5 of the Best FREE Online Tax Filing Options

Looking to file your taxes for free? Here are the best free tax filing options for 2024!

There’s still time to file your taxes for FREE and we’re sharing how!

You need to have your taxes (or an automatic extension) filed by Monday, April 15th, 2024, so don’t wait!

This year, the IRS is urging taxpayers to file electronically with direct deposit as soon as they have the information they need.

Note that residents of Massachusetts will have until April 17th due to state holidays and some of the residents of Maine have an extension until June 17, 2024 due to recent storms and flooding.

Below, we’re sharing a list of FREE electronic tax filing programs that are quick and easy to use, so you can check income tax filing off your to-do list in the most painless way possible!

Hip Tip: Although the IRS typically issues more than 90% of federal tax refunds within 21 days of accepting them, sometimes it can take longer than that to receive your money.

Learn how to check the status of your federal income tax return here.

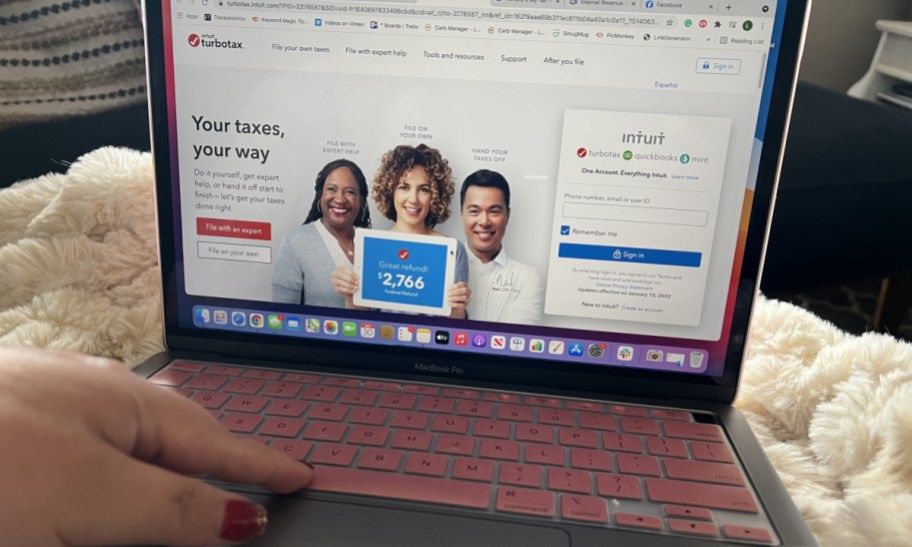

1. File simple federal and state tax returns for FREE with TurboTax.

For as long as we can remember, TurboTax has been one of the easiest tax filing options to do from the comfort of your home.

TurboTax allows taxpayers to file simple federal and state tax returns completely FREE with TurboTax Free Edition.

2. FREE online tax filing with H&R Block – even with select deductions.

Head over to H&R Block where you can file your taxes online for FREE! Their free online tax filing includes deductions for student tuition, payments, and loan interest.

3. Enjoy advanced features at no extra cost with FreeTax USA.

Consider using FreeTaxUSA.com to e-file your Federal return directly with the IRS, and you can choose from their Basic, Advanced, Premium, or Self-Employed filing programs – all for free!

Add a state return for just $14.99.

Hip Tip: This site has been highly recommended by our Hip2Save readers for its easy-to-use platform and no-nonsense pricing!

4. Surprise filing fees? Not with Credit Karma Tax.

Note that this free service ended on February 9th. But here’s what you need to know for next year:

Filing with Credit Karma Tax (formerly Cash App Taxes) is as FREE as it gets! Head on over to Credit Karma Tax to get started with your free federal AND state return.

And if you filed with Credit Karma Tax last year, you can file even faster by importing your past returns from Credit Karma Tax.

Hip Tip: Don’t fear an audit! Credit Karma Tax guarantees 100% accurate calculations, and you’re covered by their 100% FREE Audit Defense.

5. Get a maximum refund guarantee with TaxAct.

Head over to TaxACT where you can file a simple federal tax return for FREE!

If you used a different service last year, it’s easy to switch to TaxAct from your previous online tax provider by uploading a PDF of your previous year’s return.

