Several States Are Sending Out A Stimulus Check in 2022 (Are You Eligible?)

A state stimulus check might be headed your way in 2022.

Some states are providing economic relief via tax rebates.

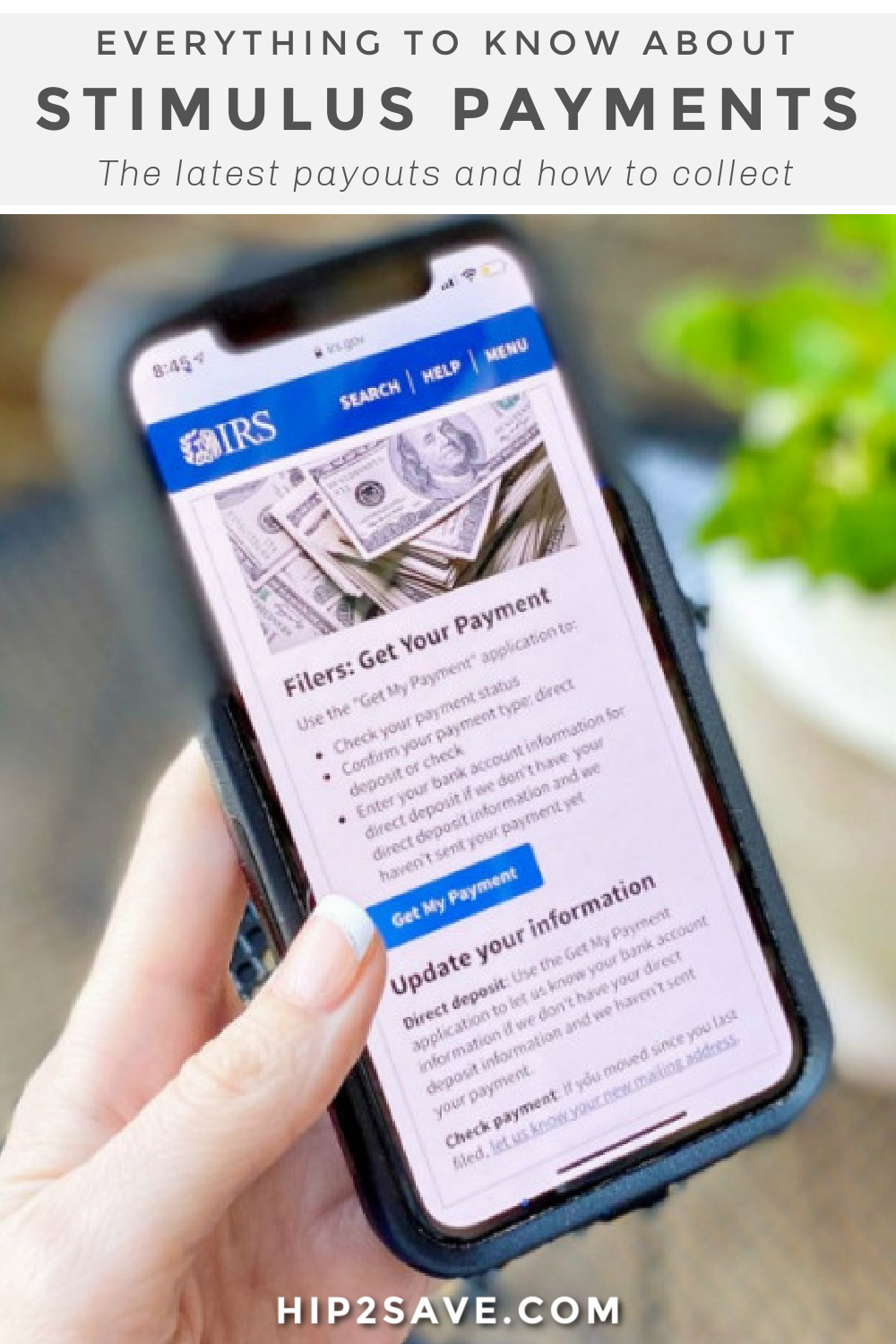

Though the federal government probably won’t send stimulus checks in 2022, you might be receiving some help from your state. In the latest attempt to combat inflation and stave off a recession, well over a dozen states have decided to send income tax rebate checks to their residents. Most of these refunds are for small amounts (so don’t get too excited) but we do have the scoop on who qualifies and when to expect a payment!

