensive explanations, the average investor who puts money into a fund that earns 12 percent does not see that return. On average, it is more like 8 or 9 percent. For one thing, you cannot invest directly in the fund. Your investment guy is one layer of expenses that chips away at the 12 percent. Further, some people neglect to think of it this way–

Your money has to weather the ups and downs of the fund. Say you put in $2000 this year and the fund drops 50 percent in value the first year. So then you have $1000. The next year it goes up 100 percent. Well, then you still have just $2000, the amount you started with. Over time, these ups and downs for the average investor has equaled at most the aforementioned 8-9 percent and does not approach the 12 percent index. Yes, of course the fund has a 12 percent index. They are out there. But that’s not what you see at the end of the day due to the constant losses and replenishing.

Anyway, saving early and aggressively is the most important part. And well, learning to live without a lot of creature comforts.

Wish you the best of luck.

Even if it doesn’t make 12% who cares? I’m still putting in money and will be investing in other ways soon. We’ll pull around 3 mil out of it (his+mine) if it works out the way you say it will, and that combined with our savings and whatever other investments we’ve made will be nice once we’re 65 and ready to settle down. The whole point of this is to prove that you CAN do this for all of those who think they can’t. I think it’s a nice motivator. I’m just trying to put some (+) thoughts out there!!!

I assume the “if you keep doing what you are doing” is not $5,000 but saving that percentage of your income. Our experience is that if you keep saving the same percentage the money starts growing like crazy as time passes and incomes increase.

I’m sorry, but 400 a month in rent is not even close to realistic for the average american, at least where I live

Yes, I’m in a low-cost of living area and HUD pays about $550 for people to live in dumps.

I live in TX, college town. It’s nice! If my rent goes up for some reason (say, to 1,000, I don’t know if that is reasonable but it seems like that’s what I see on TV and stuff for the East coast), then my entertainment budget will go down, to say 800 a year. Then I’d take the rest out of house savings (booo!) and I’d only be able to save 8,400 a year. Though, if it was that high I think I’d be scrimping in even more locations. I’d probably dump the internet and just go to the library every day so that’s another 800+ and start grooming the dogs on my own 400+ (I’d have to get shears, nail clippers and shampoo). So really I’d only be out 4,400 on my yearly savings. The whole point of this post is you CAN do it, you just have to scrimp and work for it!

Oh, I wholeheartedly believe people can do it. And to be honest, I don’t feel like you are doing without in an extreme way. You have pets, entertainment, you are not required to work full-time to get by, etc. To many people, going to school actually IS a luxury. Most people I am acquainted with drive their cars at least 10 years before getting a new one. I didn’t mind driving the same car for the past decade, but I just got a brand new car and cannot believe how much I am enjoying it and how many of the “new stuff” I didn’t know about, LOL. I gave my old car to my teen who pays her own gas and insurance and helps pick up her siblings so Mom and Dad can work.

I have lived long enough to tell you just how many different things can alter your plans, but the road is different for everyone.

I love working, which is why I’ll never see not working as a “perk” but money is to help us all achieve our goals and quite honestly, if it’s someone’s goal to work 6 months of the year so they don’t have to work the next six months while they lounge out on a beach, then I’m all for it.

Not that any of this applies to you and your situation, LOL but it’s amazing how many different incomes people have and various levels of savings, yet most people live exactly as they wish. About the only folks I’ve seen who completely lose out are those with substance abuse issues.

Yeah here in california it’s not 400 a month. Try at least 4 times that. However, I will say that it is our main concern to get our 5 year old into a great school which obviously requires paying a bit more.

I’m with you! What planet do you live on where 2 adults and 3 kids can pay $400 a month or with what parents do you live with and pay $400 a month.

