Several States Are Sending Out A Stimulus Check in 2022 (Are You Eligible?)

A state stimulus check might be headed your way in 2022.

Some states are providing economic relief via tax rebates.

Though the federal government probably won’t send stimulus checks in 2022, you might be receiving some help from your state. In the latest attempt to combat inflation and stave off a recession, well over a dozen states have decided to send income tax rebate checks to their residents. Most of these refunds are for small amounts (so don’t get too excited) but we do have the scoop on who qualifies and when to expect a payment!

Find your state below and see if you qualify for a stimulus payment:

California

Who qualifies:

- Single taxpayers who make less than $75,000 annually or couples who filed jointly that make less than $150,000 annually will receive $350 per taxpayer and an additional $350 if there are dependents.

- Single taxpayers who make $75,000 – $125,000 annually or couples who make $150,000 – $250,000 can expect $250 per taxpayer and an additional $250 if there are dependents.

- Single taxpayers who make $125,000 – $150,000 annually or couples who make $250,000 to $500,000 annually will receive $200 per taxpayer and an additional $200 if there are dependents.

When: First payments will go out as soon as October in the form of a direct deposit or debit card.

Colorado

Who qualifies:

- State residents who filed their 2021 returns by June 30 qualify.

- Individual filers will receive $750 and joint filers will receive $1500.

When: If filed on time, expect a check by September 30, 2022. Those who filed an extension will see a check by Jan 31, 2023.

Delaware

Who qualifies:

- State residents who filed their 2020 and 2021 tax returns qualify and can expect $300 per adult.

When: Checks will be sent out from May 2022 through the end of Summer 2022. Adults who did not file timely may also receive a check after October 17, 2022.

Georgia

Who qualifies:

- Full-time state residents who filed their 2020 and 2021 tax returns timely. If you filed an extension, you have until October 17, 2022. Part-time residents will receive a proportional refund.

- Single taxpayers will receive $250, heads of household will receive $375, and married couples filing jointly will receive $500 together.

When: Payments began going out in May 2022.

Hawaii

Who qualifies:

- Single taxpayers and heads of households making under $100,000 will receive a $300 return.

- Married taxpayers filing jointly and surviving spouses who make under $200,000 will also receive a $300 return.

- Individuals who make above $100,00 and couples who make above $200,000 will receive a payment of $100.

When: Payments will come via direct deposit or paper check beginning at the end of August 2022.

Idaho

Who qualifies:

- Full-time residents who file their 2020 and 2021 tax returns by December 31, 2022, are eligible for a payment of $75.

When: Payments started in March 2022 and were sent out via direct deposit or paper check. You can track your rebate payment on Idaho’s State Tax Commission website.

Illinois

Who qualifies:

- Individuals who earned less than $200,000 in 2021 (and were full-time residents) will receive a $50 income tax rebate.

- Couples filing jointly who earned less than 400,000 in 2021 will receive, together, a $100 tax rebate.

- Those with dependents can collect $100 per dependent with a maximum of up to 3 dependents.

- Illinois residents may also qualify for a property tax rebate or other economic relief under the Family Relief Plan.

When: Payments begin starting September 12th, 2022, and will be sent in the same method that your original tax refund was sent.

Indiana

Who qualifies:

- All state residents that filed their 2020 taxes before January 3, 2022, will receive a $125 taxpayer refund.

When: Payments should be received by September 1, 2022, and will come in the form of a direct deposit or check.

Maine

Who qualifies:

- Full-time Maine residents who filed 2021 tax returns (and are not listed as dependent on anyone else’s return) qualify for a payment if they file by October 31, 2022.

- Single taxpayers who make less than $100,000 qualify and will receive a payment of $850.

- Heads of households who make less than $150,000 qualify and will receive a payment of $850.

- Couples filing jointly who make less than $200,000 qualify and will receive a single payment of $1,700.

When: Payments started in June 2022 for those who filed timely.