Find your state below and see if you qualify for a stimulus payment:

California

Who qualifies:

- Single taxpayers who make less than $75,000 annually or couples who filed jointly that make less than $150,000 annually will receive $350 per taxpayer and an additional $350 if there are dependents.

- Single taxpayers who make $75,000 – $125,000 annually or couples who make $150,000 – $250,000 can expect $250 per taxpayer and an additional $250 if there are dependents.

- Single taxpayers who make $125,000 – $150,000 annually or couples who make $250,000 to $500,000 annually will receive $200 per taxpayer and an additional $200 if there are dependents.

When: First payments will go out as soon as October in the form of a direct deposit or debit card.

Colorado

Who qualifies:

- State residents who filed their 2021 returns by June 30 qualify.

- Individual filers will receive $750 and joint filers will receive $1500.

When: If filed on time, expect a check by September 30, 2022. Those who filed an extension will see a check by Jan 31, 2023.

Delaware

Who qualifies:

- State residents who filed their 2020 and 2021 tax returns qualify and can expect $300 per adult.

When: Checks will be sent out from May 2022 through the end of Summer 2022. Adults who did not file timely may also receive a check after October 17, 2022.

Georgia

Who qualifies:

- Full-time state residents who filed their 2020 and 2021 tax returns timely. If you filed an extension, you have until October 17, 2022. Part-time residents will receive a proportional refund.

- Single taxpayers will receive $250, heads of household will receive $375, and married couples filing jointly will receive $500 together.

When: Payments began going out in May 2022.

Hawaii

Who qualifies:

- Single taxpayers and heads of households making under $100,000 will receive a $300 return.

- Married taxpayers filing jointly and surviving spouses who make under $200,000 will also receive a $300 return.

- Individuals who make above $100,00 and couples who make above $200,000 will receive a payment of $100.

When: Payments will come via direct deposit or paper check beginning at the end of August 2022.

Idaho

Who qualifies:

- Full-time residents who file their 2020 and 2021 tax returns by December 31, 2022, are eligible for a payment of $75.

When: Payments started in March 2022 and were sent out via direct deposit or paper check. You can track your rebate payment on Idaho’s State Tax Commission website.

Illinois

Who qualifies:

- Individuals who earned less than $200,000 in 2021 (and were full-time residents) will receive a $50 income tax rebate.

- Couples filing jointly who earned less than 400,000 in 2021 will receive, together, a $100 tax rebate.

- Those with dependents can collect $100 per dependent with a maximum of up to 3 dependents.

- Illinois residents may also qualify for a property tax rebate or other economic relief under the Family Relief Plan.

When: Payments begin starting September 12th, 2022, and will be sent in the same method that your original tax refund was sent.

Indiana

Who qualifies:

- All state residents that filed their 2020 taxes before January 3, 2022, will receive a $125 taxpayer refund.

When: Payments should be received by September 1, 2022, and will come in the form of a direct deposit or check.

Maine

Who qualifies:

- Full-time Maine residents who filed 2021 tax returns (and are not listed as dependent on anyone else’s return) qualify for a payment if they file by October 31, 2022.

- Single taxpayers who make less than $100,000 qualify and will receive a payment of $850.

- Heads of households who make less than $150,000 qualify and will receive a payment of $850.

- Couples filing jointly who make less than $200,000 qualify and will receive a single payment of $1,700.

When: Payments started in June 2022 for those who filed timely.

Massachusetts:

Who qualifies:

- If relief is approved, individual taxpayers who made more than $38,000 but less than $100,000 in 2021 will qualify for a $250 payment.

