How to Check the Status of Your IRS Tax Return

Here’s how to track the status of your tax return refund from the IRS.

Wondering “Where’s my tax refund?” There’s an app for that!

When you file your income taxes and find out that you’ll be getting a tax return from the federal government, then you may soon start wondering, “Where’s my refund?!” The IRS gets this question enough that they’ve dedicated an entire page of their website to answering this query!

Access the IRS ‘Where’s My Refund’ tool on your computer or mobile device.

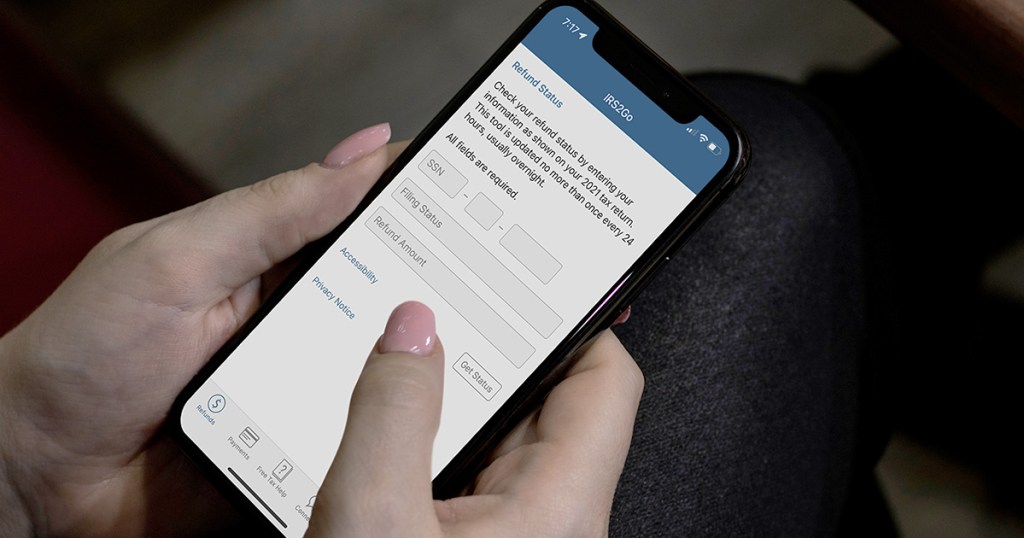

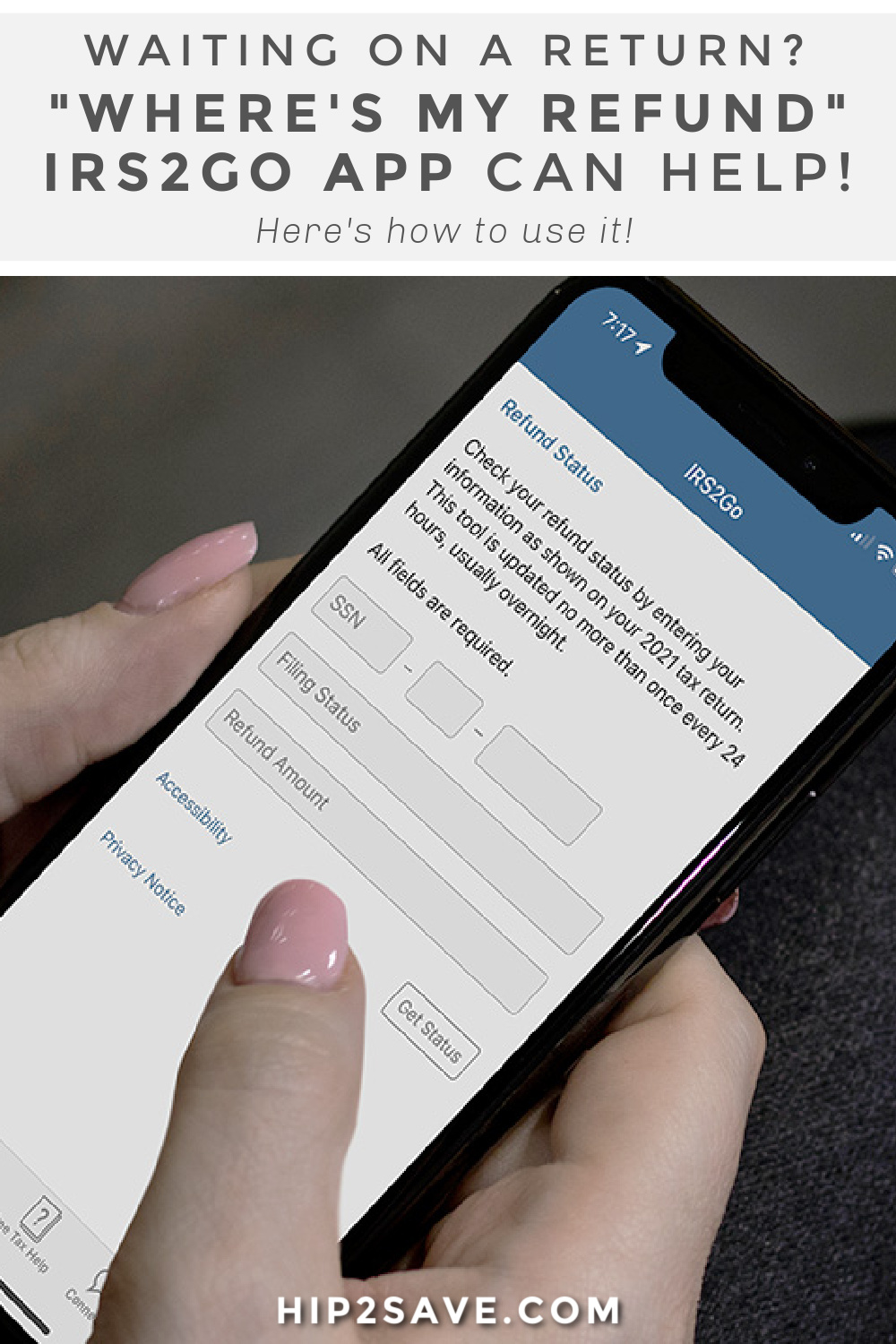

There are two easy methods of checking the status of your tax refund with the IRS’ Where’s My Refund tool. You can either download the IRS2Go app on your mobile device or open any web browser on your laptop or desktop computer and navigate to the Where’s My Refund page on the IRS website.

No matter how you access the Where’s My Refund tool, you’ll be asked to enter the same information: your Social Security Number or ITIN, your filing status, and the exact refund amount you’re expecting to receive. Be sure to have this information handy so you can check the status of your refund.

You can use the IRS’ Where’s My Refund tool 24 hours after the IRS receives your e-filed return or 4 weeks after you mail a paper return. To get started, simply open the IRS2Go app on your phone or use your web browser to head on over here and click the blue “Check My Refund Status” button.

After entering the required information, you will receive a personalized refund update based on the processing status of your tax return. The Where’s My Refund tracker will display your refund’s progress in one of three stages:

- Return Received

- Refund Approved

- Refund Sent

Once the IRS has processed and approved your tax return, you will also be provided with an actual refund date. The Where’s My Refund tool has the most up-to-date information available about your refund and it’s updated daily (usually overnight), so there’s no need to check more often than once per day.

What if the IRS’ Where’s My Refund tool can’t locate my refund?

The IRS issues more than 90% of federal tax refunds in less than 21 days, but sometimes it can take longer than that to receive your money. Some tax returns require additional review, or it might just be taking longer this year (like so many other things!) due to staffing issues.

If the Where’s My Refund tool is unable to provide you with an update on the status of your tax return, the IRS asks you not to file a second tax return or contact them by phone. They do have phone and walk-in representatives who can help you research the status of your refund, but only if it has been 21 days or more since you filed electronically, more than 6 weeks since you mailed your paper return, or if the Where’s My Refund tool specifically directs you to contact the IRS.