Massachusetts:

Who qualifies:

- If relief is approved, individual taxpayers who made more than $38,000 but less than $100,000 in 2021 will qualify for a $250 payment.

- If relief is approved, couples who filed jointly and made no more than $150,000 in 2021 will qualify for a $500 payment.

When: If implemented, your stimulus check will be issued before September 30, 2022.

Massachusetts previously provided relief for eligible low-income workers. If you had a household income at or less than 300% of the federal poverty level and did not collect unemployment, you should have received a stimulus payment of $500 earlier this spring.

Minnesota

Who qualifies:

- Frontline workers who were employed at least 120 hours in Minnesota between March 15, 2020 and June 30, 2021. Review the eligibility guidelines and apply for the payment before July 22nd, 2022.

- Frontline workers with direct COVID-19 patient contact qualify if they made less than $175,000 or $350,000 if filing jointly.

- Frontline workers without direct COVID-19 patient contact qualify if they made less than $85,000 or $185,000 if filing jointly.

When: Payments are anticipated to be sent in Fall 2022.

Gov. Tim Walz has also proposed an income tax rebate that is yet to be approved. His proposal is for a $1,000 relief for individual taxpayers making less than $165,000 and a $2,000 relief for joint filers making less than $275,000.

New Jersey

Who qualifies:

- New Jersey residents qualify if they filed the NJ-1040 in 2020 and have at least one dependent.

- Individual taxpayers who made less than $75,000 are eligible.

- Surviving spouses, heads of households, and couples filing jointly who made less than $150,000 qualify.

When: Checks began being mailed on July 2nd, 2022. New Jersey residents might also qualify for property tax relief which will be a separate payment.

New Mexico

Who qualifies:

- Individuals filing separately qualify for a $250 rebate if they made less than $75,000 in 2021.

- Married couples filing jointly, heads of households, and surviving spouses who made less than $150,000 in 2021 are eligible for a $500 tax rebate.

When: Payments for relief above begin in July 2022. New Mexico also offered two other separate stimulus checks. One was mailed in June 2022 and another will be sent in August 2022.

New York

Instead of income tax relief, New York has issued property tax relief for homeowners.

Who qualifies:

- Those who qualified for a 2022 School Tax Relief (STAR) credit or exemption are eligible for up to $1,050 provided their 2020 income was less than $250,000 and their school tax liability for 2022-2023 is less than their 2022 STAR credit.

When: If you qualified, your stimulus check was sent out starting in June 2022.

Pennsylvania

Like New York, Pennsylvania has issued property tax relief for homeowners.

Who qualifies:

- Homeowners who applied to the MyPath program and fit the eligibility requirements listed below.

- Homeowners are eligible for a maximum rebate of $650 if they make less than $35,000 (or are a renter who makes less than $15,000) and are seniors above the age of 65, have a disability and are at least 18 years old, or are a surviving spouse age 50 and above.

- Seniors in need may qualify for additional relief.

When: Check the status of your rebate using the “Where’s My Rebate?” tool.

South Carolina

Who qualifies:

- Any state resident who paid taxes this year is eligible for an income tax refund.

- Those that paid $800 or less will receive a full refund.

When: Payments are expected to be sent in late November and December.

Virginia:

Who qualifies:

- Only taxpayers with a tax liability last year are eligible.

- Individuals filers will receive $250 and those who filed jointly will receive $500.

When: Payments are expected to be sent via direct deposit or stimulus check starting in late September 2022.

New to Hip2Save? Be sure to browse the site. We post so many legit freebies, ways to make money, lots of frugal tips and hacks, all the hottest deals, and so much more. Get started here!

