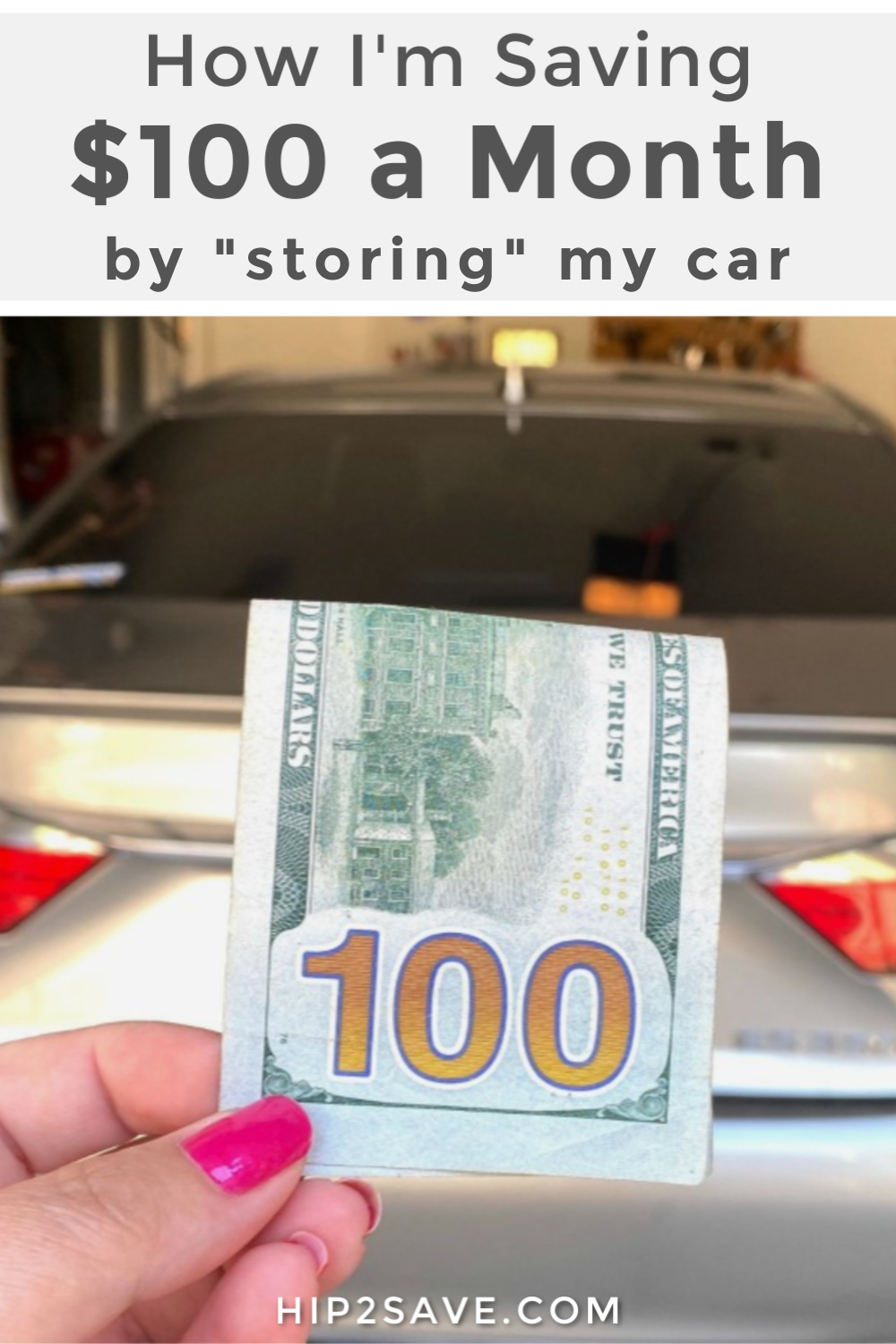

This Car Insurance Tip is Saving Us at Least $100

Staying at home, not driving an extra car?

