Several States Are Sending Out A Stimulus Check in 2022 (Are You Eligible?)

A state stimulus check might be headed your way in 2022.

Some states are providing economic relief via tax rebates.

Though the federal government probably won’t send stimulus checks in 2022, you might be receiving some help from your state. In the latest attempt to combat inflation and stave off a recession, well over a dozen states have decided to send income tax rebate checks to their residents. Most of these refunds are for small amounts (so don’t get too excited) but we do have the scoop on who qualifies and when to expect a payment!

Find your state below and see if you qualify for a stimulus payment:

California

Who qualifies:

- Single taxpayers who make less than $75,000 annually or couples who filed jointly that make less than $150,000 annually will receive $350 per taxpayer and an additional $350 if there are dependents.

- Single taxpayers who make $75,000 – $125,000 annually or couples who make $150,000 – $250,000 can expect $250 per taxpayer and an additional $250 if there are dependents.

- Single taxpayers who make $125,000 – $150,000 annually or couples who make $250,000 to $500,000 annually will receive $200 per taxpayer and an additional $200 if there are dependents.

When: First payments will go out as soon as October in the form of a direct deposit or debit card.

Colorado

Who qualifies:

- State residents who filed their 2021 returns by June 30 qualify.

- Individual filers will receive $750 and joint filers will receive $1500.

When: If filed on time, expect a check by September 30, 2022. Those who filed an extension will see a check by Jan 31, 2023.

Delaware

Who qualifies:

- State residents who filed their 2020 and 2021 tax returns qualify and can expect $300 per adult.

When: Checks will be sent out from May 2022 through the end of Summer 2022. Adults who did not file timely may also receive a check after October 17, 2022.

Georgia

Who qualifies:

- Full-time state residents who filed their 2020 and 2021 tax returns timely. If you filed an extension, you have until October 17, 2022. Part-time residents will receive a proportional refund.

- Single taxpayers will receive $250, heads of household will receive $375, and married couples filing jointly will receive $500 together.

When: Payments began going out in May 2022.

Hawaii

Who qualifies:

- Single taxpayers and heads of households making under $100,000 will receive a $300 return.

- Married taxpayers filing jointly and surviving spouses who make under $200,000 will also receive a $300 return.

- Individuals who make above $100,00 and couples who make above $200,000 will receive a payment of $100.

When: Payments will come via direct deposit or paper check beginning at the end of August 2022.

Idaho

Who qualifies:

- Full-time residents who file their 2020 and 2021 tax returns by December 31, 2022, are eligible for a payment of $75.

When: Payments started in March 2022 and were sent out via direct deposit or paper check. You can track your rebate payment on Idaho’s State Tax Commission website.

Illinois

Who qualifies:

- Individuals who earned less than $200,000 in 2021 (and were full-time residents) will receive a $50 income tax rebate.

- Couples filing jointly who earned less than 400,000 in 2021 will receive, together, a $100 tax rebate.

- Those with dependents can collect $100 per dependent with a maximum of up to 3 dependents.

- Illinois residents may also qualify for a property tax rebate or other economic relief under the Family Relief Plan.

When: Payments begin starting September 12th, 2022, and will be sent in the same method that your original tax refund was sent.

Indiana

Who qualifies:

- All state residents that filed their 2020 taxes before January 3, 2022, will receive a $125 taxpayer refund.

When: Payments should be received by September 1, 2022, and will come in the form of a direct deposit or check.

Maine

Who qualifies:

- Full-time Maine residents who filed 2021 tax returns (and are not listed as dependent on anyone else’s return) qualify for a payment if they file by October 31, 2022.

- Single taxpayers who make less than $100,000 qualify and will receive a payment of $850.

- Heads of households who make less than $150,000 qualify and will receive a payment of $850.

- Couples filing jointly who make less than $200,000 qualify and will receive a single payment of $1,700.

When: Payments started in June 2022 for those who filed timely.

Massachusetts:

Who qualifies:

- If relief is approved, individual taxpayers who made more than $38,000 but less than $100,000 in 2021 will qualify for a $250 payment.

- If relief is approved, couples who filed jointly and made no more than $150,000 in 2021 will qualify for a $500 payment.