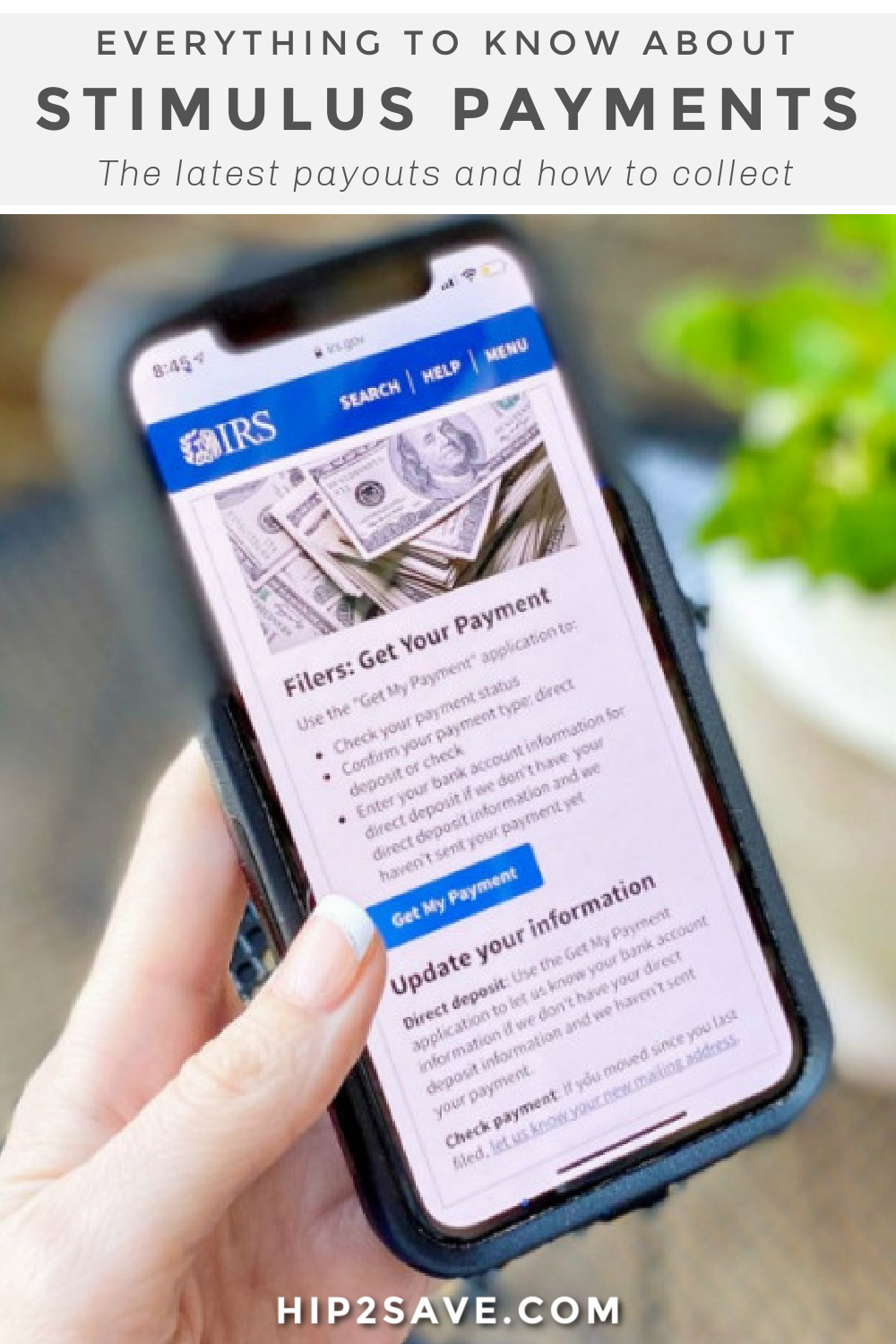

I tried to find out status of our stimulus check. We have actually already received our dir deposit from IRS for 2019 refund, but when I go to “get my payment”. It says your ” payment status is currently unavailable”. And it does not direct me anywhere. We have filed for 2019. What do we do now? Can’t call IRS?