If you’re safe at home as my family and not going anywhere soon this month, here’s a money saving tip! Consider temporarily changing the coverage on an extra car to “storage” coverage.

After a Hip2Save reader recently wrote in with this tip, I decided to try it out for myself by contacting our insurance company State Farm to see if this was possible, and it is! All we did was email our insurance rep and they changed our coverage the next day. A phone call would have been successful, too.

Heads up! Policies and procedures can vary from state-to-state, so it may be wise to reach out to the financing company for your auto loan as well as your local DMV to make sure you’ve covered all your bases.

Our savings will be $100 this month by simply changing one car to “storage” coverage.

My husband and I are both working from home due to the Coronavirus and his car has just been sitting in our garage. Our state is under stay at home orders and we have been at home leaving only once a week or so for the grocery store and it’s either me or him making the trip.

We can definitely share one car at this time, so changing our car insurance on our 2nd vehicle temporarily makes sense for my family. If you have extra cars (maybe even for your teens), this tip could be helpful!

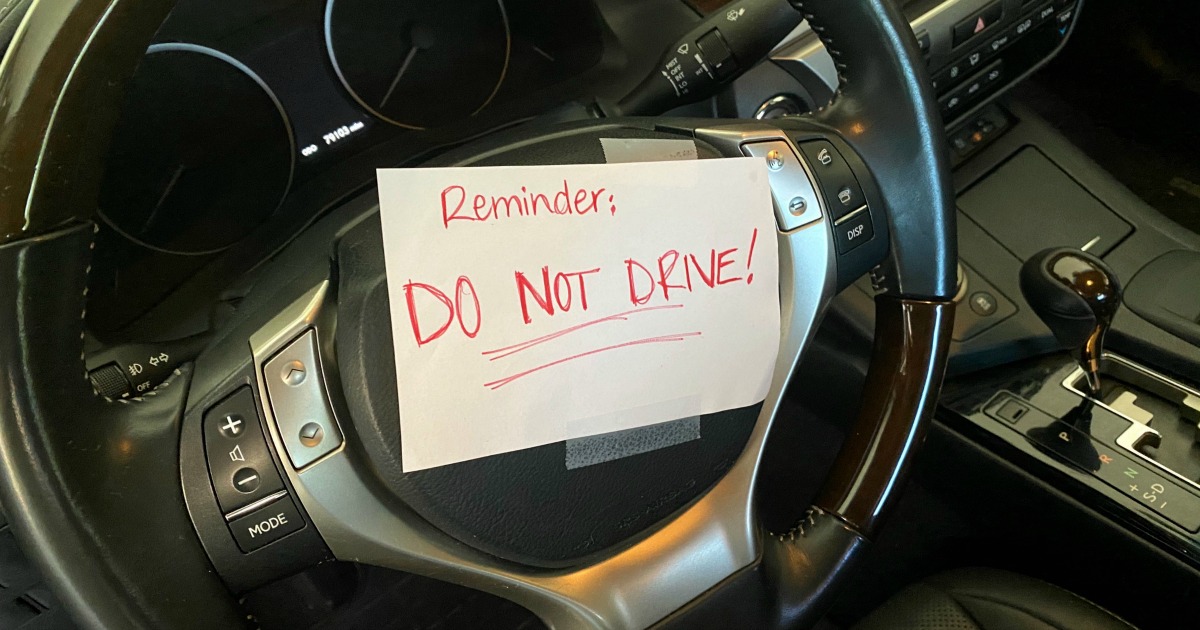

Hip Tip: If you do this, you CANNOT drive your car at ALL. As a tip, you can put a post-it or tape a piece of paper to the steering wheel as a reminder to NOT DRIVE. You can contact your insurance to revert it back to “driving” insurance easily however if you do decide you need to use your car.

Every car insurance company will vary, so I’d contact yours to see if this is possible.

Also worth noting ⤵

According to Yahoo! Finance, Allstate, American Family, and other insurance companies have announced plans to return a certain percentage of car insurance premiums due to many of us driving less during this time, so that could be a silver lining to watch for.