- If relief is approved, couples who filed jointly and made no more than $150,000 in 2021 will qualify for a $500 payment.

When: If implemented, your stimulus check will be issued before September 30, 2022.

Massachusetts previously provided relief for eligible low-income workers. If you had a household income at or less than 300% of the federal poverty level and did not collect unemployment, you should have received a stimulus payment of $500 earlier this spring.

Minnesota

Who qualifies:

- Frontline workers who were employed at least 120 hours in Minnesota between March 15, 2020 and June 30, 2021. Review the eligibility guidelines and apply for the payment before July 22nd, 2022.

- Frontline workers with direct COVID-19 patient contact qualify if they made less than $175,000 or $350,000 if filing jointly.

- Frontline workers without direct COVID-19 patient contact qualify if they made less than $85,000 or $185,000 if filing jointly.

When: Payments are anticipated to be sent in Fall 2022.

Gov. Tim Walz has also proposed an income tax rebate that is yet to be approved. His proposal is for a $1,000 relief for individual taxpayers making less than $165,000 and a $2,000 relief for joint filers making less than $275,000.

New Jersey

Who qualifies:

- New Jersey residents qualify if they filed the NJ-1040 in 2020 and have at least one dependent.

- Individual taxpayers who made less than $75,000 are eligible.

- Surviving spouses, heads of households, and couples filing jointly who made less than $150,000 qualify.

When: Checks began being mailed on July 2nd, 2022. New Jersey residents might also qualify for property tax relief which will be a separate payment.

New Mexico

Who qualifies:

- Individuals filing separately qualify for a $250 rebate if they made less than $75,000 in 2021.

- Married couples filing jointly, heads of households, and surviving spouses who made less than $150,000 in 2021 are eligible for a $500 tax rebate.

When: Payments for relief above begin in July 2022. New Mexico also offered two other separate stimulus checks. One was mailed in June 2022 and another will be sent in August 2022.

New York

Instead of income tax relief, New York has issued property tax relief for homeowners.

Who qualifies:

- Those who qualified for a 2022 School Tax Relief (STAR) credit or exemption are eligible for up to $1,050 provided their 2020 income was less than $250,000 and their school tax liability for 2022-2023 is less than their 2022 STAR credit.

When: If you qualified, your stimulus check was sent out starting in June 2022.

Pennsylvania

Like New York, Pennsylvania has issued property tax relief for homeowners.

Who qualifies:

- Homeowners who applied to the MyPath program and fit the eligibility requirements listed below.

- Homeowners are eligible for a maximum rebate of $650 if they make less than $35,000 (or are a renter who makes less than $15,000) and are seniors above the age of 65, have a disability and are at least 18 years old, or are a surviving spouse age 50 and above.

- Seniors in need may qualify for additional relief.

When: Check the status of your rebate using the “Where’s My Rebate?” tool.

South Carolina

Who qualifies:

- Any state resident who paid taxes this year is eligible for an income tax refund.

- Those that paid $800 or less will receive a full refund.

When: Payments are expected to be sent in late November and December.

Virginia:

Who qualifies:

- Only taxpayers with a tax liability last year are eligible.

- Individuals filers will receive $250 and those who filed jointly will receive $500.

When: Payments are expected to be sent via direct deposit or stimulus check starting in late September 2022.

New to Hip2Save? Be sure to browse the site. We post so many legit freebies, ways to make money, lots of frugal tips and hacks, all the hottest deals, and so much more. Get started here!

My stimulus say deposit on may,20. NOTHING. And waiting on washington unemployments operation fraud to ba over to get that payment. STRUGGLING

I have same issue

My direct deposit date was also May 20. It still has not been deposited. No explanation or new date given.

Same thing here

Same issue with mine

Get my payment tool says I was supposed to get my EIP on April 30, 2020 on my Direct Express o

DID YOU EVER GET YOUR PAYMENT.MY LETTER FROM THE IRS SAID MINE WAS DEPOSITED MAY 20 ON MY DIRECT EXPRESS..AND I STILL HAVENT GOTTEN NOTHING

I have the same problem!