Same with me. I checked this morning and mine also said payment status unavailable. And I normally get my federal refund with direct deposit. And I already have gotten my federal tax for this year. It’s really frustrating because the dental office where I work has been closed for the last 3 weeks. And I haven’t gotten any payment from the unemployment office either. I’m hoping they will send out more direct deposit through out this week.

Same issue!!!! What are we supposed to do?? This is BS I updated my info last week!

On the news this morning, they said it’s a glitch in the system and to keep checking

Same issue

I went to get my payment today trying to update my bank info and they said that they have already sent it to my old closed account. What can I do please?

Im having the same issue and no one to call about it!

Same boat

Same!!!!! I went to my old bank and they said they are automatically sending any stimulus money back to the irs that was sent to a closed account!!!!! Someone help!!!

I have the same issue. Called my bank and they told me they will send the check back and that I would have to call IRS. ??

My money went In to tax lady account and she saying the account have been closed out a year ago what should I do

same! does it go back to the IRS or what?

I have the same problem, I even filed my 2019 taxes with the CORRECT bank account info and they still sent it to the incorrect account…..there is no one to contact in the IRS about this either. I hope we will still get our money 🙁

Exactly the same boat as you, Ashley. My wife has not worked in over a month, she has not received unemployment yet, and we need to pay rent in 15 days. Thank goodness the city I live in is not allowing anyone to be evicted at the moment.

Oh, and the kicker is they know my new address in CA that was on my 2019 return, but for some reason used the bank account on the 2018 return instead of the one we listed on the return we filed in February.

Same thing happened to me please if you figure out anything please email me williambutler92@gmail.com

I am having the same problem! I did read on the website the IRS will be sending letters within 15 days after the check was “paid” and how to report any failure on the payment. Hopefully they can fix this for us if we can’t get in contact with the IRS via phone any time soon.

My fiancées check was also sent to the wrong account and now we’re screwed if someone finds a solution please help

I’m having the same issue.. I believe they would send it through the mail, but I’m not sure how long we would have to wait on that… This is just crazy… The wildest part is that there is no way for us to update our bank information.

I have the same issue. Called my bank and they told me they will send the check back and that I would have to call IRS. ??

Im hoping once the bank rejects it, it will give us an option to put in new checking information

Same thing here. Money was sent to a closed acct and I have no way to update bank acct info. I was told bank will send back to IRS and I’ll have to wait for a paper check..who knows how long!

Same here!!!

Same here. They used 2018 instead of my 2019. So going into closed account. They need to fix this. Been out of work for 3 weeks.

I had the same thing happen to me. Payment was sent to an old account. They said call the IRS.. Nobody taking calls. Wonder how long we will have to wait. My fiance has been laid off for weeks. Needed this help!

Same thing happened to me! I contacted my old bank and they stated that it will be sent back to the irs and I would receive a paper check. I’ve been waiting for days for the portal to open up to update my account info however the portal opened up at the same time the deposit was sent which makes no sense because it prevented me from updating in time. Such a dumb move by the government. The portal should have been opened prior to any deposits for situations like this! Beyond frustrated

Right! This is ridiculous

You hit the nail on the head. I’m in the same boat, and I’m sitting here thinking and wondering why the heck the IRS couldn’t have had this portal ready so that those whose account for deposit information changed wouldn’t have this issue. This is a cluster*#)$ with so many people affected.

Same issue the bank said it will be rejected and they will issue a paper check

mine says it got sent today but the acct number is the last 4 of my social? i used a turbo tax prepaid card this year when i filed for my return and used my bank acct last year, i don’t know what this means? it does not show in any of my accts

Megan i have the same issue and have no idea where the check is. If you find out any information will you please share as i will to.

what does “payment status not available” mean?? My banking information has been the same for 21 years..

I got the same message. I wonder what it means..?

Same message here! And I received my 2019 tax return today (though I expected it to be garnished, like other years, for past due student loans).

