Raise Financially Savvy Kids with GoHenry Debit Card (+ Enjoy First Month FREE!)

Easily create a better financial future for your little ones with the GoHenry debit card for kids!

Financially healthy habits at your kiddos’ fingertips. 💸

GoHenry is the freedom your kids have been looking for and parents feel comfortable granting. They’ll easily learn good spending habits, how to save, and much more with this simple debit card. Plus for a limited time, get your first 30 days FREE!

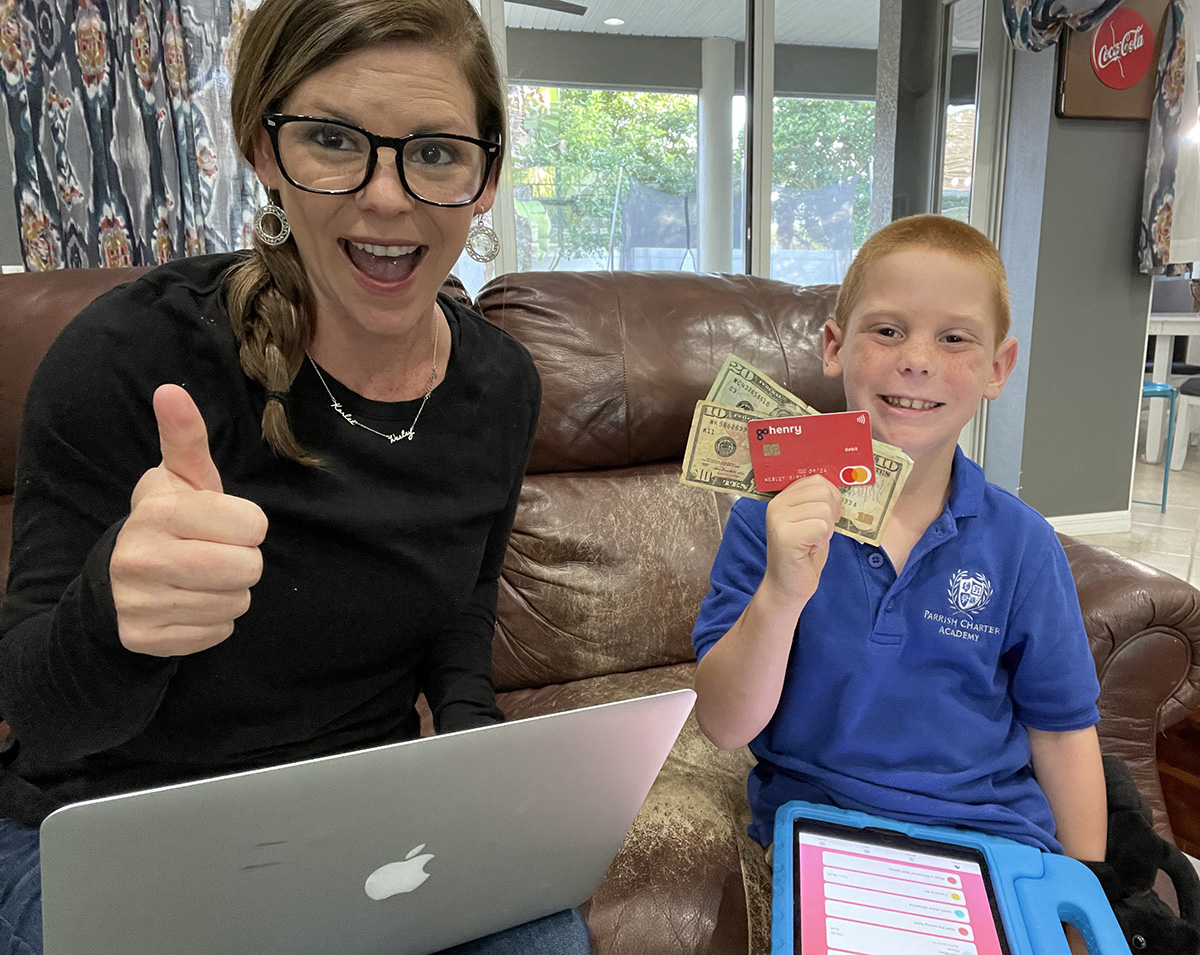

I’ve been using GoHenry with my 7-year-old son and absolutely love it!

