Hip Team Members are Loving This Debit Card for Kids–Here’s Why!

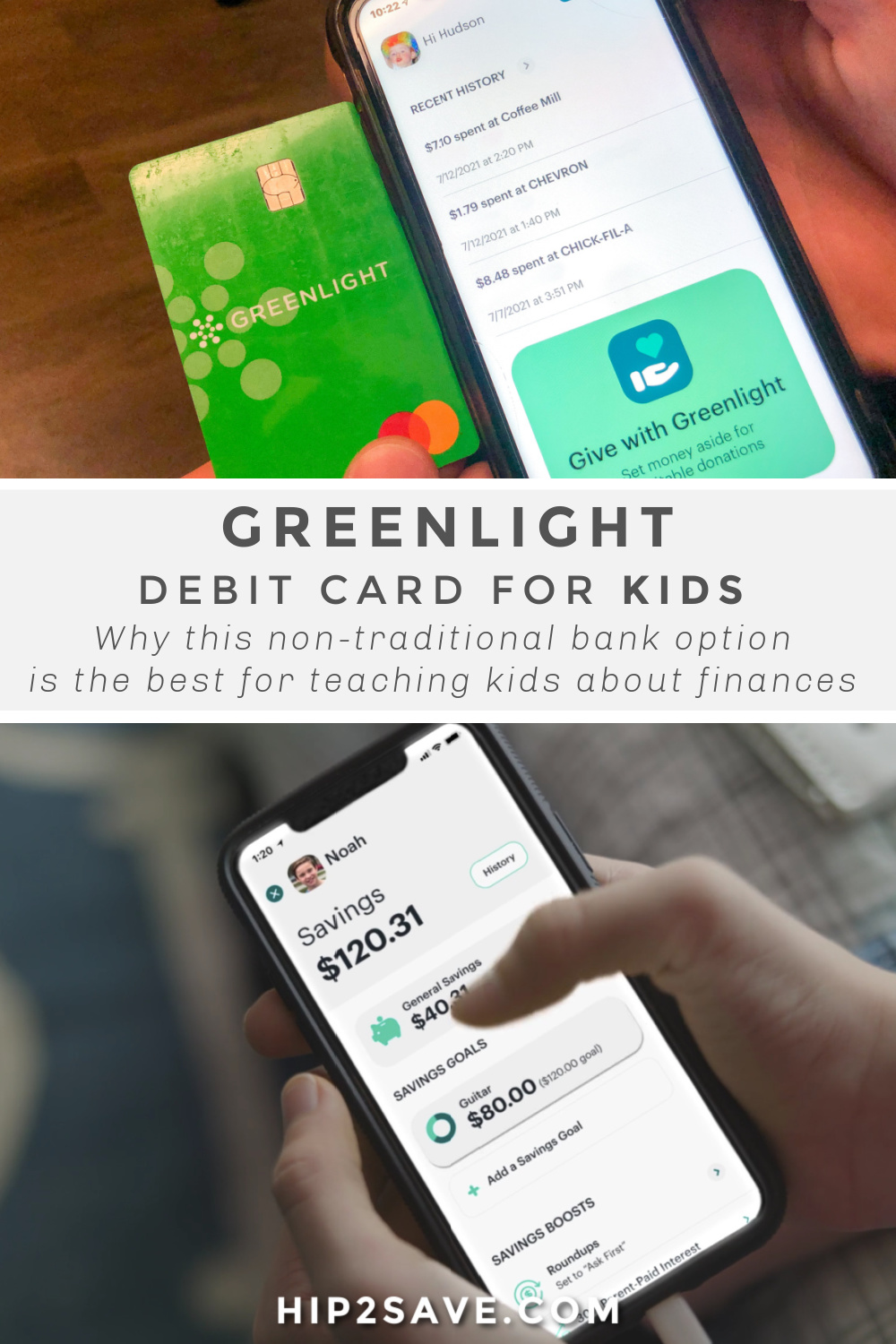

Skip traditional banks and teach your kiddos solid financial habits with the Greenlight debit card for kids.