I am currently rather stuck in Italy (for 3 months now, with COVID-time spent in the hospital, so REALLY hoping to figure this all out.

Please inform me/us if anybody figures it out! ~ thank you! ~

I received the same message today on the tool. I did receive my 2019 tax refund today but not the stimulus $1200. I know I definitely qualify for it but not sure why i didn’t get it. Does not give you much info or anyone to contact.

Same message for us too.

I tried to check a few minutes ago and I got the message that “according to the information we have on file, we cannot determine your eligibility for a payment at this time.” We should definitely be getting one, and they have our direct deposit information on file – I received my tax refund earlier this month.

Same message for us too.

Make sure you’re inputting your address correctly. Do not enter city or state in the “street address” at all. I did that at first and it gave me the same message. Then I removed the city/state and then it told me that it was already sent.

We got the same message.

Same for me too!

I got the same message what does it mean lol

Same here. I was a little confused on that. I just enetered my street address without the city and state too.

Got the same message twice. Per Google results, hundreds of people are getting the same message. Figures this wouldn’t run smoothly.

Same message, like WTF

Same message here

Yeah, same issue here. That’s an extremely generic and unhelpful message since I’m fairly certain it just means they haven’t gotten their act together on their end.

I had to try it twice and finally it worked and told me it was gonna be deposited today

Mine hit this morning for the full expected amount! Whooohooo!

I’m really hoping to get an answer because I’ve been posting this question anywhere in can’t get anything I filed my taxes on April 2nd they were accepted by the IRS but have not been approved yet I also receive Social Security every time I have check to check the status of my stimulus check I’m getting a message saying payments that is not available and that they cannot determine if I’m eligible I am currently 25 weeks pregnant and homeless and jobless and I can’t call or email the IRS to figure out what’s going on is anyone know if even though my taxes are still processing if I will get the stimulus and I don’t show a pending deposit on my chime card someone please help I am desperately trying to figure out what’s going on because I have nothing and I have a whole family to feed

It’s possible that your payment has not been cued up to be sent because your 2019 taxes have not been processed. IRS may have been waiting too to see how the launch of the Get My Payment tool worked. It seems to me like payments have gone out to people who filed their taxes earlier this year. SS should be close behind.

Thanks! I haven’t filed this year but did last year. Do you think it will come later?

It specifically states that it will use your 2018 taxes, if you didn’t file 2019.

I’m in the same boat with I filed my 2019 taxes-accepted 4/6 but not approved- & getting the same message. from what I’m reading, it sounds like this might be a generic msg because of high traffic on the site & to keep trying til it u get a msg about ur acct. It seems to be happening to alot of ppl & when they get their status it’s every scenario so fingers crossed, I took it as if the irs received my taxes, then my info is on file & maybe theres still a chance of getting the deposit later today.

I love this website. My hope is that the administrators will monitor comments and remove all of the insults, bad language etc to make this remain the site we all love to visit! This should not be about politics or insults. It is about saving money and I love that!!

You sound like a person who really does not have enough friends, or the ones that you do have are imaginary!

I tried to check a few minutes ago and I got the message that “according to the information we have on file, we cannot determine your eligibility for a payment at this time.” We should definitely be getting one, and they have our direct deposit information on file – I received my tax refund earlier this month.

Same here. Filed mine in the 3 April. My refund got deposited April 14 at 11 Pm , however I get same message can not determine eligibility. And now reading all the posts sounds like not all children under 17 are included for all folks” payment. And what’s upsetting is that all mass media is writing how this week all payments have gone to people who have filed 2018,2019 with direct deposit. Second waive will go to social security and third waive April 24 live checks. As if if you didn’t get it by 15 then expect a check?

Why did I only receive 1200 and not the extra 500 for my son? Will I receive a paper check?

IF YOU CHILD IS 17 AND OVER, YOU WON’T GET THE EXTRA $500!

Same thing happened this morning. I got 1200 but not 500 for my 6 year old and i fil3d her sd a dependent got my child tax credit so where is the $500??