We have USAA auto insurance and got an email yesterday stating “Every member with an auto insurance policy in effect as of March 31, 2020, will receive a 20% credit on two months of premiums in the coming weeks.”

Thanks so much for the reminder, Laura! Good to know! https://hip2save.com/2020/04/08/geico-allstate-other-insurers-offering-credits-to-auto-policyholders/

I have USAA also and we received that email too!!

Liberty Mutual is giving back 15% for 2 months. It only comes out to $30 but still nice.

Thanks, Dan! We’ve heard about that one too! Thanks for commenting! https://hip2save.com/2020/04/08/geico-allstate-other-insurers-offering-credits-to-auto-policyholders/

Insurance agent here! Every insurance company I work with is automatically rebating 20% of premiums to the customers for two months at this time! Also, as far as changing coverage on a vehicle, if your car is financed, the bank *may* not allow you to lower coverages. Something to check into! If anyone in FL has questions, I can help you! https://centralfloridainsurancepartners.com/

Is Farmers – haven’t heard anything?

If you’re talking about GA Farm Bureau no they aren’t. Time to look for new insurance carrier.

From GEICO:

As part of GEICO’s ongoing efforts to assist customers during this unprecedented time, we are announcing The GEICO Giveback which provides a 15 percent credit to all auto and motorcycle customers as policies come up for renewal, between April 8, 2020 and October 7, 2020. This credit will also apply to any new policies purchased during this period as part of our commitment to protecting the wellbeing of our customers.

Thanks so much for taking the time to share this, Jerica! We have those details as well! https://hip2save.com/2020/04/08/geico-allstate-other-insurers-offering-credits-to-auto-policyholders/

And you’ll probably need to use the $100 you saved on a new battery after letting it sit for too long! Cars need to be driven in order to keep the battery charged.

CK, two things you can do… simply start it up every week or so (with the garage door open preferably!). Also, you can disconnect the battery and place it on a battery charger on trickle charge, again, it will be fine. Have done it both ways and both work fine. Now, we’re down to one vehicle and have been for 2 years and absolutely LOVE that savings.

Hi, you can always buy a float charger or a battery tender for as low as 6$ if you don’t want to waste fuel just to keep your battery from dying. I have a couple cars I only drive every 6 months and use battery maintainer type chargers. Thanks H2S for the insurance notice :)and be well everyone!

Also with a battery tender you don’t need to disconnect the battery at all

Not running cars for a long time can also cause gaskets and seals to dry out and start to dry rot. We found that out the hard way a couple years ago and it can be costly to replace gaskets. Running the motor every couple weeks gets all the fluids moving and keeps everything lubricating. You can still store it, but start it up once in a while.

we have 3 cars and only drive and insure one at a time. We switch cars every 4 months to rotate them. Anyway if you turn it on with the garage open and let it run for 10 minutes every 2 weeks the battery will be just fine. We save so much money on insurance, gas, maintenance etc…. If you can go down to sharing one car it’s so worth it!

once a week drive will keep it charged unless u r somewhere below freezing

I have State Farm and haven’t heard anything about a credit from them.

I have them as well and I haven’t either.

I just went to their website and they offer a good neighbor relief up to 25% https://newsroom.statefarm.com/good-neighbor-relief-frequently-asked-questions/#1

Thanks a bunch for sharing that link, Barbara! SO helpful!

State Farm and Allstate both announced yesterday they offering credits. For State Farm it will be credited to your bill automatically

Progressive is doing 20% back for April and May

Thanks, Tracy! We have more details on that credit over here – https://hip2save.com/2020/04/08/geico-allstate-other-insurers-offering-credits-to-auto-policyholders/

Humm, come on AAA! Have not heard anything from them … yet. Fingers crossed.