When: If implemented, your stimulus check will be issued before September 30, 2022.

Massachusetts previously provided relief for eligible low-income workers. If you had a household income at or less than 300% of the federal poverty level and did not collect unemployment, you should have received a stimulus payment of $500 earlier this spring.

Minnesota

Who qualifies:

- Frontline workers who were employed at least 120 hours in Minnesota between March 15, 2020 and June 30, 2021. Review the eligibility guidelines and apply for the payment before July 22nd, 2022.

- Frontline workers with direct COVID-19 patient contact qualify if they made less than $175,000 or $350,000 if filing jointly.

- Frontline workers without direct COVID-19 patient contact qualify if they made less than $85,000 or $185,000 if filing jointly.

When: Payments are anticipated to be sent in Fall 2022.

Gov. Tim Walz has also proposed an income tax rebate that is yet to be approved. His proposal is for a $1,000 relief for individual taxpayers making less than $165,000 and a $2,000 relief for joint filers making less than $275,000.

New Jersey

Who qualifies:

- New Jersey residents qualify if they filed the NJ-1040 in 2020 and have at least one dependent.

- Individual taxpayers who made less than $75,000 are eligible.

- Surviving spouses, heads of households, and couples filing jointly who made less than $150,000 qualify.

When: Checks began being mailed on July 2nd, 2022. New Jersey residents might also qualify for property tax relief which will be a separate payment.

New Mexico

Who qualifies:

- Individuals filing separately qualify for a $250 rebate if they made less than $75,000 in 2021.

- Married couples filing jointly, heads of households, and surviving spouses who made less than $150,000 in 2021 are eligible for a $500 tax rebate.

When: Payments for relief above begin in July 2022. New Mexico also offered two other separate stimulus checks. One was mailed in June 2022 and another will be sent in August 2022.

New York

Instead of income tax relief, New York has issued property tax relief for homeowners.

Who qualifies:

- Those who qualified for a 2022 School Tax Relief (STAR) credit or exemption are eligible for up to $1,050 provided their 2020 income was less than $250,000 and their school tax liability for 2022-2023 is less than their 2022 STAR credit.

When: If you qualified, your stimulus check was sent out starting in June 2022.

Pennsylvania

Like New York, Pennsylvania has issued property tax relief for homeowners.

Who qualifies:

- Homeowners who applied to the MyPath program and fit the eligibility requirements listed below.

- Homeowners are eligible for a maximum rebate of $650 if they make less than $35,000 (or are a renter who makes less than $15,000) and are seniors above the age of 65, have a disability and are at least 18 years old, or are a surviving spouse age 50 and above.

- Seniors in need may qualify for additional relief.

When: Check the status of your rebate using the “Where’s My Rebate?” tool.

South Carolina

Who qualifies:

- Any state resident who paid taxes this year is eligible for an income tax refund.

- Those that paid $800 or less will receive a full refund.

When: Payments are expected to be sent in late November and December.

Virginia:

Who qualifies:

- Only taxpayers with a tax liability last year are eligible.

- Individuals filers will receive $250 and those who filed jointly will receive $500.

When: Payments are expected to be sent via direct deposit or stimulus check starting in late September 2022.

New to Hip2Save? Be sure to browse the site. We post so many legit freebies, ways to make money, lots of frugal tips and hacks, all the hottest deals, and so much more. Get started here!

These are my details:

I live in Maine.

I filed my taxes Feb. 7 and my tax refund posted to my credit union account on Feb. 24.