Are your kids ready to learn about real-life finances?

Giving them a debit card when they’re younger can be a practical, effective way to teach them all about the value of a dollar and let them practice a little independence.

Unfortunately, there are often a lot of hoops you have to jump through when trying to get your child a debit card with a traditional bank. You also may not be totally in love with the idea of giving your teen access to cash before they’ve learned the basics of budgeting and finance.

If you’re in the market for a safe & easy-to-use debit card for kids with a ton of neat perks and features, we have several Hip team members who use the Greenlight card and absolutely love it!

And for a limited time, you can get a FREE $10 deposit once you complete your free trial!

Head over to Greenlight

Enter your mobile number & click “Get Started”

Enter code promo10 (case-sensitive)

Finish filling out your information & you’re all set!

The $10 deposit will be applied automatically after the 30-day free trial ends and your paid subscription begins.

Note: You will not receive a $10 deposit if you do not begin the paid subscription.

All kids can get a debit card with Greenlight!

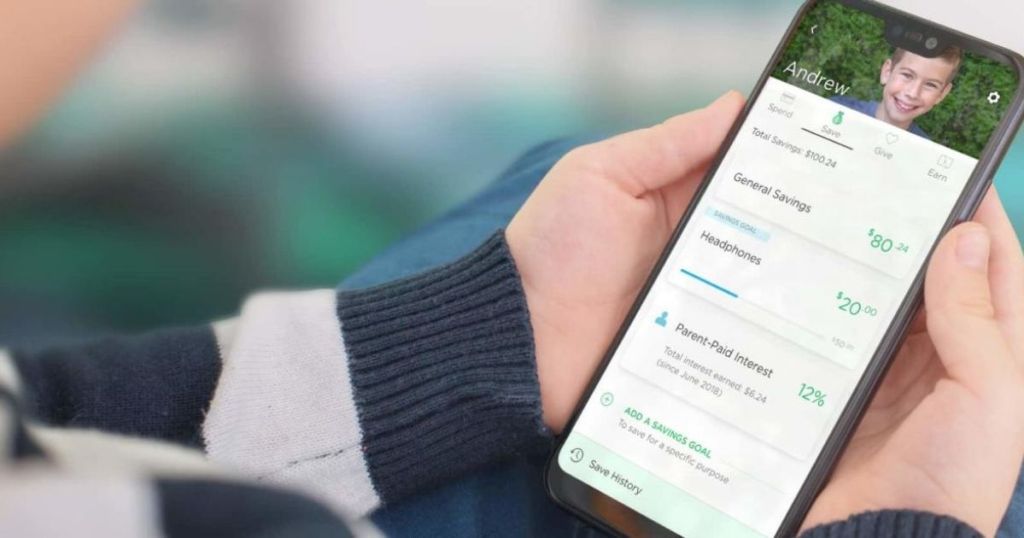

One of the most unique aspects of Greenlight debit cards is that there’s no age limit. It’s truly a debit card that allows you to start teaching them practical financial skills at any stage. 🙌 You can apply for a debit card as soon as you want to start allowing your kids to use them.

The cost per month to maintain the card is only $4.99–the same, if not cheaper, than many other financial institutions.

And right now, Greenlight is offering your first month free + free cancellation any time!

While kids can use the Greenlight debit card, the parents are still in control.