Please let me know when you get it.

I will post if I get it before you but idk… Maybe it was schedule but the transaction takes 3 business days

Hey did you find out anything my check was sent to my bank to but I still haven’t seen nothing do u know what it means

What I have been reading is that maybe the bank account information on file is incorrect, so they sent the direct deposit to the wrong bank (In my case, a closed bank account). That bank rejects the deposit, and sends it back to the IRS who then puts your name back into the pool of those receiving the payment, and then mailed to the address on file.

I Recieved My Letter About 2 Weeks Ago Saying My Check Were Deposited On April 29th ,Called My Bank No Deposite Had Been Deposited On The 29th Of April,Kerp Checking The Web It Still Say The Same Thing Deposited On April 29th,What Do We Need To Do,About This..???

Mine said the 29th as well and still nothing

Mine said april 30th still nothing. And i too have gotten a letter saying it was deposited

Mine said deoposited april 29th still javent gotten a dime so annoying

I’m having the same problem mine said April 15 and I have nothing in my account either this is so frustrating with no answers

Have you received a letter about it? I got one dated May 6th which was the same day as my deposit date. All it says is the money was deposited. My bank never received a deposit so idk

I have a deposit date for may 13th but haven’t gotten it yet I draw disability Evey month and my kid draws a check off me so why haven’t I received it if I was giving a deposit date

I check IRS get my tool for my similar’s check and it said I Was scheduled for May 13 to be deposited and did not get it I got a letter for me from IRS Telling me about my deposit and then I get it why

Same thing happening to me. But did you say you got it after your letter came? I got my letter yesterday but still no check.

Did you receive your payment and how long after your scheduled date did you receive it!

I am still waiting as well I do not have children so child support is out the question my direct deposit date was May 13 2020 still nothing and it’s June 9 2020

Mine said it was suppose to deposit may 20th, but I didn’t get it… Two days ago I got a mail with a letter saying I recieved my money May 20th but I haven’t and I cant get any information.

I got the same message. Mine was supposed to be deposited on the May 20. I have no pending deposits.

Same thing here mine says deposited on May 13th and NOTHING!!! The real kicker is that I got a letter today on May 27th saying they deposited the money!!! But I didn’t get a dime and the bank said no deposit has tried going to my account and they have the right account#.

Same here I’m like where’s the money?

I have the exact problems same be date may 13th letter may 27. Still don’t know what to do

Hopefully this helps going to send this to as many on here as possible. GOD bless.

Reach real person at IRS follow steps below

Before you call, make sure you have all of the information that you need.

- Social Security cards and birth dates for those who were on the return you are calling about.

- An Individual Taxpayer Identification Number (ITIN) letter if you don’t have a Social Security number (SSN)

- Filing status – Single, Head of Household, Married Filing Joint or Married Filing Separate

- Your prior-year tax return. We may need to verify your identity before answering certain questions

- A copy of the tax return you’re calling about

- Any letters or notices we sent you

The IRS telephone number is 1-800-829-1040, and they are available from 7 a.m. – 7 p.m. Monday thru Friday. The best time to call is early in the morning.

The first question the automated system will ask you is to choose your language.

Once you’ve set your language, do NOT choose Option 1 (regarding refund info). Choose option 2 for “Personal Income Tax” instead.

Next, press 1 for “form, tax history, or payment”.

Next, press 3 “for all other questions.”

Next, press 2 “for all other questions.”

When the system asks you to enter your SSN or EIN to access your account information, do NOT enter anything.

After it asks twice, you will be prompted with another menu.

Press 2 for personal or individual tax questions.

Finally, press 4 for all other inquiries. The system should then transfer you to an agent.

My deposit date still says May 6th. Nothing has been received. No payment and no letter!