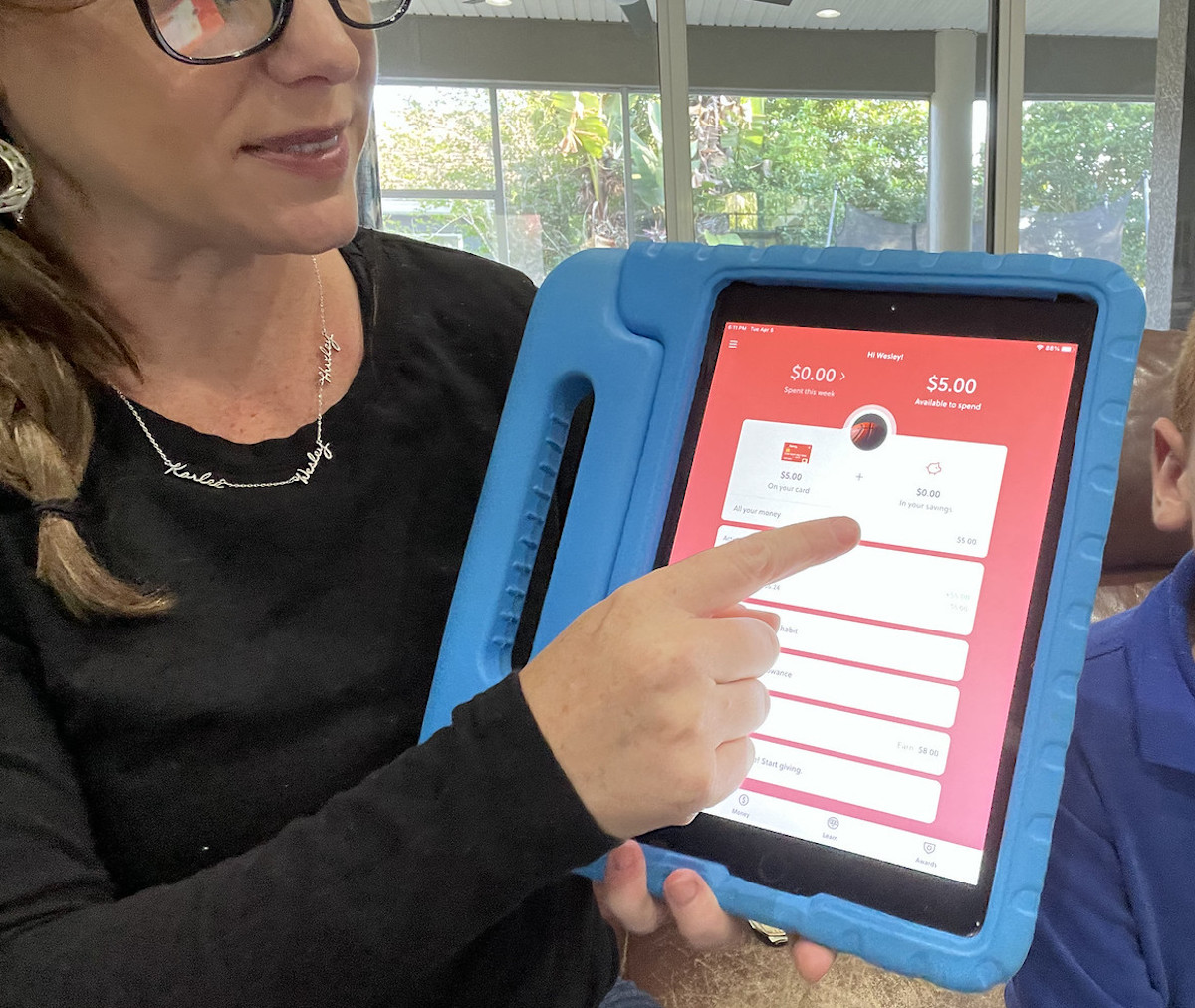

GoHenry is a debit card for kids ages 6 to 18 so they can feel financially responsible, but with the safeguards parents dream of. Better yet, it comes with an app so they can learn everything they need to know about spending, earning, and saving money.

Fun Fact: 92% of parents said their children are more money confident since using GoHenry!