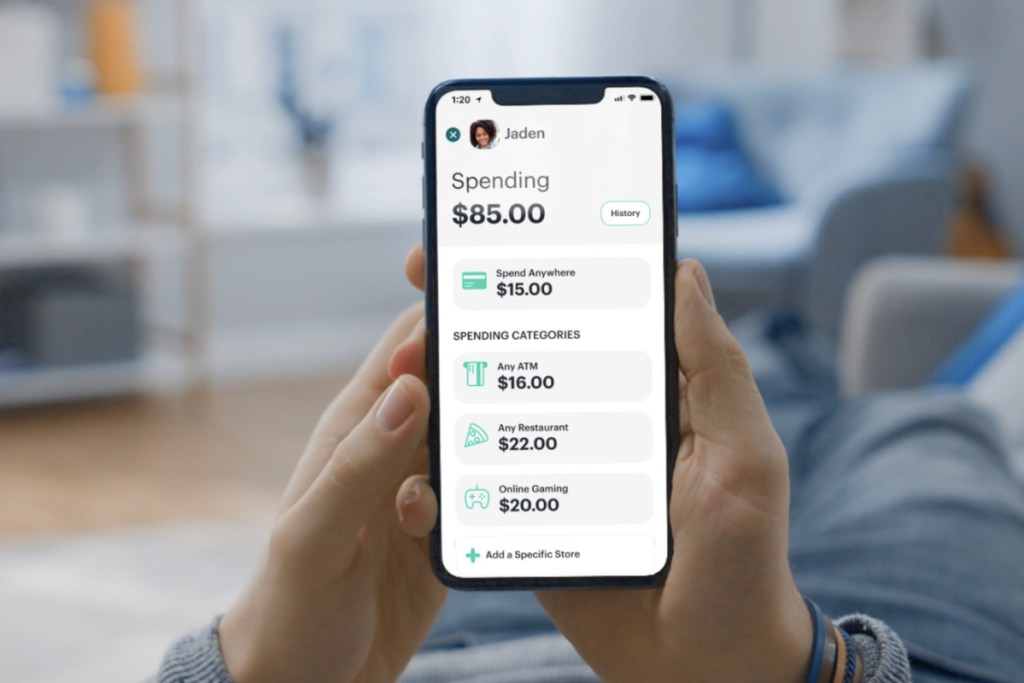

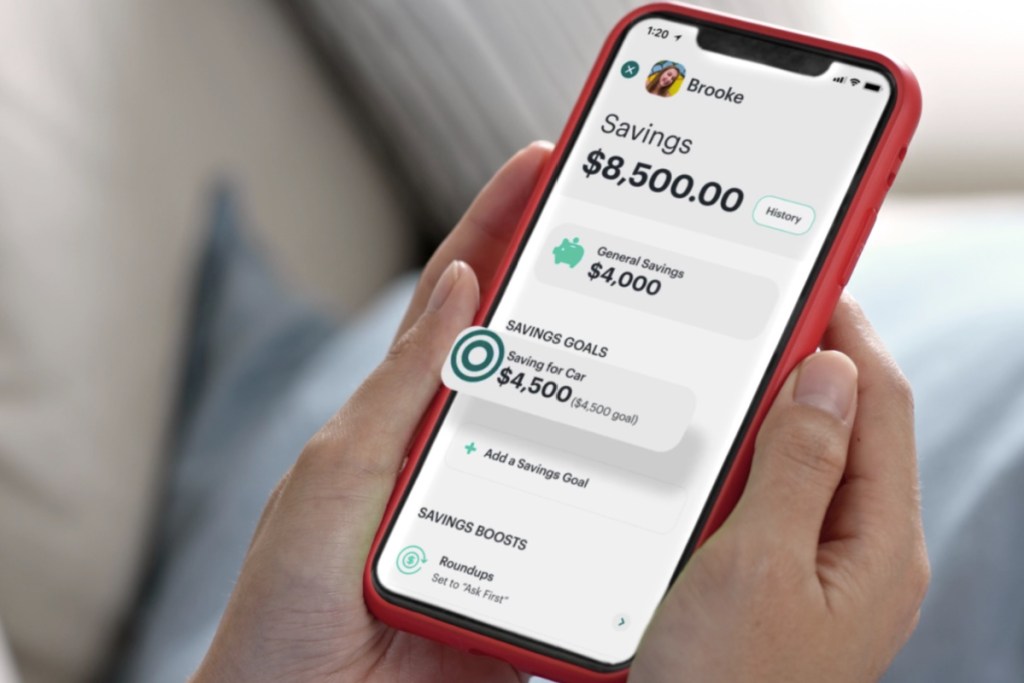

Once you receive your Greenlight debit card, you and your child can both download the same Greenlight app, but you’ll have access to different features. Parents can easily transfer cash into their kid’s Greenlight account via the app, so they’ll be in charge of how much their child has access to.