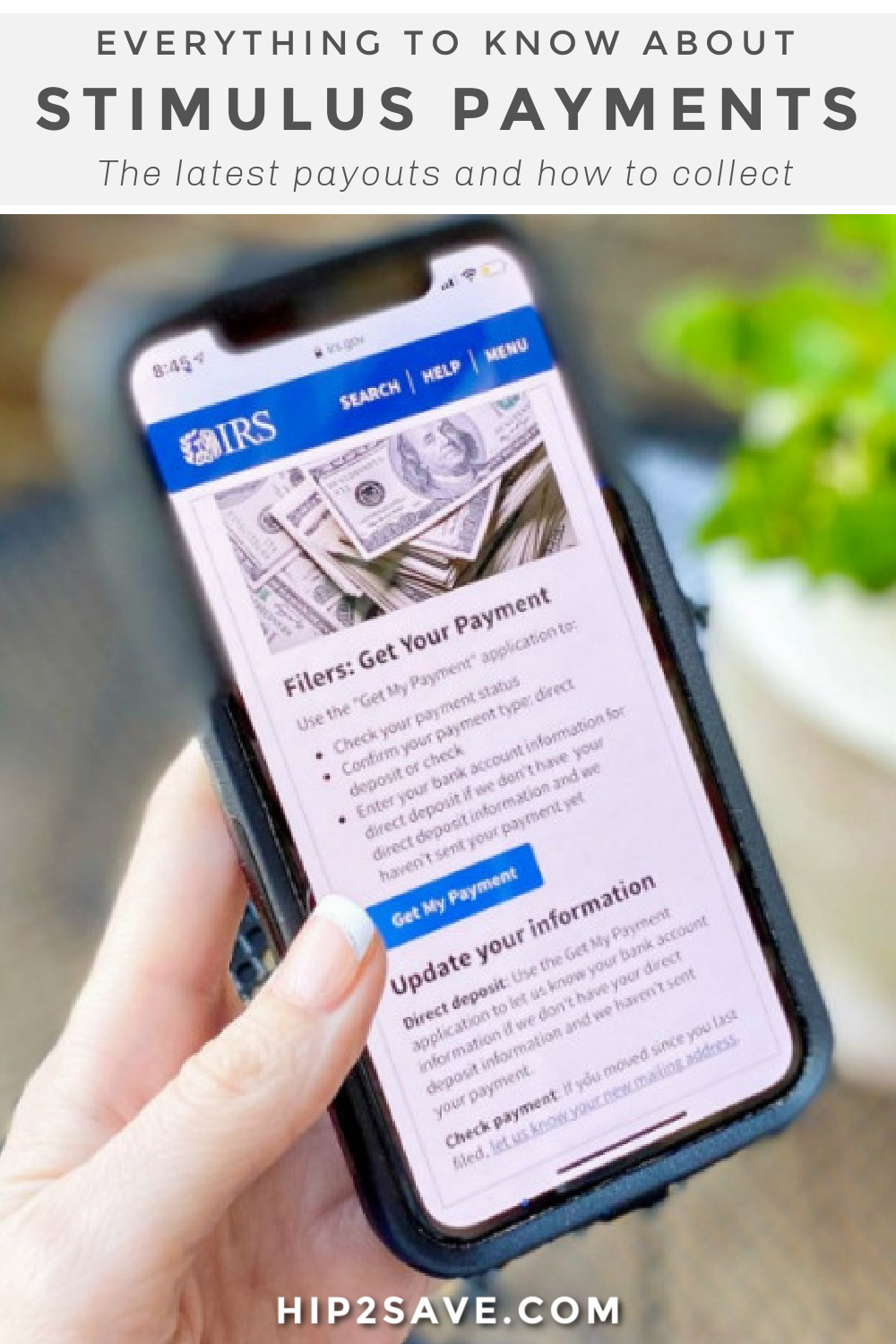

My stimulus DOES NOT show in my CU app, but does show in ONLINE CU ACCOUNT. Under Account Summary there is an hourglass with Pending ACH. When I click on that, I see the amount of my stimulus and IRS TREAS 310. Mine will post to my account Wed. the 15th.

From what I’ve read, they may do another round Fri. the 17th. They usually do it overnight, so you may not see it pending until the 18th.

I filed for us approx 10 days ago. We got our refund deposited this week. When i go to Get my payment on IRS site- it tells me “your current check status is unavailable? What do we do? What does this mean? I cant email IRS..

I have read all the comments to try to educate myself on the scenario of not ever providing direct deposit information to the IRS and always receiving any refund in the form of a snail mail paper check. But golly, who would have thought that there are so many unique situations that would prevent this stimulus check program from being straight forward? Like filing for injured spouse status? I had to look that one up and it’s not exactly what the name implies. It means one spouse owes money that they have not paid; like student loans, child support etc. and it’s to protect the other spouse that does not owe money and who may receive a tax refund, from having that refund withheld by the government to go toward the other spouses debt. Wow is all I have to say.