I’m still waiting on them too…

Replying to Dsch we are all waiting on AAA but honestly I feel as if they don’t do anything for their customers

Oh, no, I still have optimism! While I am still going to be optimistic, maybe that just means we already have lower insurance premiums to begin with, right?! We always shop around every few years and AAA has been the lowest by far for the same coverage.

mommyx4, do you utilize their AAA Drive feature in order to save even more money? (I believe it depends on the AAA Club though as well). Some people are queasy about letting the monitor your driving habits, but hey, I look at it like this, the minute you step out of your door, you are being monitored in some regard… why not get a discount while you’re at it.

I have same feeling about AAA after many years as a customer. It’s all give and no take. I am thinking of making the move.

Nationwide did a one time policy refund of 50$ that goes back into your Bank account.

So if they are rebating 15-20% off premiums, is it still worthwhile to change second car to storage car? Is the rebate on top of the $100 savings?

Farm bureau hasn’t done anything yet. I might call them today and see if they will offer any discounts like this. Crossing my fingers!

Ya it could be worth a call! 👍

They are doing a percentage in May and sending us a check. Call the 877 number and ask about it.

Please include in the post that if you have current financing on your car, you NEED to speak to your lender about this. Your lender will receive immediate notification from your insurance company that their collateral is now uninsured, and they will force-place an insurance policy on you (at a MUCH higher rate than your savings). This process is not as easy as it sounds for vehicles that still have loans attached to them. Please give readers the full story!

We drove off the lot with a new car about a year ago and got a letter two months later from the lender saying the insurance plan we had wasn’t high enough coverage and if we didn’t change it higher and notify them we would be in violation of the lease agreement. I’m sure if I tried this now I’d be in the same boat. If you fully own it I don’t see why not though.

Correct – that’s why I said if you have financing. If the car is it being used as collateral in a loan/lease agreement, then no one is monitoring you for insurance coverage. If the vehicle is financed, you need to speak with your lender. I would hate to see people put in a worse financial situation because of this advise (because full details weren’t provided) and now hundreds of families are being charged for even more expensive insurance by their lenders’ coverage company.

I have State Farm full coverage on all 4 of my cars but in the winter time I put storage coverage on them … they are both sports cars that can’t be drove in the Indiana snow and my lender told me as long as they are parked in the garage they would fall under your home owner’s insurance if something were to happen to them.

When you put it in suspension(storage)comp is still on there.

Hi there! Your autos are never covered by your homeowner policy. (Possibly could if there is no motor or tires..) Your Comp coverage that remains on the vehicle while it is being stored is what covers it. Covers theft, fire, tree falls thru the garage, etc. This is why you never do a total suspension of coverage…you suspend all but Comp. NOW…if items are stolen out of the vehicle (no matter where the vehicle is or what coverage it has at the time).. then THAT claim is filed under your homeowners policy and is subject to your deductible. Sorry, just didn’t want you to have false information.

My Mom’s car was damaged during a hurricane, and her auto insurance company said her homeowner’s policy would cover it – and it did. So homeowner’s insurance most certainly can cover a car.

I use Metromile; you are only charged for the miles you do drive plus a low monthly base charge. I currently pay 7 cents a mile. If i do a long road trip I only pay for 150 miles. After that, free miles per day. My commute to work was 4 miles so it was super cheap compared to my previous Geico and Progressive plan. I used to pay $85 or 98 a month, now I am at $60 a month.

I called Geico this morning to take advantage of this awesome deal and switch our second car over to storage status but my state (Kentucky) doesn’t allow storage status on any vehicles. She was able to change the mileage to 1 mile driven per year, which only saved me a few dollars off my monthly bill. It was worth a shot though.

We have State Farm, and three cars. I checked with my agent, and we put two in the garage, and are only driving one now. A big savings during shelter in place orders, and working from home.

Nice! Thanks for sharing Sheila.

This post prompted me to go check my insurance company’s website (auto owners), and they are doing a 15% reduction for April and May. It won’t be a lot, but every little bit helps!

It sure does! That’s awesome, Sarah! Thanks for letting us know about the savings you could score!