You can keep it simple by transferring a set amount and calling it a day, OR you can take advantage of the neat features that Greenlight offers!

Transferring from your existing bank account is also really easy with Greenlight.

Parents can transfer money into their child’s account from their own checking account at any bank instead of having to create their own just for Greenlight transfers.

My Hip teammate, Melinda, recently started using Greenlight and said the flexibility was one of her favorite perks.

“We want our kids to have an account and get used to having a debit card. When looking at other banks and trying to decide what sort of debit card to get our daughter, we realized we needed a bank account wherever we got her a debit card. For example, if we wanted to get her a Chase card, we needed to have a Chase account. With Greenlight, you can link your existing bank account to the card. So our daughter’s Greenlight debit card is linking to our Charles Schwabb checking/savings account, which we like.” – Melinda

Transferring between accounts at different banks can be difficult and often loaded with fees, so Greenlight is perfect for parents looking to avoid those unnecessary steps.

Here are some other things that set Greenlight apart from a traditional debit card:

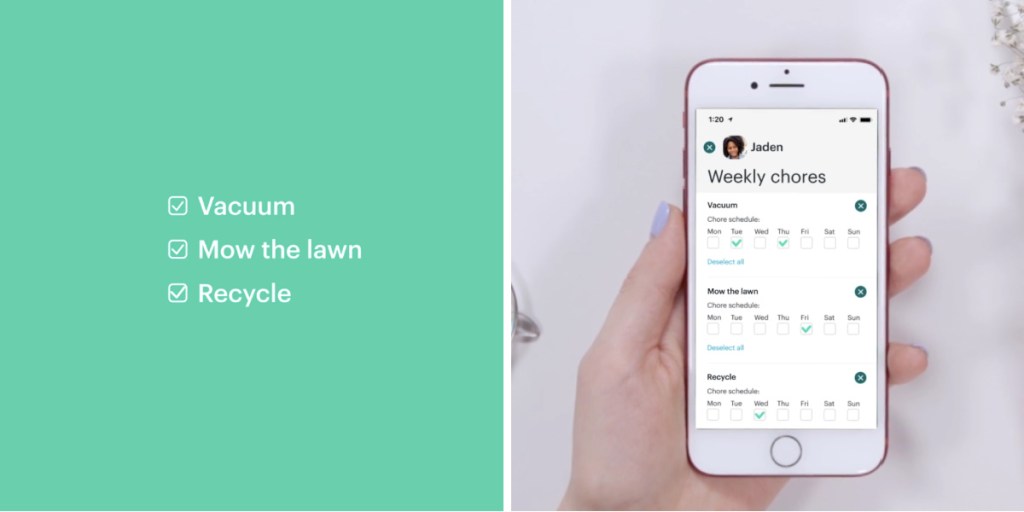

- The ability to create chore lists. Parents can delay their kid’s ability to access the money until they complete their chore list, rewarding them for completing all the tasks.

- Real-time spending alerts. Parents will always know what, when, where, and how much their kids are spending.

- The ability to switch off the card. If the Greenlight card is lost or stolen, freezing it is as easy as clicking a button.