Also they haven’t factored in things like taxes and health care for themselves into the scenario. I know that my family makes around what they do but just because that’s my husbands salary doesn’t mean we bring home nearly that much because of taxes, retirement and health insurance that is automatically taken out of his check. Also where I live (in Idaho) which is relatively a low cost of living state I don’t think you could find a place that wasn’t subsidized by the government for 400.00 a month. Especially one big enough for a pet. I think it is great that some people are able to save,but I do think that sometimes people try to be too cheap and it affects their way of living. For example my sister in law decided to save money by having her family not get good health insurance. They were all healthy at the time but life threw them a curve ball and she got sick and also had a child that was sick a lot. Because they have terrible health insurance they have depleted their savings and are struggling with high health care costs. I guess my point is that you can only be so cheap. Realistically I think that most people are not able to save the amount that these people claim to be saving. It seems a bit inflated.

my house payment is right under $500 a month and its a 2 bedroom 2 bathroom in a good part of town.

$400 is a very realistic rent where I live. Our mortgage itself (including taxes and insurance) is just barely over $400. Go to the nearest big city & it’s 3 times that. Location, location, location. It cracks me up how some people can’t believe other places in the same country have drastically different living costs and ways of living.

Yeah, I moved from L.A. to Nashville and the cost of living is VERY low. We pay more than $400, but I’m sure the small towns outside are around that much.

I hear you, thats what they pay for rent they aren’t saying thats what everyones plan should be so not sure why people are arguing with it lol Love that they put all their expenses out there so we could see it. I admit I am jealous wish I could pay $400 a month or $500 for my mortgage :-). I pay three times that but I live on the east coast and its $$ here. Love that everyone is sharing! ill be reading htis post for hours lol

It depends if you are paying the mortgage which could be quite low. We bought a house and saved $100,000 off the selling price from 4 years ago. The mortgage (rent) price is low. Furthermore, if you are renting from a relative that owns the property you can have cheap rent.

ditto. $400 per month? I pay $1,400 for my mortgage for 3br/2ba.

It is possible. We pay less than $500 on mortgage for a 3 bedroom 2 bathroom house. This includes property tax and house insurance. I think most would agree we live in a pretty good area too.

And the whole point of my post was to prove even if you don’t make much you can still sack away money pretty easily! We’re putting away ATLEAST 19,000 a year, that’s nearly 30% of our income (and like I said, we could put away a decent amount more, but for right now, I want to have a little fun). This time next year we’ll be sacking away nearly $80,000!!! It’s going to be a beautiful thing. That is, minus our house. My future is so bright I have to wear shades!

LOL. That’s cute.

Congrats to you! I think that is great you should be very proud! I get your point and thanks for sharing your story!

AMAZING story! Your success is something to be VERY, VERY PROUD of!!! Why pay full price when you have coupons? GREAT JOB!!!!

This is the most comments Ive seen on one post , pretty interesting tho but I forgot I need to get my coupons ready for Sunday lol !@_@!

Sometimes you can plan, save, work extremely hard, be frugal…..do all the right things and life throws you a curve ball. If working hard + good values, motivation etc etc…..if all those things equated being a millionaire, I would have been rich long ago.

You have an extremely good point.

ME: I agree with you, but I also think it depends on your attitude. You sound like an amazing person, and I bet you keep your chin up and keep going, no matter what comes at you. 🙂 Some people let life get them down and they give up, and that’s when things get terrible. Hang in there girl! Here’s to good health and hanging on in 2012 for you! 🙂

re: “you can plan, save, work extremely hard, be frugal…..do all the right things and life throws you a curve ball.”

You are absolutely right, especially in the current horrible economy with so many people out of work. But, as I tell my kids when those curve balls come, that is Life. There is no getting around it.

The truth is, there is no simple formula for becoming rich. The writer was not saying there was. But certainly, the person who works hard, has good values, motivation, etc will be far better off than if they had not worked hard, had good values, etc. We only see what our conditions are now. We don’t see how bad they would have been if we had lived unwisely.

I don’t ever expect to become a millionaire. But, there have been so many times since I have started couponing that I have felt “rich”, even though our meager family income has decreased by at least 25% over the past few years due to the economic downturn, while our bills have increased.”Miraculously” we have less money, but our money goes further. I am so thankful for coupons and wonderful sites such as Hip2Save that give me power and inspiration to stretch what money and resources we have.