Keep in mind that the US Postal Service may still be experiencing mail processing delays related to COVID-19. This means that it might take longer than usual to send, receive, and process mailed documents like paper tax returns and other tax-related correspondence. The IRS is currently processing all mail in the order that it is received.

Haven’t filed your return yet? Here are some FREE options to get started!

I just wanted to let everyone know…my husband works for the IRS. Due to Covid, there is a HUGE back log. They are still doing paper returns from 2019. That means if you “mailed” a 2019 return in the year 2020, there is a huge possibility that it hasn’t been looked at yet. You will definitely get your refund faster if you efile (but unfortunately that isn’t saying much either…sorry).

Agreed e file if you can vast majority can e file for free as well

I e-filed in May 2020 and still haven’t received my refund of 7k +. That’s a lot of money for us right now. I’m sure we wouldn’t be allowed to not pay money due for months and months without repercussions. 😠

Adding that now you can’t even check the status of 2020 refunds anymore because the IRS is so incompetent that they can’t even have a drop-down menu to choose which year you want to check on even though they have several years backlogged. You can only check on this year’s refunds now. 😠

I was reading that next year to efile you will need to be registered at ID.com. Uploading a selfie and video. Put in place due to fraudulent tax returns. I don’t think it’s in place for this years efile returns.

*ID me

WRONG. The id me verification is if you want to access your information using the IRS website. It is not for filing a tax return. And I will remind people – you get what you pay for. If you don’t want to pay taxes you aren’t going to get services. It’s not incompetence, it’s understaffing. Their budget is down 25% (adjusted for inflation) from what it used to be. Try working at your company with 25% less staff and all of the experienced people retired….

Thanks for the correction. I was a bit off. 🙂

My son is still waiting for 2020 taxes. He called and the representative told him to wait another 16 weeks and if nothing shows up then give them a call back. He is a broke college student waiting on a few $$. So we’ll see

Thank you for posting this! I am still waiting on my 2019 return and have been rather sick to my stomach over it. Was forced into paper filing because IRS kept kicking my e file back to me ~ it was my first year filing as a widow (the ONLY difference) so I assume that was the issue. Again, thank you for your message!

You’re very welcome, Susanne. 💖 SO sorry for your loss.

Filing direct for Direct Deposit, IRS accepted my taxes on February 8th and it is now June 7th and I have still not received my return of $5.999. My bank has not received my return, I have checked with them. I do not understand what is taking this so long?

Sorry to hear that! Be sure to download the app or head through the link above to try and find the status of our refund. Hoping that might help! 🤞❤️