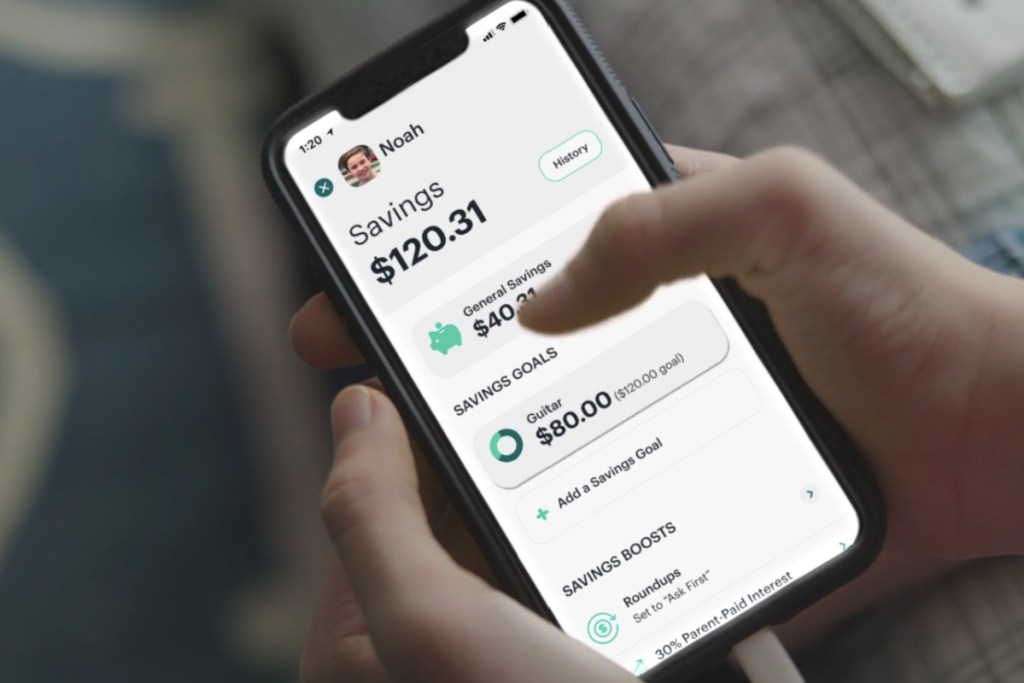

- The Round-Up program. Kids can save while they spend! Each time they make a purchase, Greenlight will round it to the nearest dollar and put that toward their savings.

- Parent-paid savings interest. Want to teach your kids the benefits of compound growth? You can opt to set a parent-paid interest percentage for their savings accounts!

My Hip teammate, Bryn, has also been using the Greenlight card for several years and finds it super helpful!

Here are a few reasons she loves it:

“We quickly discovered how awesome Greenlight is especially for families with tweens. First, the Greenlight app is super easy to use and allows you to easily and instantly move money from your Parent Wallet into your kiddo’s wallet (I have used this feature when my kids have been with a friend’s family and end up stopping somewhere to eat and quickly need some $ to cover their meal). I love that because it’s a debit card and it has a Mastercard logo so it is accepted anywhere Mastercard is accepted. Kiddos cannot spend any money that they do not actually have in their Greenlight wallet.

Parents also have the ability to instantly turn the card off via the app, automatically transfer allowance payments, manage chores, and (my favorite feature) receive alerts whenever the card is used! I love this feature as it is super helpful to get real-time alerts about where my kiddo is spending money AND how much they just spent.”

She also noted, “we do pay a monthly fee of $4.99 but this fee is well worth it in my opinion, and keep in mind that it includes debit cards for up to five (5) kids so both of my boys have their own Greenlight card.”

A lot of folks are turned off by monthly fees, but seeing as most banks charge the same monthly fee per account, you’re still getting the best deal with Greenlight. 🙌

Another great perk that comes with getting a Greenlight debit card for kids is zero risk of NSF fees! Even if you set up a guardianship account with your child at a traditional bank, they’re very limited in what they can do and may still get hit with overdraft fees if they aren’t careful. These can be outrageously high and often compound to put overdrawn accounts severely in the negative.😱

My Hip teammate, Stacy, said it best:

“I could totally add them on to my credit union account and have the perk of easy transfers. They even have bank cards for kids, but they don’t have a built-in system for chores and they don’t have any safeguards to keep the kids from getting NSF fees.”