Mines says April 22nd

Same date for me and nothing yet…but I got the letter saying it should be deposited.

mine was the 6th of May as well bank says nothing and date has not changed on the IRS site

Mines said same thing,scheduled to be deposited May 6th still nothing.They even sent a letter stating i recieved payment

Same here May 6th deposit dat (no deposit in my account), but I received a letter on the May 27th stating it was deposited!!

Hey that was my deposit date to may 6th. I’ve gotten nothing..I got the letter on the 28th. Still no word are anything about it

Yea mine say. Direct deposit on the 20th still nothing anyone receive it yet?

I’m the same as you all may 20th but nothing deposited or pending. No new update on irs site either. Not sure where to go from here lol

Mine said May 9th and still not deposited. This is insane.

Payment deposit date saysMay 20. No payment, no pending transactions either. My friend said april 19th and still no payment either

Hey did you find out anything my check was sent to my bank to but I still haven’t seen nothing do u know what it means

I typed this earlier, but I have been reading that, in my case which is much like everyone else on here, that the direct deposit was supposed to be in my account on May 6th. However, the IRS may have sent the deposit to an old, closed bank account who rejects the deposit. That bank then sends the deposit back to the IRS who puts your name in a pool of eligible recipients, then mails you a check to the address they have on file.

That letter and website should provide the last 4 digits of account it sent the money to. That way people can make sure if it hit their correct account.

It has the last four of my account for my husbands stimulus. Says we were suppose to get his may 13th though but still nothing. We have a walmart money card to get our paychecks early, and had it sent there. Got an email from walmart money card in the 22nd saying your direct deposit for 1200.00 is processing and will post to your account on 5/28. Still nothing and they dont care to help at the call center for our prepaid card. It’s ridiculous!

I’m praying so mine says it was deposited into my account on the 13 of May 2020 and it has the correct last four digits of my account shown still no depoist and it’s the 9 the of June 2020

I have read that, in my situation, is that the direct deposit was sent to the wrong bank account (In my case, a closed account). That bank rejects the deposit and sends it back to the IRS. The IRS then puts your name back into the pool of eligible recipients and sends you a check to the address they have on file.

Get my payment says mine should have been deposited May 20th and isnt. My bday is the 26th. I have chime..any news????

Mine says may 13th it had been deposited but it’s still not there

Same here except date april 29 chime also

I have the same problem as everyone else on here. mine was supposed to be deposited April 30 and it is now may23. It shows the last 5 numbers of my bank account. It also is the same bank account I have had for like 20 years. I called my bank yesterday and she looked all around that date to see if it tried to hit . She thought it was weird all so. She put a note on my account to be on the look out. Today I just got the letter about the money. But it still says april 30th. So I have no clue what is going on. I have always had direct deposit into my same bank account for at least 20 years and it shows on there site the right last 5 numbers of my bank account. I already received my tax return direct deposit no problem. What is going on? And there is no information on this subject on there site. So what to do? Did someone there steal it. Everyone else I know already had received it well before they got there letter.

Same here. April 30th no deposit and the letter says it was deposited:/

Same problem mine said may 28 no deposit bank said never received it what’s going on

The portal saying my check was mail out on the 4th of may.. I received a letter today that I have received my Eip and I have not received it yet … What do I do…

Same issue May 20 th but no deposit an I know my info is accurate for DD Last 4 digits are the same an my banks said no depending deposits or nothing came through. Weird

Mine said my check was mailed on May 1st…..I still haven’t gotten it. Today is May 24th already. Don’t know what’s going on

Ugh so tired of only finding info regarding the taxpayer putting in wrong info or an old account! Ive had the same account for over 20yrs. What if the Irs screwed the pooch & hit a wrong key? Mine says May 13th. My bank (pathetic) says “oh thats just the SCHEDULED date. It doesnt mean it is going to be deposited then.” Um excuse me? So that means the deposit dates mean nothing.