We didn’t get credit for our 4 year old what can be done to find out what’s going on??

Ours showed up in our bank account this morning. Correct amount for 2 adults & 3 children

Anyone have lake trust? My fiancé hasn’t received his yet and I did. He banks through them. Just wondering if they’re slow?

I have the cannot determine eligibility message i wonder if they deposit by earliest tax filers, i only filed mine on the 3rd

I don’t think so. I filed early but as did another family member and she did not receive yet either.

Same here. Filed mine in the 3 April. My refund got deposited April 14 at 11 Pm , however I get same message can not determine eligibility. And now reading all the posts sounds like not all children under 17 are included for all folks” payment. And what’s upsetting is that all mass media is writing how this week all payments have gone to people who have filed 2018,2019 with direct deposit. Second waive will go to social security and third waive April 24 live checks. As if if you didn’t get it by 15 then expect a check?

I checked the site and it said they didn’t have enough info on my bank account. I’ve had the same account forever so I just submitted the same info.

Where did you submit the info to

I checked the payment and it says it would be deposited today to an old closed account! And it wont let us create an irs account to change bank info, bec it wants forms of identity we dont have, such as a mortgage loan account #, credit card, auto loan or equity, etc so i cant even go on there to update bank info. And no one to call

But the Get My Payment tool, which launched Wednesday, will also allow taxpayers to input their bank account information so that they can receive the money electronically rather than by a paper check — which could take weeks, or even months. To do so, a taxpayer will need to submit their adjusted gross income from their most recent tax return, the refund or amount owed that year, as well as the account and routing numbers for their bank account. However, taxpayers won’t be able to update their bank information once the payment is already scheduled for delivery, and it won’t allow you to update bank information already on file, the Treasury Department said.

If they have banking info that is outdated or incorrect, they give no option to change it though

I am a single mom, i Have 3 kids and only (today) received stimulus for one. No way to get ahold of anyone at IRS and dont know what im supposed to do..

My issue as well. My 2 year old wasn’t included.

Please let me know if you get any info on this. Im in the same boat. Thanks

Me as well. 3 children but only one qualified? All under 17 at time of filing 2019 taxes.

Per online But the Get My Payment tool, which launched Wednesday, will also allow taxpayers to input their bank account information so that they can receive the money electronically rather than by a paper check — which could take weeks, or even months. To do so, a taxpayer will need to submit their adjusted gross income from their most recent tax return, the refund or amount owed that year, as well as the account and routing numbers for their bank account. However, taxpayers won’t be able to update their bank information once the payment is already scheduled for delivery, and it won’t allow you to update bank information already on file, the Treasury Department said.

I got the payment status not available.

We got ours today! 2 adults who work full time, pay taxes, and filed our 2019 return in March. 3 kids, one of which was born last October. We got the correct amount. We do not have SSI or disability income.

I see a deposit,but it’s not a round number. Was it taxed? It was for 2967.25, anyone know?

Is that your regular return and not the stimulus check?

No, I had already received both my returns back in February.

If you have outstanding charges or overdrafts you bank can take that out

My accounts have more than enough, just wondering why, not complaining

IRS said that they cannot verify my information. Nothing has changed on my end, but I did try it too many times already so they locked me out for 24hrs

how many times did you try so I know when to stop trying as I am also getting the same message?

I tried 3 times before it locked me out.

Try too many times and it tells you you’ve tried too many times, come back in 24 hours. We haven’t filed 2019 yet and did not supply direct deposit info for 2018. However, it’s like the IRS is forcing people to file 2019 in order to update their info. There’s even a blurb saying if you are trying to rely on 2018 filing, and need to change info, the only way is to file 2019. There is no method to just update direct deposit info with 2018 tax filing data. They probably knew this and are using this as a way to force people to file taxes for 2019 (e.g., quid pro quo – you file your taxes now, pay what you might owe, and then we’ll think about sending you this stimulus payment).