And speaking of safeguards, here are the ways that Greenlight keeps parents protected when getting a debit card for kids.

First, like almost all banks, your Greenlight account is FDIC-insured for up to $250,000.

Second, there are certain debit card transactions that your kids will not be able to complete. Per the Greenlight website, these include:

- Wires or money orders

- Security brokers or deals

- Dating/escort services

- Massage parlors

- Lotteries

- Online casinos or online gambling

- Horse racing and dog racing

- Non-sport internet gaming

- Cashback at the point of sale

It’s a pretty comprehensive list, and it still allows your kids to use their debit card for normal, everyday purchases without the risk of them using it for something that could get them in trouble.

If you want to take things a step further, you can also teach your kids about investing!

Signing up for Greenlight Max lets you start teaching your kids about investing–starting with only $1!

And while signing up for Greenlight Max will increase your monthly payment from $4.99 to $9.98, you aren’t on the hook for any trade fees, which are often even more than the difference between the regular and Max Greenlight accounts.

Thxs for this. We had this card for our teen & it was nice. We have since moved her to an actual bank card that has set up similar options like chores. Since you can only use what’s in your account, we do not incur NSF fees either. I really enjoy the learning aspect of these cards. Thxs!

Great idea. I have an extra account I transfer money to when shopping online. My son 14, has this debit card to this account he uses, but knows I don’t keep much money on there unless I’m buying something or I’ll set a limit what he can spend if he’s out. I don’t have overdraft or anything on here just in case it gets lost or stolen m.

We have this for both of my teens. Love it. I never have to worry about them having money when they are out. I can easily turn their cards off, if needed. They are learning alot about money

We have this, and I do like Greenlight, and we pay the $4.99 monthly fee, and it is worth it. Just be aware that if the parent want to transfer money back into their bank account from GL, you need to speak with customer service and it can take 5-10 business days. It is much easier to transfer in (instantaneous) than to transfer money out. Also, I did not realize I had to move money from Spend Anywhere category into the ATM category. My daughter’s ATM transactions were denied for that reason–so I guess we are still learning–but we do like the convenience of the card-and you can send a photo and get it personalized which was a lot of fun for my kids!

My 16 year old niece could not cash her paychecks without a checking account so I opened a teen checking with Capital One. It’s available for any kid 8+, No fees, parent controls if you want them, debit card, she can electronically deposit her checks and get cash at ATM and earns a little bit of interest. At 18 she can transfer to a regular checking of her own and/or keep the teen Checking if she wants.

Yes! I just switched to Capital one from Greenlight, no fees and I can still see the balance and transfer money if needed!

Our local bank offered a similar program when my boys were younger. No fees. I wouldn’t pay for green light when there are other options.

Oh my gosh! Thanks for this! I’ve been searching for an alternative because the fee is stupid with GL. Nothing I could find was for under 13.

My child has had a greenlight card for almost a year. It has been good. I love the parent alerts when she spends. I am divorced so it is especially useful because both parents get the alerts. Also both parents can add funds to the account. If you upgrade to the $9.99 you can also purchase stocks. While I find it very beneficial I can’t stand the monthly fee. Chase has recently added a debit card for kids with no monthly fees. It doesn’t come with all the additional features but it will be a back up for the GL card.

We just got an advertisement in the mail in the last couple days from chase and they are offering a debit card with no fee- I want to say it was for ages 6-16, but I’ll have to double check

Yes, I just opened an account for both of my kids (7 and 9) last week. I have a Chase account so it was free and it has all of the same features as Greenlight!

If you have access to USAA they have amazing youth accounts with lots of options.