Thanks to all you guys for these incredible tips and ideas. I am in my twenties and this really inspired me to continue using my coupons. I use to coupon a lot for my husband and I, but since I started college I don’t do as much as I use to.

Collin please post ideas or ask readers about how they save for college, or how they paid for college what loans to get etc. just some general questions for college students. (beside coupons) or list websites. please!!!

Thanks to the person who wrote this email to you. Congrats to her 🙂 FYI- I just signed up for mint and realized that i am spending Way too much money on eating out, clothing, and groceries 🙂

Great website. Thanks

I would suggest you research “work-study” at your school. My friend had a work/study job as a monitor for the on-campus art gallery. No one ever came in; he sat at a nice desk working on his studies for 10 hours a week (paid to do homework-my dream). The pay wasn’t much more than minimum wage, but it came with a huge break in tuition. I worked in the admissions office in grad school. The pay was lousy, but I received an enormous discount (over 30%) on tuition at a private university. Get to know the staff in the financial aid offices. There is a lot they can do for you. Just ask

Thank you so much for this tip, and I will definitely look into, ”work study”. Getting any type of discount off tuition would be GREAT!

Work study is a type of federal student aid. You can get it by filling out the FAFSA along with the federal loans you may qualify for.

Re College – My husband is currently in college (after his workplace shut its doors permanently). He has been able to do this only because of Federal Pell Grants. You apply for it by submitting a FAFSA application: www . fafsa . ed . gov

Thanks Rebecca, I had applied this semester for FASFA, but I was not qualified it’s WEIRD! Because I am currently unemployed hubby is the only person that works.

One of my Instructors told me to apply every semester,so I will definitely try again next semester.

Do you know what they look for when a FASFA application is filed?

Definitely reapply every semester; things are always changing. (It takes some digging, but explore the whole FAFSA website; it has info on student loans, etc, too.) Financial need is the main thing they look at in addition to others. I’ve quoted a few main points but read the whole page at the website:

https:// studentaid . ed . gov/PORTALSWebApp/students/english/aideligibility . jsp

“Student Aid Eligibility

Eligibility for federal student aid is based on financial need and on several other factors. The financial aid administrator at the college or career school you plan to attend will determine your eligibility.

To receive aid from our programs, you must

•demonstrate financial need (except for certain loans).

•have a high school diploma or a General Education Development (GED) certificate, pass an ability-to-benefit (ATB) test approved by the U.S. Department of Education, meet other standards your state establishes that the Department approves, complete a high school education in a home school setting that is treated as such under state law, or have satisfactorily completed six credit hours or the equivalent course work toward a degree or certificate.

•be enrolled or accepted for enrollment as a regular student working toward a degree or certificate in an eligible program. Note: You might be able to receive aid for distance education courses as long as they are part of a recognized certificate or degree program.

•be a U.S. citizen or eligible noncitizen.

•have a valid Social Security Number.

•register with the Selective Service if required. You can use the paper or electronic FAFSASM to register, you can register at http://www.sss.gov, or you can call 1-847-688-6888. (TTY users can call 1-847-688-2567.)

•maintain satisfactory academic progress once in school.

•certify that you are not in default on a federal student loan and do not owe money on a federal student grant.

•certify that you will use federal student aid only for educational purposes.

…

Even if you are ineligible for federal aid, you should complete the FAFSA because you may be eligible for nonfederal aid from states and private institutions.

…

How will I know what I’m eligible for?…

You can get worksheets that show how the EFC is calculated by downloading them from our Web site at www. studentaid. ed. gov/pubs . Click on the award year appropriate to you under “EFC Formula.”

The amount of your Pell Grant depends on your EFC, your cost of attendance (which the financial aid administrator at your college or career school will figure out), and your enrollment status (full time, three-quarter time, half time, or less than half time).