I found this on another site have not had a chance to call but:

At the bottom of the stimulus check letter, below President Trump’s signature, a phone number is listed if you want to get more information about your Economic Impact Payment. “Visit irs.gov/coronarivus or call 800-919-9835,” the letter says.May 6, 2020

Get my payment said my check should have been deposited on the 13th still shows nothing I also have chime and they said they have not received anything what do we do

I’m still waiting for my stimulus check,my get my payment keep saying May 20 I havent received anything I check my bank account every day

Mine said deposit date of May 13th…nothing

It says it is was going to be there 5/13, but it isn’t there yet. What are we supposed to do if it’s not there? Thanks for the help!

So for those with scheduled dates what are we supposed to do to have better understanding

Same for me too… Check was scheduled to be deposited May 20 and still haven’t received it…This is very aggravating

I also got the info from Get My Payment was deposited on May 13th and still nothing. I received the letter from IRS today stating once again it was deposited on May 13th. The website they list on the letter is useless, does not answer the question of what happened. The 800 number is a joke too, no info for situations like this. I listened to the options 3 times and no option to speak with someone. My bank said they need a trace number. I also know my bank info given is correct. Had it for 30 years. This is ridiculous!

I also had the same thing happen. I got a letter saying mine was deposited on may 13th but still nothing I’ve tried everyway to contact someone. If you find out anything can you let me know thank you

Reach real person at IRS follow steps below

Before you call, make sure you have all of the information that you need.

- Social Security cards and birth dates for those who were on the return you are calling about.

- An Individual Taxpayer Identification Number (ITIN) letter if you don’t have a Social Security number (SSN)

- Filing status – Single, Head of Household, Married Filing Joint or Married Filing Separate

- Your prior-year tax return. We may need to verify your identity before answering certain questions

- A copy of the tax return you’re calling about

- Any letters or notices we sent you

The IRS telephone number is 1-800-829-1040, and they are available from 7 a.m. – 7 p.m. Monday thru Friday. The best time to call is early in the morning.

The first question the automated system will ask you is to choose your language.

Once you’ve set your language, do NOT choose Option 1 (regarding refund info). Choose option 2 for “Personal Income Tax” instead.

Next, press 1 for “form, tax history, or payment”.

Next, press 3 “for all other questions.”

Next, press 2 “for all other questions.”

When the system asks you to enter your SSN or EIN to access your account information, do NOT enter anything.

After it asks twice, you will be prompted with another menu.

Press 2 for personal or individual tax questions.

Finally, press 4 for all other inquiries. The system should then transfer you to an agent.

I received explanation letter today stati g my stimulus check was deposited on May 6 for $2,400 i never received it. Irs tool still says may 6th. Anyone else in same situation?

In the same boat as you May 6 deposit date and a letter stating 2400 was deposited. I still have not received a dime!!

My address was wrong on my tax return (just moved) so I updated the direct deposit. Hope they received it in time. However, I too was told that 5/20 was the deposit date and nothing has been received.

my deposit said May 6 but no deposit. I received the letter yesterday but the funny thing is that on top the letter has issued date May 6 for the letter. I don’t think the deposit dates on the get my payment are correct it might be the date when they started the process. i do know that some people that filed taxes or did changes to bank info in the beginning of April are just receiving checks in the mail instead of direct deposit.

Same boat as you. Found it odd as well that the deposit date and the letter date were both May 6. Something is off!!

Yes I agree exact same as me

Mine is the exact same. You ever find out how to fix it

Im a veteran with a direct express card. Im a non filer the IRS says no further steps are required

The IRS said my stimulus check was issued May 13 and ref a bank account number but not the name of the bank

Why didnt it get deposited to my direct express card

And as of May 28 I have not received a letterIm not even sure the IRS will get my address correct

.

Went to Get My Payment toolbar and it said the money would be deposited in my account on the 28th which is today but the money is not there, I wonder whats going on?

Have you had any luck on finding out any new info!? Mine says it’s scheduled to be deposited today (may 28th, 2020) but still haven’t seen any changes there’s no pending deposits or anything – I’m kinda screwed If it doesn’t come through, was kinda my means of escape & I’m literally dependent on it in order to get outta this…..