You can file taxes now and don’t need to pay any money you owe yet, ya know….

Yeah, but we qualify for the full amount based on our 2018 filing, and won’t qualify at all based on our 2019 earnings. There’s a valid reason I’m not filing for 2019 yet!

Any ideas if it is supposed to come by check when it will be here? 2 kids and no job until this mess is over, not sure how we are going to make it 🙁

They said that could take up to 5 months to receive so I wouldn’t hold my breath

It’s in a rolling mail out depending on how much you made in 2018 or 2019. Couples making more than $100,000 won’t see a paper check until summer, or later. Couples making $40,000 or somewhere around there will see checks in the next few weeks. In other words, paper checks will be dragged out from now through September (according to an info/news site I read yesterday). They’re only able to print so many checks per week and are only doing once-per-week mailings, which means the stimulus is going to drag so slow, it’s net effect won’t be much help to anyone.

I’m a single mom with 4 kids and I only receive $1700

Yes, but the banks are crazy busy as I have been trying to check my mother in laws account and cannot get through. My mom and dad did not get theirs yet and my son did get theirs.

We got ours this morning. The amount did not reflect the baby we had in July 2019. I know it goes off your 2018 taxes UNLESS you have already filed for 2019, and we filed the very first day you were able to. Trying to just be grateful for anything we get though🙏

If you have never provided your Direct Deposit info. to the IRS for you tax refund, but would like to for your stimulus, act quickly.

If you do it too late, and the IRS gets to your name and you are cued for a check, you will not be able to change it.

Plus, if you get the info. submitted,

I read you could receive it in as quickly as 7 days.

Got mine!

I getting the message “Payment Not Available” at minimum we were expecting the $1000 for two children and my sister had that deposited into her account this morning. This generic message does not allow us to do anything about it nor does it give further instruction.

I have 2 children, 3 year old and a 1 year old. I was supposed to receive 3,400 dollars but only got 2900. Is their a way to reach out to anyone? I can’t seem to because it looks as though they have shut down contact.

Similar circumstances but the payment we received was 3328.35 instead of the full $3400. I came here to see if anybody had similar issues.

Same here, I was supposed to get $3100, only got $2967

Are you over the income threshold?

Yes but I was supposed to get $3100 since I’m over, just wondering why it wasn’t full amount, no big deal

Is the bank charging a fee to deposit? I’m seeing so many saying the same thing. I can’t even see my acct , site down

Not saying this is your circumstance, but I did read that if you owe any bank fees, that banks are allowed to collect those fees out of the stimulus payments.

Not my situation, just wondering. No big deal

Mine is present today ….I bank with SunTrust

Ours hit correctly married filing jointly with 2 kids 16 & 8. Our oldest is 17 so he doesn’t count towards it which we already knew in IL.

We got ours today. Thankful it covered our college daughters work study and summer job loss since she didn’t get anything. And that we didn’t lose anything else during this time. It will all go straight to college tuition.

In reply to hannah i got the same message on the where’s my payment website….i have no clue what it means… i am on social security

That’s what I’m wondering I’m on social security too and they should have the same direct deposit information that my benefits comes in every month

I mean get my payment

I got my return on an american Express card and when I try to check the status it says information does not match theirs and won’t let me do anything

Don’t put any dash on your address or apt number

If you have a payment plan with the IRS, they have our banking information to take money out each month, will they use that for deposit?

Same, payment status not available at this time, not helpful.

Is anybody else getting an error message that says “Error The information you have entered does not match our records. Please try again.” I’ve double-checked the info and tried both 2018 and 2019 returns, as well as my SS and my husband’s. I’m not sure what to do when the information is direct from my 1040 and the IRS says it’s incorrect. Wondering if there is a system glitch?

Don’t put any dash on your address or apt number

I didn’t. I got through to the page that says we are eligible and they need our bank information, but it says that our AGI and amount we owed is incorrect, even though it is direct from our 1040.