…”

Pell Grant Calculator: https://www . pellgrants . us/pell-grant-calculator . aspx

If you did not qualify, your husband may make too much for you to qualify and you may be considered able to pay for college on your own through private student loans.

Congrats…very inspiring! So glad that coupling and saving is finally becoming a positive thing. I love using a coupon to save a few bucks-to me a deal makes me so satisfied.

I’m a young mom of two girls, we coupon. And coupon and coupon. We do it all together, we use to live paycheck to paycheck now we live insert to insert. I love that your a millionaire, I always said if I was a millionaire I would still coupon, saving money is Saving money. I want my kids to Learn the value of a dollar.

This is so amazing and true. I truly believe that every penny saved by using Qs is every dollar earned. And my kids and hubby as well as friends think that it is cheapo to using Qs when one can afford.

For me we have worked our way through rough waters and even if I hit a mega jackpot, I will not pay full price. The reason is it gives me to use extra for philanthropic purposes.

Thanks for amazing story and of course to you for doing this Q blog.

Amen on not ever paying full price! Why wouldn’t we use the “free money” we get though coupons? The book, The Millionaire Next Door, was very validating on this point as it shared how many millionaires coupon! 🙂

That is such great inspiration! I hope to be able to do this one day. Thanks for sharing:]

A great inspiration! Thank you for sharing and demonstrating what living within your means can do!

I too grew up poor. Our electricity was always cut off and we didn’t have a phone. But its because my mom wanted to make sure we had fun things. Instead of paying the light bill, we’d go out to eat or buy a new movie. There were 5 kids in our family so it wasn’t cheap. We didn’t have a lot of stuff and my parents couldn’t handle money. If it weren’t for my aunts or my grandparents, we probably wouldn’t have had boots or coats. My mom wanted to make us happy even though it was irresponsible. My sister and I don’t handle things like that for our families. Bills first then fun. I love my mom for trying but that doesn’t make it right. When she died two years ago, their car had gotten repossessed and my dad and brothers had to move in with my grandma. Mom had life insurance through her job but just enough to cover funeral expenses with a little left over. My dad bought another car with cash but blew through the rest pretty quickly. I wish that my parents had planned and not lived for the now because what happens when your “now” is over?

Well said. Thank you for sharing with us!

This is so inspirational! I just started following Dave Ramsey. Although I’ve been coupoining for two years, I hadn’t been budgeting correctly. My husband and I both work and between the two of us make over $130k per year, so not HUGE money, but still pretty good. After doing our taxes I got to wondering where the heck all of our money goes. After starting Dave’s program, for the month of March alone, I found $3000 extra dollars to apply to our home equity loan! 🙂

The average family in America makes $40,000 a year combined, so 130k a year is HUGE money! Good for you! Love Dave Ramsey.

I don’t care how much/little money you make couponing saves money and everyone should do it. When you are older and need to retire those savings can be helpful to everyone. I think the story is amazing. My grandparents are really frugal with everything and that is why they are able to take a new vacation every month because they saved a lot, invested money and spent little money on electric and utilities. What I mean by that is they will not spend more then $65 on electric a month. We live in Florida so I would never do that but it’s not the point, the extra savings are great for long term. Several people are correct in their post, that is how millionaires stay that way, by being frugal and saving money. This made me start thinking about taking the money I save from grocery shopping and putting it aside in a savings account or investments.

I think it’s awesome!! You and your husband should be proud of your accomplishments, and your kids will be proud of the values your teaching them! Couponing has changed my ENTIRE way of thinking, and this website has been a great help! Not only do I coupon, I research pricing on bigger purchases to make sure I wait to get the best deal, I shop year-round for birthdays, etc., to save money…we actually have SOMETHING in our savings account now. It’s wonderful!

I’m not anywhere close to being a millionaire, and I don’t really see myself ever being a millionaire, but if I were, I’d totally use coupons too!!