Ugh, just hoping for some positive news on it….!?!¿‽¡!

Same with me said 28 bank never got it dont no what’s going on

My dd was also May 28th and there was nothing. Just chked the IRS site and now it says will mail June 10th. We shall see🤦🏽♀️🤷🏽♀️

Mine the 28th and the letter the 28th of May and nothing still.

Mines says June 3 today is June 3 nothing yet I don’t even recognize the bank account I int have one

I have been getting direct deposit for my SSDI check for over 20 years at the same bank and I never received my check, I know that I am suppose to get a check anyone else have the same problem.

Mine was supposed to be in my account May 6 come to find out 2 1/2 weeks later mine was garnished from an old child support garnishment from 5 years ago. If your payment was garnished at the federal level Check with your local state government. In Washington they cannot garnish

IRS hotline 800 919 9835

Fed garnish 800 304 3107

I live in Washington and I was also told that my deposit was made on May 6th. I received a letter a couple days ago that says the same thing. But I do owe some back child support so I just assumed it went to that, but I have checked my support account and it is not there either. Did you get a letter saying it had been deposited on 5/6 too?

We were supposed to have had our stimulus check deposited on April 15 but it was not our account number that it was deposited in, so we must have hacked or scammed. We talked to our bank and they said to contact the IRS. So I need to know it we are going to still get our stimulus checks, because we were scammed or hacked or what ever. Please let us know.

I have called this number from the bottom of the letter, but there is no option to speak to an agent. I tried pressing 0 then saying agent then saying operator the saying customer service but it hangs up on me every time. Get my payment shows check mailed to my address may 1st, i received the letter mid may but as of today i have still not received the check they say they sent.

My the same

Well I guess I’m joining the club, just with the date of may 28th,…I’m trippin an yea there NOTHING ANYWHERE TO FIND OUT WHAT THE HECK TO DO NOW ,WHERE IS IT AM I GETTING IT..???.OR AM I JUST SCREWED HAHA JUST KIDDIN TYPE OF DEAL BY THEM..LOL

My deposit date was listed for May 28th. I called Citibank for an update, and nothing. I have no pending transactions. They did not have any information to offer at all. I cannot call anyone. I cannot speak to anyone. There is no direct number to get any help. I notice there are thousands of people going through this same exact thing. If direct deposit is faster why is it that people are receiving paper checks before our direct deposits even clear! This is absolutely not okay. I don’t know what to do, and I really need this money.

OK so follow these instructions and you will be able to speak to a rep be patient we were on hold for 32 min then we were told to please hang up and call again we held for another 32 min and was finally answered by a very nice rep who informed us that because they were sending out such volume that it could take up to 5 days to post to our account and if it still does not show up after 5 days to first call the bank and verify that no deposit were made them we are to call back the IRS and they will assist us further! I hope this helped!

Aloha

Call the IRS: 1-800-829-1040 hours 7 AM – 7 PM local time Monday-Friday

When calling the IRS do NOT choose the first option re: “Refund”, or it will send you to an automated phone line.

So after first choosing your language, then do NOT choose Option 1 (refund info). Choose option 2 for “personal income tax” instead.

Then press 1 for “form, tax history, or payment”.

Then press 3 “for all other questions.”

Then press 2 “for all other questions.”

– When it asks you to enter your SSN or EIN to access your account information, don’t enter anything.

– After it asks twice, you will get another menu.

Then press 2 for personal or individual tax questions.

It should then transfer you to an agent

I called this phone number, after waiting for 47 minutes, the guy put me on hold and I went through the whole hold process again. After another 35 minutes, the lady transferred to the 1-800-919-9835 after I told her there was no way to get a live rep. OMG!

GET MY PAYMENT SAID DIRECT DEPOSITED INTO MY BANK ACCOUNT MAY 20.BUT I HAVENT SEEN NOTHING.