If you aren’t driving – whether you do this or not – be sure to start your car every week or two and let it run for a bit (just pull it into the driveway, don’t run it in the garage!). Keeps everything running smoothly.

Awesome tip just called my insurance and saved $75 a month!

Woohoo! Congrats on the savings! 🎉🙌

I called Geico and couldn’t change coverage to storage but the guy was nice he changed it to “liability coverage” and I got $75 in refund. Since we are working from home we can use my husband’s car. Thank you guys!!

That’s great! You’re welcome, Janet! Thanks for letting us know how it worked out for you!

Just received an email today from Amica Insurance that we’ll receive a 20% discount for April and May. That’ll be helpful. I’m only required to be in the office once a week and my husband is only driving a few times a week for work.

Oh good! Thanks for sharing that with us, Raquel! That’s some great savings to grab for sure!

We are with them as well & got that email. We have 3 cars but my son & I both work so those 2 cars still move 3 miles each way. ❤️ this

Anyone know about Metlife?

We’ll keep an eye out! 🧐

I have MetLife as well. This was just posted a couple of hours ago. Looks like 15% credit should be applied for April and May. https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/metlife-mercury-insurance-returning-auto-premiums-amid-covid-19-crisis-57996208

Thanks, I added that to this post!

My husband retired from Michelin. You need to move the vehicle to a different spot on the tires each month or you can develop flat spots which are permanent. We moved our motor home every month back when we owned it to avoid this problem.

Thanks so much for that helpful tip, Lana! I never knew that!

Erie Insurance in PA: “After careful consideration, ERIE has decided to lower personal and commercial auto rates in order to provide additional relief to our Customers. We estimate the total rate reduction impact to be approximately $200 million throughout the 12 states and District of Columbia where ERIE operates.”

Progressive is offering 20% discount for April and May!

Thanks for the reminder, Josie!

I called my insurance company, Liberty Mutual, and they can do it but they said it has to be out (‘in storage’, though it doesn’t have to be in a garage or anything, just not driven) for a MINIMUM of 30 days. They can bring it back whenever, as long as it has been out for 30 days. We have 4 cars in my family and I am debating if we will all be out of work/school for at least 30 days more. It will save me $143/mo if I take the kids’ cars off and leave mine and my hubby’s on.

Just make sure you find out your insurance company’s policies on doing this before you agree to it.

Yep, good advice and also may vary by state. Thanks for sharing your experience!

We called for other reasons and All State did confirm that they would be doing what was posted on here giving us a discount for the stay at home order and also they checked to see if there were additional new discounts we were eligible they found and additional discount. So, if you call your agent it doesn’t hurt to check. Thank you for looking out for us.

Thank You so much Lina and whoever that was responsible for this post . It helped me save a 3rd of my car insurance for the next 2 months and a 5th for the rest of the year. You guys Rock!

Allstate offers a very discounted rate when we put one of our cars in storage. And you are allowed to drive it three times per month as long as you notify them. I can text or call them.

Oh wow thanks for sharing Tig.

Farmers is offering a “no cancellation” if you can’t pay but nothing back to policyholders that are current.

Farmers is offering a 25% discount now! It’s automatic and you don’t have to do anything to get it. It’s for personal auto policies.

I did this last year when my daughter wasnt able to drive due to health reasons. Allstate was able to lower the policy to a bare minimum saving my daughter quite a bit of money per month. She went from $180 per month to $100 per month.

Thanks for sharing!

I just got a letter in the mail from American family telling me that they are going to be sending me $50 for every car we have insured!

Wow awesome!

I just called AAA, rebate of 3% of monthly premium for April & May. It’s not automatic, you have to call 1-800-922-8228

Yay! I’m so glad to hear that!

Geico says that to qualify for storage, a vehicle must surrender tags. ”You must surrender your vehicle tags and registration to the motor vehicle department prior to removing liability coverage.“ Has anyone else encountered this?

yes, I was told the same from Allstate today. Then you pay for your tag renewal again…doesn’t look like a good deal