If bank rejected my income tax and sent me a check, how Will i get my stimulus?

Reply asap please

Was it rejected by the bank because you closed the account, or was there a glitch at the bank ?

We received $5900 for us and our 7 children. We are in Texas. I heard that this stimulus will be taken out of next years tax return. Anyone else know if that is true?

Not true. You won’t have to pay taxes on it.

From my understanding you wont pay against it but it will count against what you should have received . . .. so basically you’re getting a forward on what you may be getting next year. For instance if your 2020 return was totaled out to be 7500 you’ll only get 1600 because you already got 5900 of it

I don’t think that is how it is going to work. It doesn’t go against your 2020 income tax refund.

This is total BS. The stimulus payment is not an advance of a future tax refund. It is just a payment. Period. STFU “Gina” and “Megan.”

Total BS. The stimulus payment is not an advance of a future tax refund. It is a payment, free and clear. Period. STFU “Gina” and “Megan.”

That’s incorrect. It will not effect your refund next year

The amount you are eligible for will be determined by your 2020 tax return. They are using 2019 and 2018 returns to determine your eligibility think of it as a “cash advance”. If you receive it now and you end up making over the limits this year or your kiddos are over the age of 17 when you file 2020 taxes then you will owe the credit back when you file next year. If you don’t receive the credit this year but are eligible once you file next year you’ll receive it then. Make sense?

This is total BS. The stimulus payment is not an advance of a future tax refund. It is just a payment. Period. STFU “Gina” and “Megan.”

It’s working like the childcare tax credit. This stimulus payment is just another tax credit. What will happen when you file your 2020 taxes if you will be given an extra credit equal to the stimulus amount you get. But, the credit is being prepaid by the current checks going out, so this payment will cancel out the credit on your tax return. So, you’ll just be back to where you were with your normal tax return.

I received $1200(pending) instead of $1700. I have a 11 months old whom I claimed when I filed my 2019 tax even though I had no income in 2019 ( pregnant, had a baby and was stay at home the rest of the year). I was not eligible for CTC because I had no income. Will I get the $500 stimulus check? I meet all requirements except I had no income for 2019

Same here I have 3kids and married couple instead of $2400 I only receive $2200 and $1200 for my 3kids missing $500 in total

So you got for 2 kids instead of 3

My walmart money card said they was processing 2200$ which where suppose to get but 1032 was just deposited ! Not sure whats goin on!

I’m trying to figure out the something. I only got $2200 also. I also have 3 Dependants. So I’m not sure why it was not what was promised. Anyone have a number to call?

I also have three kids and only got 2200 I don’t understand I was pose to get 2700 I tried to call it’s but they not accepting call

This is crazy! I feel that we should’ve have gotten what they told us we would.

Similar with us. We have 2 kids, 6 and 3, and we only received 500.

Mine is pending for deposit tomorrow

Unrelated but the unemployment filing is a nightmare.

Wow. Wait til yall get a look at the physical checks.

How are people seeing their payments that are pending or when their payment will be deposited? The tool on the IRS site to check payment status and estimated date doesn’t seem to be up and running yet.

Some banks give the pending info. Check your account.

Go to irs.gov look for:

Get Info on Economic Impact Payment

Scroll down until you see the tool;

Get My Payment

So will it go on wallmart money card, if that’s how you received your taxes for 2019 and when?

That’s what I’m trying to figure out, as well, I say to wait until 6am-8am to see if it’s hit or not, I remember I received my tax refund on the last possible day the IRS website said I would get it. I’m imagining & hoping it was sent yesterday & last night, & waiting for deposit tomorrow. On the day I got my taxes, I didn’t get them untill 6am-8am the day of. & the thing I hate about the website(I don’t have the app or space on my phone to download the app), is it doesn’t let you see anything pending, at least on my end.

How do you see pending deposits?