My payment was to be direct deposited to my account on May 20, 2020. I just got an update on Get My Payment saying “We scheduled your check to be mailed on June 05, 2020 to the address we have on file for you” There is still hope.

My payment was issued on May13th to a bank account # But how can I find out the banks name Im a veteran with a direct express card why didnt they put it on my card

I had my check mailed as the IRS does not have my account number and I got my check over a month ago. My daughter had hers deposited with no issues in the 1st few weeks of released checks. There are millions of people and lots of scammers and criminals. It might take awhile……

Please go check the IRS website, put in your social security and your tax #. There’s a lot of problems, with the IRS, not having the right bank accounts. We solved our problem online and got the money in the bank, in less than two weeks. Check, to make sure they have the right information.

How did you correct the problem? How were you able to make changes to enter correct info?

Check you mails, you might have received the card that exactly look like the one in the post. When I checked IRS website it said my check scheduled to mail on May 22 nd and received my card in the mail with in 5 days .

I’m still waiting

Thank you for this post! Ours came today, looking like junk mail! It was the debit card from Money Network Cardholder Services. I may have thrown it away, had I not seen this post! You guys rock!

I am so glad you didn’t throw it away! Yay!

The IRS doesnt have my bank account information and there is no way to change/add it on the IRS site.. I wonder what the odds are of me actually receiving a check in the mail. I am not holding my breath. Ugh

My son recieved an extra stimulus check. It cannot be accurate. He’s 7. I can’t get the IRS on the phone to clear it up. Anyone have a clue what I am supposed to do?

Write them instead of calling and they will have a hard copy when they tell you that you owe them.

This is so frustrating for people who are still waiting on their money. I have a 5 year old and don’t have a reason to file taxes at this time so I filled out that portion dedicated for this on the website. I should have recieved 500 for my dependent but didn’t. I checked and all her information was filled out correctly. I’m a single mother and nobody else can claim her either. The only thing I have seen about if that money didn’t come for the dependents is to wait until next year and file it with your taxes. But I don’t file taxes so that doesn’t allow me to receive those funds at all. And they say do not call the IRS about any stimulis check money. So I guess I am just SOL.

Has anyone else had a similar situation?

Same problem I have three children all in school n under 17 n only received $1200 I claimed the kids on my 2019 taxes also , idk what to do or who to call , help !!

Michelle: My stepson does not file taxes but I filed a 1040 Ez and he received his money. Try doing this. It is simple and easy. Good luck.

My Dad called me and was confused with (2) cards he got in the mail. He was not setup with Direct Deposit and they mailed him debit cards to use. He said he called and confirmed they were legit and had $1200 for him and $1200 for my mother.

USPS informed delivery shows I was supposed to receive a letter from the US Treasury on Friday 5/29. Its 6/2 and it’s still not in my mailbox. I have a feeling it was stolen. Is there any way to contact them to see what the letter was? My stimulus payment was about $600 short so I don’t know if it was the missing portion. I don’t know what to do. If anyone has any advice please help.

IRS said that my stimulus check was deposited May 13th I have received a letter from the IRS stating that they deposited it on May 13th but the bank still says there’s no money there what is the situation with this I can’t even get a hold of my bank to verify whether or not it has been deposited when I go online and check my balance my balance is regular there’s no deposit of the check I had even called to find out if it has been intercepted and according to IRS nothing has been intercepted as far as payments I owe anybody and it’s still not in my account

Has anyone gotten theirs yet or new info? Mine said deposit directly into account May 6th and nothing. I had to enter in bank account info but even if I was a number off they don’t make account numbers that close together but the last 4 is right that it’s showing so I’m sure I did it right. I don’t believe I got in mail as a card either as I open everything. Any updates would be appreciated. Thanks!

I got my letter but no check. IRS says they mailed a check on May 1st. I am abroad so I must wait 9 weeks before reporting it. It makes no sense to get the letter before the check if the letter is mailed 15 days after the check. I know U.S. citizens in Germany who have already received a physical check weeks ago.