Yes! I just opened one yesterday for my 14 year old son. I was really surprised with all the options.

I have been a financial counselor for 14 years. Please don’t do this as a means to “teach” your children how to manage money. It’s not tangible in the same sense as cash. Swiping vs handing over physical cash has different affects on the brain. Most adults cannot overcome this, let alone kids. Think twice.

YES! I was just wanting to comment on this. They need to actually see the value of money not just swipe a card and receive something. I even have a hard time sometimes and have to refocus my brain that it is actual money. Teach them how many hours have to be worked in order to buy something. When you look at it that way items aren’t so appealing anymore.

Meghan, I could not agree more! This does not seem like a way to teach children. Having cash to spend or save is a better option.

In an age where digital currency is taking over, this might not be the best decision. Teaching them how to use a card and showing the impact of a swipe might be more valuable as that will be the way of the future. I appreciate Dave Ramsey and his mentality, but that is for people who have little to no financial discipline. This app also shows the power of compound interest and the impact of saving money. You wouldn’t teach your children to put cash under your bed? Why would you teach them to only use “tangible cash”?

We use Copper. No fees. We love it.

I opened kids accounts with Capital One and it has worked well for us. My boys can access their account through pc or phone and allowance is automatically transferred from my account. And if they lose their card, etc., they called customer service themselves! That’s a real life lesson 😉

Now that they are adults, they still use Capital One as their primary accounts. And I am still connected to all their accounts so if they need to borrow money from each other, I can instantly transfer rather than use an app that will deduct a percentage. And no fees!!

My 11 and 12 year olds have these. I put their allowance on it so they can buy what they want. Works especially well for things like roblox (as opposed to cash allowance, where they’d have to hand me cash and I put it on my card).

We opened an account at Wells Fargo for our teenage son. There is no fee and he can deposit checks in person or with his phone, get cash at ATMs, free Zelle for transfers and use Apple Pay. Since it’s a minor account, I see all his activity and can transfer money to/from my account.

We looked into Greenlight, but at $60 / year, it didn’t make sense. Seems like if you want to teach your kid about managing money, avoiding unnecessary fees is a good place to start.

I had one of these growing up, it was awesome! Thanks for sharing.

Oh cool! You’re welcome! Thanks for commenting! 🙌

Greenlight is…not awesome. My daughters chores are quarters, not dollars. So when the fee is $5 a month and I have to pull teeth to get her to do anything anyway, then r washes it all down the drain basically. I guess if you are a parent giving their child $50+ a month, it’s great for you. For me, my daughter earns money the hard way, it’s not given to her, and it’s not in large amounts. This last time I complained and they offered me three months free. Prior to that ending, I said no thanks time to cancel now. They extended another three months. Flash forward a month later and I got charged. They refunded and supposedly gave me the offer again. Regardless I’m looking into other options on this thread. I’ve tried researching a lot and can’t find anything for under 13 but sounds like there are a few.

It seems the concensus is Capital One over Greenlight. No fee, same features, it’s a no-brainer.

These are some other things to consider…

1. Greenlight offers up to 2% (depending on the plan) up to $5000 for the whole family. In my case, I have 3 young children who maybe by the time they are teenagers can have a total balance similar. So in a year, I could make an extra $100 if that is my balance. Capital One offers .10% which would equal $5 for the year. So your fees for Greenlight could be made up just in the savings. 2. Greenlight offers 1% cashback on purchases. Capital One does not offer cashback on purchases. 3. Greenlight allows you to show your children the power of saving and compound interest. It focuses on financial literacy, not just having an account. 4. Greenlight allows you to invest. If you are looking to just give your kids a debit card then maybe Capital One is for you…if you are looking to teach money management go with Greenlight.

Thank you for this post! My teen is going to Europe on a school trip, and I need to get them a card to take that I can easily/quickly fund with my bank account. So I’ve got to find one with no foreign transaction fees. I’d love to know what other parents do in a similar situation!