I got my stimulus check but, I am concerned that I didn’t get the full amount, that I should have. I am a single mom with 2 kids. Stimulus amount should have been $2200 and I only got $1700. Now, my son is on Social Security Insurance and his payments get direct deposited into my checking account. However, his father got to claim him on his taxes for 2019. But, my son lives with me and has every other weekend visits with his father.

Do Social Security recipients receive their checks at different times??

Social security checks has anyone got there’s yet on in chatt tenn

his father will get the $500 for him if he claimed him in ’19. Whoever claimed gets the $

Yes. I know someone that has there’s deposited to Walmart card. He started showing pending deposit on Saturday for today.

Thank you JESUS! It showed up, pending at midnight for 4/15. I hope for all of those who can use this right now get what you expect very soon!

My child lives with me but his father claims him every other year on taxes. How does that affect the stimulus check? He claims him in the even years and I claim him in the odd years. I completed my 2019 taxes already.

Hes gets it in his deposit

I claim a dependent (My daughter) on 2019 return… Instead of getting $1,700, i only gotten $1,200… Is there another payment for my dependent $500 coming separately ? Or it should of have been on my account altogether ?

Same thing happened to me not sure what’s going on.

I claimed my daughter last year but only got 1200

I filed my 2019 in feb. my state taxes were linked to my bank account and the federal to a Walmart money card . Does anyone know if the irs will use the money card to deposit my check ?

We got ours this morning, $2900 (2 adults and 1-15 yr old.). We live in FL. Haven’t filed our taxes yet this year. We did direct deposit last year. Hope this helps someone.

If adults are supposed to get 1200 how come I only got 571 dollars??

Are you sure that check isn’t your regular tax refund and not the stimulus check?

Do you make over 99k a year?

I filled both of my daughters one is 8 and one is 1 on my taxes and only received 1700 instead of 2200 ? Any idea why or what to do about it

So what if I filed my 2019 income taxes but they are still pending will I still get a stimulus check

My tax refund is still processing (5 weeks now 😠), but I DID receive my stimulus $ today.

I filed in Feb 5 and it still says processing. Have not received refund or stimulus. IRS My Payment site says my stimulus was deposited to my acct today, but bank does not see any pending deposits. At this point idk wth is going. Cant even call IRS to get any answers. Its so frustrating!

I claimed 2 dependents for the 2019 income why did i only get 1700.00?

I never received a pending status on bank account so I checked the IRS website and I was supposed to receive my deposit today on an account that I don’t even have. I’ve been using the same checking account for my taxes for at least 8 years. I don’t know what to do? Anyone else having this problem?

Rec’d only $298.30 today because income was over 75K in 2019. Only reason was I had to close my Trift Saving which put me over 75K. Never made over 75K in my life. Am I getting penalized because I filed early? If I didn’t file already, they would have used 2018 return instead. Am I entitled to the full $1200?

This has happened to me also and i dont know what to do! It was sent to an account ive never had was my social!

This has happened to me also and i dont know what to do! It was sent to an account ive never had was my social, well the last 4 was. What do we do??

Same here! How do we find out what’s going on?

Same thing has happened to me =(

Got it this morning and it was the proper amount. I hope everyone stays safe.

We received ours this morning. Thanks for the reminder to check!

Yay! You’re so welcome!

What does it mean if it says payment status unavailable

Mine says that too 🤔

I get the same message!

Got the same message

Mine says that also.

I received the same message. I filed in 2018, so not sure what the problem would be.

Yep I got mine this morning

We received ours today in IN. The amount was correct 2 adults, 3 children $3900. Did you hear about the volunteer fireman who accidentally got $8.2 million for his stimulus automatic deposit!! He reported it and the error was fixed but holy cow!

I have only recieved 2200 and should recieve 3400 I have a 1 year old and a 2 year old in missing 1200

Did you file married jointly?

It’s based off your 2018 taxes. Was your youngest filed on the taxes? And if you make more than $75K the amount goes down.

We are in H1 visa my husband works here and me and my 2 kids are in depenent visa .but we are not an American we are from other country we dont have greencard or citizenship but we have SSN. So are we eligable to get the govt stimulus amount and how much we are able to get?.And we filed tax every year.Thanks looking for reply

No, if you’re not a US citizen you do not qualify.