Hey Laura, I am having the same exact issue you are having, and now I am locked out.

Laura- did you put just your husbands ss number or your s too?

I tried mine first and got locked out after 3 attempts. So I tried husband’s next with the same info from our 1040 and got the same response – that my information was incorrect. I pulled it directly from the 1040 that we filed jointly and tried both 2018 and 2019 numbers.

Received ours this morning in our bank account. 2 adults, 2 children, $3,400. Have not filed 2019 taxes yet. They used our 2018 information. Hopefully everyone will get the correct amount, it may just take some time.

We get Payment Status Not Available. We filed 2018 taxes AND fit all the criteria to receive a stimulus payment. Looks like this is not a perfect distribution. You know, I expected it, because NOTHING has been going smoothly for us. We’ll be ok, but I know others won’t be and it’s disturbing. Smh

Is there anything we can do at all when the payment was sent to a closed account, even when we filed a 2019 return with the correct bank info?

I filed head of household with 2 kids 5 and 13 and and was supposed to receive 2200 but received 1692 does anyone have a answer is to why the difference in the payment?

I’m wondering same, I was supposed to receive $3100 according to calculator, but only got $2967.25

when i check online it says my payment was deposited to an account number.. Only thing is that i dont get my tax returns to a direct deposit. i always get a check through my tax preparer.. anyone know what i can do to find out what happened?

Check with the tax preparer. It sounds like it went to them and you need to get a check from them like before? Just a guess.

I’m actually decently sure this is illegal for the preparer to get your refund.

Gaby my mother has a financial advisor. Her check automatically goes to him so that he can decide where the best place is to put it where she would earn more money. He got her check yesterday.

We got ours this morning. Correct amount for 2 adults and 3 children.

Is anybody else getting a message that says “According to information that we have on file, we cannot determine your eligibility for a payment at this time.”

Yes. We did and we filed 2018 taxes with direct deposit information and fit the criteria to receive payment.

That’s the message I’m getting as well. And I have filed my 2018 taxes and my existing directly deposit is still valid. I am also in the qualifying stimulus payment income bracket.

Yes I got the same message.

Yep I got the message and my husband SSN got the message too. My direct deposit info is not in, so I have to wait until the 17th to be able to fill it in, I believe.

We got ours this am and was the perfect amount!

We got ours direct deposited April 14th. Filed 2018 taxes but haven’t filed 2019 taxes yet.

I also went on the IRS site to update my checking info because we usually pay taxes. I also got the message Payment Status Unavailable, your eligibility could not be determined at this time. We filed jointly and our AGI ins under 198,000. I guess I will try tomorrow.

We got the same message.

The max AGI for married w/ no children is $150,000, so if that’s not your case, you’re probably phased out.

I did not receive my direct deposit & when I check my status it is as “We cannot determine your eligibility for a payment at this time”. Does this mean am not really eligible for the amount?. However I filed my 2019 tax & received my returns last week.

Yes, got it this morning. Also, I did receive funds for my child who turned 17 last month. My 21 year old daughter who lives with us, who we do not claim, got hers this morning as well. My good friend who has no kids and her husband and she made close to 100k combined last year both got theirs as well. All in AZ and all different banking institutions.

Additionally, all amounts were what we expected. I was not initially sure on whether or not we would get funds for my 17 year old, but wanted to confirm that we did. I can confirm also that my 21 year old efiled her tax returns for 2019 back in February with direct deposit. My husband and I have not yet filed our 2019 taxes, but did have correct direct deposit info from our 2018 taxes.

I filed on 4/2 as single with no dependents. I have offsets from federal loans, but the CARES act is supposed to stop that. I did get my refund in my bank this morning, but no stimulus? When I try the get my payment on irs it says your ” payment status is currently unavailable”. I don’t get why I didn’t get my stimulus…

I was supposed to get 1700 and only got 1200