Anonymous here (I sent this to Collin). I’ve really enjoyed reading the comments to this post. I’m going to go through all previous comments and try to respond to some specific questions/comments. But, I am most pleased that the majority of readers understood my purpose – definitely not to flaunt our savings (if that were the case I would have provided my full name, and a picture of me rolling around the floor covered in $100 dollar bills). My purpose was to suggest that living frugally can be used for more than just making ends meet. Frugality for me is raising kids that aren’t entitlement-minded, supporting causes that I deem worthy, financial freedom when bumps occur without assuming government will take care of me, and proof that hard work and good decisions really do pay off. So many of the stories posted in these comments have touched me. I’m proud that there are so many like my family, that feel the same about their frugal lifestyles. Thank you all for sharing your stories.

I’m so happy you decided to chime in. I have been following this thread too since the post was first put up (I wish you had been married on the 13th, because I was comment #13 :). Anyway, I have enjoyed reading the comments from so many other people that think about the value of money like I do. It is wonderful the way you and your family have handled money responsibly, and I think you summed up the whole point of living this way with this statement – “Frugality for me is raising kids that aren’t entitlement-minded, supporting causes that I deem worthy, financial freedom when bumps occur without assuming government will take care of me, and proof that hard work and good decisions really do pay off.” So, though I will never know you, I want to say thank you for raising your children to value money, for saving for your future and those tough days, and for using your money to better the lives/missions of those charitable entities you believe are worthy. YOU ROCK!!!

Thank you for sharing, Anonymous. And I think that the few negative comments were from people who misunderstood what a “Couponing Millionaire” was. It appears they only skimmed or misread your story, and thought you were trying to present your 1.8 million as having been attained solely by couponing. Since such an achievement would be nothing short of miraculous, they were trying to feel better about their own financial positions by saying such savings were impossible for the average person. I feel sorry for those people who feel financial freedom is an unattainable goal, so they choose not to even try.

Thank you!

Thank you (and Collin) for sharing this! I have a few scattered thoughts:

1. “You are a rock star!” -Dave Ramsey

2. To the naysayers: “If you think you can do a thing or think you can’t do a thing, you’re right.” -Henry Ford

May your blessings be multiplied ten-fold!

Thanks for sharing! It is very Motivational!

My hat is off to you! My husband and I could not agree with you more! While we haven’t hit the million mark yet we are definitely working on it and hope to be there within 5 years. Right now we are debt free. We paid off our house last year. The kids’ college funds are fully funded. We have insurance in all the right places. It’s more about freedom and peace of mind than anything else. To the people who say that’s not “living” – for us, any sacrifice we make is worth the lack of financial stress in our lives! And, yes, we do live plenty. When we splurge, we splurge on fun – plays, vacations, etc. vs. stuff!

I live lets just say a very “privileged ” life style in Beverly Hills and I still do my coupon routine every single day. My parents used to think I was wasting too much time doing it, but then I would show them how much money I have saved in the last year and they are completely blown away. I already have saved about the same amount money as if I had a full time job! Even if you have the money, why pay full price? I love saving!

Good for you! My brother told me that if people have time to coupon they should just get a job instead. I had to hold my tongue….

Very cool!

Someone mentioned in this thread that “a penny saved is a penny earned.” I would like to point out that a penny saved is much more than a penny earned. Each dollar that we spend requires that we earn more than a dollar to offset it given taxes.

I happy for her andher family. That’s great that they are a millionaire. My goal is working toward a $1M plus when I retire. I love to hear stories like this and hopefully we will hear more hip2save loyal reader with the same stories.

anyone can be rich if they have the right investments!

I disagree. The point of the story was not they made the right investments but how they continued to be conscience of their spending and not live up to their means. This couple should be congratulated ~ you sound bitter.