Only US citizens and green card holders

Mine was sent to a closed bank account. Guess I’ll have to wait a few more weeks 😔

Did non filers, did not receive payment

Just received ours when I checked our banking account this morning and we live in Aurora, CO.

We got ours this morning but it was pending since friday. We filed March 26 and I had a baby last year and we got the proper amount good luck to everyone that’s waiting.

Mine showed up this morning on our account.

We live in Tampa FL area.

Yes it was in our account this morning!

Got mine and now going to find charities/families to bless.

Wow, good on you!

Mine was rejected by my bank because a friend who helped with my taxes accidentally left out the last 2 account numbers!!! This is so my life and my luck…sigh. Anyone know when they get mailed if bank rejects? This is sad!!

Cooksonhills.org is a pretty amazing organization 🙂

Got mine Tuesday, right amount. I barely made the cutoff for getting one at all so I don’t think they’re going by lowest income first necessarily. I filed 2019 taxes in early March, not sure if that made a difference.

Rec’d only $298.30 today because income was over 75K in 2019. Only reason was I had to close my Trift Saving which put me over 75K. Never made over 75K in my life. Am I getting penalized because I filed early? If I didn’t file already, they would have used 2018 return instead. Am I entitled to the full $1200?

Got mine. Correct amount, $1200. Buffalo, NY.

Nope

Got mine today.

Received our correct amount yesterday here in MT. No issues at all!

Yes! Thank You so much. Very grateful!!!!!

I have two kids and only received 1700 instead of 2200. Had baby October 2019 and claimed him on tax returns, and have a 3 year old… anybody know yet whats going on with that?

They based it off of your 2018 taxes. If the baby wasn’t born yet, that’s why you’re missing $500

I had a baby last year and i recieved the extra $500 for my baby. They actually look at 2019 and only 2018 if you have not filed.

Not true. Myself, and many others, have already filed 2019, and yet they have still based the stimulus payment off of 2018. It’d be interesting to know how they actually decided these things, but so far I haven’t seen any rhyme or reason yet.

Our was in our account this morning. We haven’t filed our taxes yet. Correct amount for filing jointly with two kids.

Just checked this morning and we got ours. We had already filed and had direct deposit set up. Yipee!

I pay in every year because I am self employed. Not sure how this will affect me since the IRS does not have my refund bank account, but the new online form says its for people who do not file a return, etc. Nothing is pending for me but I suspect it is due to the fact that I pay in every year.

On the 17th a feature is supposed to appear on the section that says check status where you will be able to put bank account information in for those who file but do not use direct deposit. That is my understanding

Received $2400 today for my husband and me even though my college kid wasn’t included…

Same here…I’m sooo grateful for the 💰 but at the same time feeling sad for my almost 19 year old college son, who works so hard to put himself through school. Because he’s a full time student, was claimed on our taxes, he gets nothing and he’s actually laid off from his job too. Obviously we’re helping him but it’s just too bad they didn’t consider that when they put together the stimulus rules…

Anybody know what ” payment status not available ” means? So frustrating….

Where did you get that information?

I have a question. When I filed my taxes in January (2020), I e-filed and I asked that my funds be transferred to me via direct deposit. However I input my routing number incorrectly and therefore the IRS had to send me a paper check for my tax refund.

Since the IRS is sending the stimulus payment to the same WRONG bank information, it’s guaranteed to reject.

Then what happens?

You can update your banking info online on the irs website

No unfortunately I tried using the “new tool” on their site to do so but you can only input your bank details if you didn’t originally request direct deposit when filing your taxes. The status from “Get my Payment” tool, says it’s already en route to my bank account so I can’t do anything but wait for it to reject and maybe get a paper check several weeks from now.

Im having the exact same issue. Please inform me if u hear what happens next. We are desperate for that money

Same here desperate for info

System says we are eligible to receive one, but I cannot get past the verification page to enter our bank information! I have entered the adjusted gross income and refund amounts from both our 2019 return and our 2018 and it won’t take it. I’m even copying the exact figures from our online IRS Tax Account information screen! Frustrating!!!