Then, you’ll be able to prepare, print, and electronically file your tax return for free!

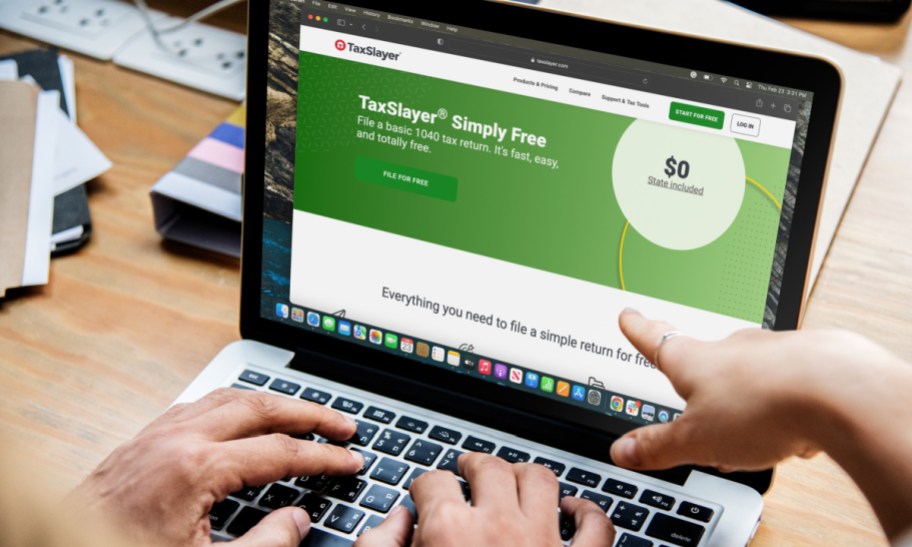

6. File your federal & state taxes FREE with Tax Slayer.

File your federal and state returns for FREE online when you use the TaxSlayer Simply Free plan.

You can also get low pricing on their advanced filing software.

More Hip tips for free tax filing options:

- If your income is $79,000 or less, you can head directly to IRS.gov and file your federal taxes for free!

- Residents of Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Wyoming, Arizona, California, Massachusetts, New York, and Washington may be eligible to file their taxes free of charge thanks to the pilot program IRS Direct File. Visit the IRS Direct File website to check your eligibility.

- Check the daily deal sites. Groupon has offered up significantly reduced vouchers for online tax preparation products in the past, and they will likely have similar offers throughout this year’s tax season.

- Ask your local college or university. One reader reported that the accounting students at her local college will complete tax returns for free. They’re then reviewed by the professor to ensure accuracy.

- The AARP Foundation Tax-Aide offers free help for older taxpayers and people with limited incomes. Find an AARP Foundation Tax-Aide site in your community by visiting the AARP website.

- If you’re in the military, check out Military One Source for more information about the different tax filing resources available.

- Check for Volunteer Income Tax Assistance (VITA) or Tax Counseling for the Elderly (TCE) sites near you. Those who generally make less than $64,000 per year, persons with disabilities, limited English-speaking taxpayers, and the elderly may qualify for assistance through the VITA and TCE Programs. IRS-certified volunteers provide free basic income tax return preparation with electronic filing to qualified individuals. Find a VITA Volunteer site in your community by visiting the IRS tax prep website.

(Thanks, Chris!)

It may be worth checking with your local library as well. At our local branch, volunteers offer free help with filing.

What a great tip! Thanks for mentioning that, Beverly! 🙌🤗

I have helped several through United Way and it was totally free.

Thanks for sharing that, Kathy! Good to know it was free through United Way! ❤️🎉

I got a free CPA on freecycle that did my taxes for free every year for 10 years. Now that she is retired and does it from home it costs me $15 (what it costs her to file it online). One of the best deals I got on freecycle over the years.

Wow! What a great find, Patricia! 🙌 Thanks for sharing where you’ve been able to score free tax prep. 💓

It looks like the Credit Karma free filing deal ended Feb 9th, 2024. It now costs $69 to file with Credit Karma.

Bummer! Thanks for letting us know, rano! We’ll get this updated! 🤗💕