Credit Karma: Free Credit Score (No Credit Card Required!)

IMPORTANT: Please note that Credit Karma has an A rating with the Better Business Bureau!

If you’re planning on making a big purchase in the near future (house, car, etc.) or will be applying for a loan, you may be interested in finding out what your credit score is ahead of time! Knowing your credit score (which is a number from 300-850 based on your personal information and payment history) before making a large purchase that will require payments to a lending institution will help you determine how much a lender may be willing to lend to you. Generally, the higher the credit score, the more they are willing to lend and the lower the interest rate will be on the loan. Also, checking your credit before getting a loan will help you to improve or correct the score (if necessary) ensuring that you get the best loan program that fits you.

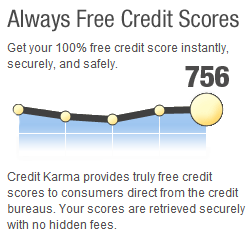

With all that said… did you know that Credit Karma, as seen in MSNBC, Smart Money, The Wall Street Journal, USAToday, CNN, and other news sites, offers completely FREE credit scores with no hidden costs or obligations…and no credit card is required and there are no strings attached!?! Plus, you can also return to their site as often as you like and use their service to track your credit file and stay informed! I just signed up with Credit Karma and was able to see my FREE credit score immediately after signing up as well as my credit report card displaying my open credit card utilization, percent of on-time payments, average age of open credit lines, total accounts, hard credit inquiries, derogatory marks, total debt, debt to income ratio, and more!

By signing up with Credit Karma, you’ll be able to…

*Access your FREE Credit Score anytime

*Receive exclusive offers based on your score

*Utilize tools to track your credit score

*Receive valuable credit and finance content

*Calculate and research to find best rates

*Engage in community feedback on offers & partners

Also, did you know that you are entitled to a FREE credit report once a year? If you have bought a home, own a car, or carry credit cards, it’s very important to look into your credit report at least once a year to make sure that your credit report is accurate. Keep in mind that a credit report differs from a credit score in that it only contains credit inquiries, bankruptcy, payment history, credit use and current credit accounts and does NOT show your credit score or FICO number. By checking your credit report annually, you help to keep yourself safe from or even help yourself prevent identity theft. It can also benefit you by keeping you knowledgeable to any inaccuracies that could result in a higher interest rate toward your next loan, credit card, or credit purchases.

As you can see, there are many benefits to knowing your credit score and requesting your free annual credit report!

Now it’s your turn!

Do you consistently request an annual credit report or credit score? If so, what site do you prefer to use to request your FREE credit report? Have you found it helpful to request your credit report or ever found any discrepancies in your report that have needed disputing? Please feel free to share your thoughts on this in the Comments section!

(Thanks for some of the tips, Personal Finance 4 You!)

Wachovia/WellsFargo is also giving away free credit reports from Experian. You have to go in and ask for it, they give you a code to do it at home and then you bring your report in and they can help you understand it as well give you advice on how to improve it.

I dont work for them but I do bank with them and thats how I found out 🙂

Yeah i got mine too 🙂

Is this just the credit report or the actual score? I have my mortgage through them so i was going to see about it. Thanks for any info! =)

Unfortunately this is a FAKO score not a FICO. 🙁

whats the difference?

Please note that there are 3 credit reporting agencies you want to check: Experian, TransUnion and Equifax. One score may be great and another poor. I worked in credit repair and depending on the lending institution, they may only pull your score from 1 of these and it may not be an accurate representation of your overall credit. I think it is annualcreditreport.com that that allows you to also pull your report from all 3 once a year. It is smart to do so at least before a large purchase. I would say do it SEVERAL months BEFORE a major purchase (at least), since it will take that long to clear up any discrepencies you may have with each agency (if any). I have perfect credit and still found many errors on my reports and my scores varied more than they should between agencies……

To clarify, I believe you only get the reports and not the scores on annualcreditreport.com. The scores you may have to pay for. However, you want the reports, since they provide all the info you need to make sure is accurate 🙂

It’s been mentioned on other credit boards, that these Credit Karma scores can vary significantly from your actual fico scores. Just keep this in mind.

agree. in my case…score is way way off

Was the Credit Karma score higher or lower than your actual score? From which of the 3 reporting agencies did you obtain your actual score?

Also, a BBB rating is highly overrated. Means nothing, a for profit business that just relies on a compter system to transfer correspondance from complainant to business , they don’t even read them and the only way you can acheive an A+ rating is though “accreditation”.

I use ID theft protection through Wells Fargo. It monitors my credit monthly and emails me if there are any inquires or new loans/lines. It has been a great help and also helped me clear off some things on my report that wernt mine

It’s great to hear this product works for you I work for Wells and you would not believe how many people do not understand how important this service is for them!

I signed up for it but I have no idea how to see the credit report. They were supposed to be sending me something but I haven’t received anything! 🙁

I use annualreport.com to check for discrepancies, etc. I also have a fraud alert on my Equifax report due to an identity theft issues a few years ago. Also, one of my Visa cards shows my Experian score and any changes.

I’ve used this site for over a year now and I LOVE IT! Def trustworthy and awesome!

This score is not the same as your actual credit score. I recently bought a car and I had used Credit Karma — it inflated my score by about 20 points (which is a LOT). Just be wary!

You can also get free credit checks (not the same as a score, but will indicate any problems, etc.) from the government website every year.

I use creditkarma,but for me also it gives out a way off score it (my score was actually way higher) I found out ,because I paid for a real credit monitoring service,but this site is wonderful for everything in credit advise,it even has credit card reviews,and blogs for credit questions , I still use creditkarma and love it.

I’ve been getting my score and free reports from Quizzle.com. Kiplinger finance magazine recommends them. I think I can get it every 180 days.

Does anyone know if those scores are more accurate? I really hope so lol.

I use both credit karma and quizzle and equifax…. I have a 100 point difference in scores with credit karma and quizzle… credit karma is 100 points lower and it is also 60 points lower than my equifax score! Crazy the differences…. I would say quizzle is probably closer than credit karma…. and naturally equifax is pretty close… I just closed on a car loan a few weeks and my equifax was actually lower than what the bank pulled by about 20 points… All the differences make it hard to know your true score unless a bank pulls it or you order the actual FICO