I am not bitter, it is just funny how everyone is completely missing the point!

she said she clipped coupons and had investments…i am sure the investments are what made her the millionaire! the coupons are probably a hobby

i have a total of 12 nieces and nephews. this year i made a budge3 of how much i will spend on their bday presents. $10 each including cards and wrapping. so when i see cute stuff Collin post= and its under 10 i buy it. for exp. i bought th1 star wars lunch box from williams sonoma for my nephew. his birthday isnt until aug. so i feel great that i got him something he will love, its in my budget, and its done. i dont have to worry when its the day before on what we are going to buy him.

I think that is cool, i shop clearance, coupons ect. Save every penny I can. My Children always say man it would be cool if we had allot of money. i always tell them, even if i had the money I wouldn’t live any different. I try to teach them about value of money, that is cool the kids don’t know.

This is a great post, I read every single comment and can not understand the “hate” of some people. Why people can not be happy for each other ?

I started couponing about 7-8 years ago and it changed my life. I was not close like Anonymous before I started couponing. I was making about 500K but was spending all the money on mostly my self. I did not save any money because I thought that money will be coming in all the time BUT things in life change 🙁 unfortunately.

I went through divorce and lost everything, so after 2-3 years of struggling I heard on the TV about couponing and saving money and it make me do the same. I am stay at home mom for past 5 years and have $0 income and live only from my husbands income which is about 28K

I know that we are never going to have millions but I am glad that I can provide everything my kids want from food to clothes and toys. Thanks for the coupons 🙂

I try to save every penny that I can but with so low income and all the bills is not much BUT I am proud to say that we have a nice little emergency saving fund.

All this and she gets a gift card to boot! Hee-hee…Good stuff, keep smiling guys. ;0)

I’ve been couponing for almost 20 years. I have 8 children; my oldest is now 19; 2 are in college. My husband makes 83 k annually; I stay home and manage everything else. We have about $100 k in assets (stocks, funds, etc) My husband is not much of a saver; I only send him grocery shopping if I really have to. He is learning though and has cut back on impulse shopping. When my second child was a senior in high school, I took a break from couponing to help my son search for scholarships. It paid off because he received scholarships that cover most of his tuition for the next 4 years. He took out a 2k loan for the year. Not bad for a college education that would have cost him $120 over the next four years. He lives at home, packs his lunch, pays for his car/travel/book/dining expense with his workstudy earnings. During my couponing break, my family lived off my stock-pile. We do not have a budget nor can I tell you how much I have save in coupons. I am content with knowing I have saved. Yes, we do live. My children go to a private Catholic school. (Tuition is very reasonable/ cheap.) This will be the first summer that I will NOT have my children signed up to do summer activities ie baseball, swimming, piano, etc. We have 4 weekend camping trips planned. My 13 y/o daughter is going abroad for the whole summer with her aunt and her kids. Expensive but the experience and lessons she will gain will be priceless. I shop year round, plan my birthday/ Christmas/gift list. I have made my own laundry soap (Thank you pinterest), etc. We also got rid of cable, but we do have internet and cellphones. I love my credit card but I pay off the balance each month and still get my points. No, I no longer do every deal I see; just the ones I think family and friends can use or items I know my children’s school can use. I am thankful for Collin and her website because she has helped my family and some friends save money.

I have read and enjoyed everyone’s comments. I save money on one thing, so I can spend it on another one that I will truly enjoy — that’s LIVING. I think everyone here does that. I don’t think any of us LIVE WITHOUT that which we enjoy.

My friend started with nothing. He lived during the Great Depression and served in WWII. After the war he started a busines in his basement while his wife worked as a school teach and did the bookkeeping for his business — all while raising two kids. He and his wife were able to own their own home, buy other real estate and travel. When he died he had made arrangements to rent out the local steak house and hosted a great big party for hundreds of friends, family, employees, and business associates. He died a millionairre because he made choices how to spend his money. His business is still running but has no more than 21 employees and sometimes struggles — its no cash cow –, so that’s not what made him wealthy. He spent his money wisely….or didn’t spend it at all. He was well known for having a graveyard of old machinery from his business that he used to repair and rebuild machinery for his business. His upbringing during the Depression made him realize that money is a choice — whether you earn it, spend it or save it.