It’s SO simple to sign up! Here’s how you can score your first 30 days of GoHenry FREE:

- Start by heading to GoHenry.com

- Click “Start free trial”

- Fill out your name, email, phone number, and create a password

- Your promo code AFUSS158 will automatically be added for your first month free

- Add your child’s information

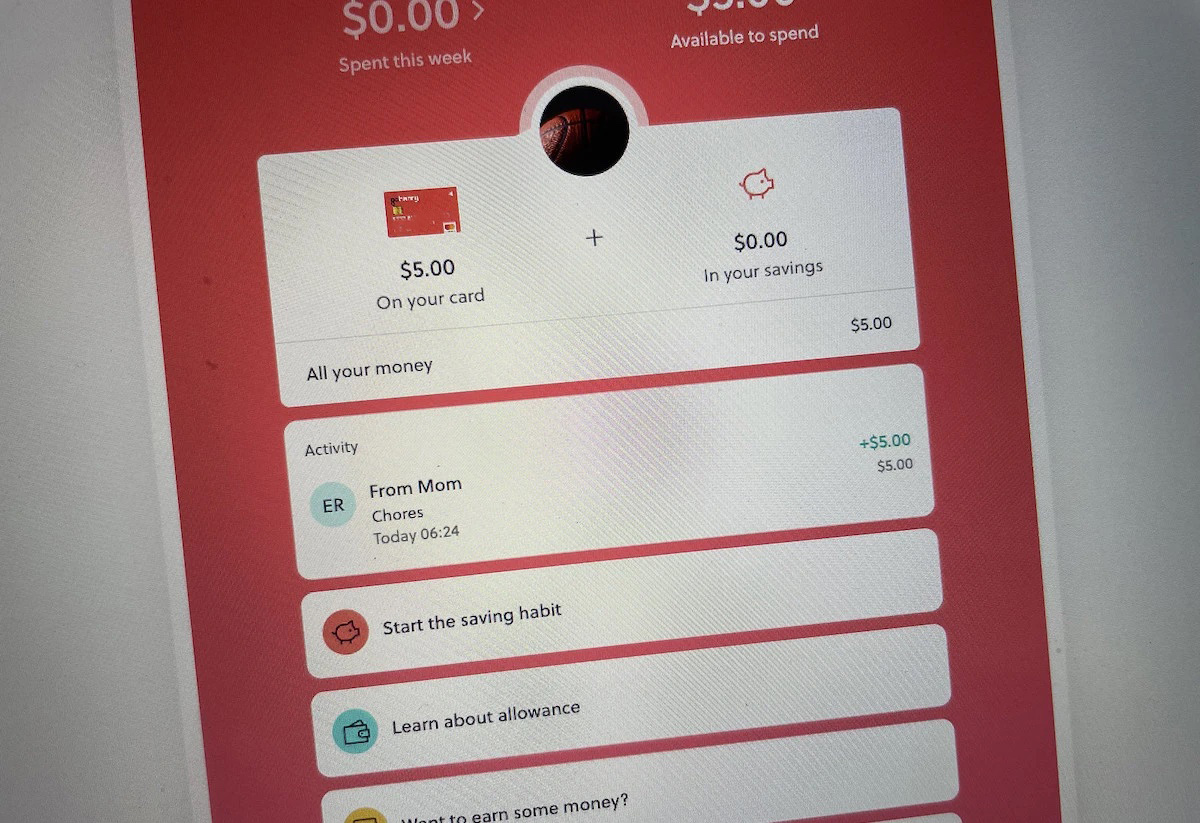

- Load at least $5 onto the card to get started

*Note: It will take 5-10 business days for your GoHenry card to arrive and your free trial starts immediately. After your trial is over you’ll be charged $4.99/mo or $9.98/mo for a family plan (up to 4 kids)

Let’s face it, learning about money can be super complicated – even for adults! That’s why I was really excited to start using GoHenry because I knew it would simplify many things I didn’t necessarily know how to explain and would provide newfound confidence for my son.

It’s also incredibly user-friendly and despite my son only being seven, he’s already learned so much from GoHenry and the missions he gets to do customized to his age.

The best part about GoHenry is that it’s FUN for kids!

Yup, I said it. Who says learning about money and earning it can’t be fun?! My son has been having a blast with the GoHenry app! It motivates him to work hard to earn the things he really wants with the money missions!

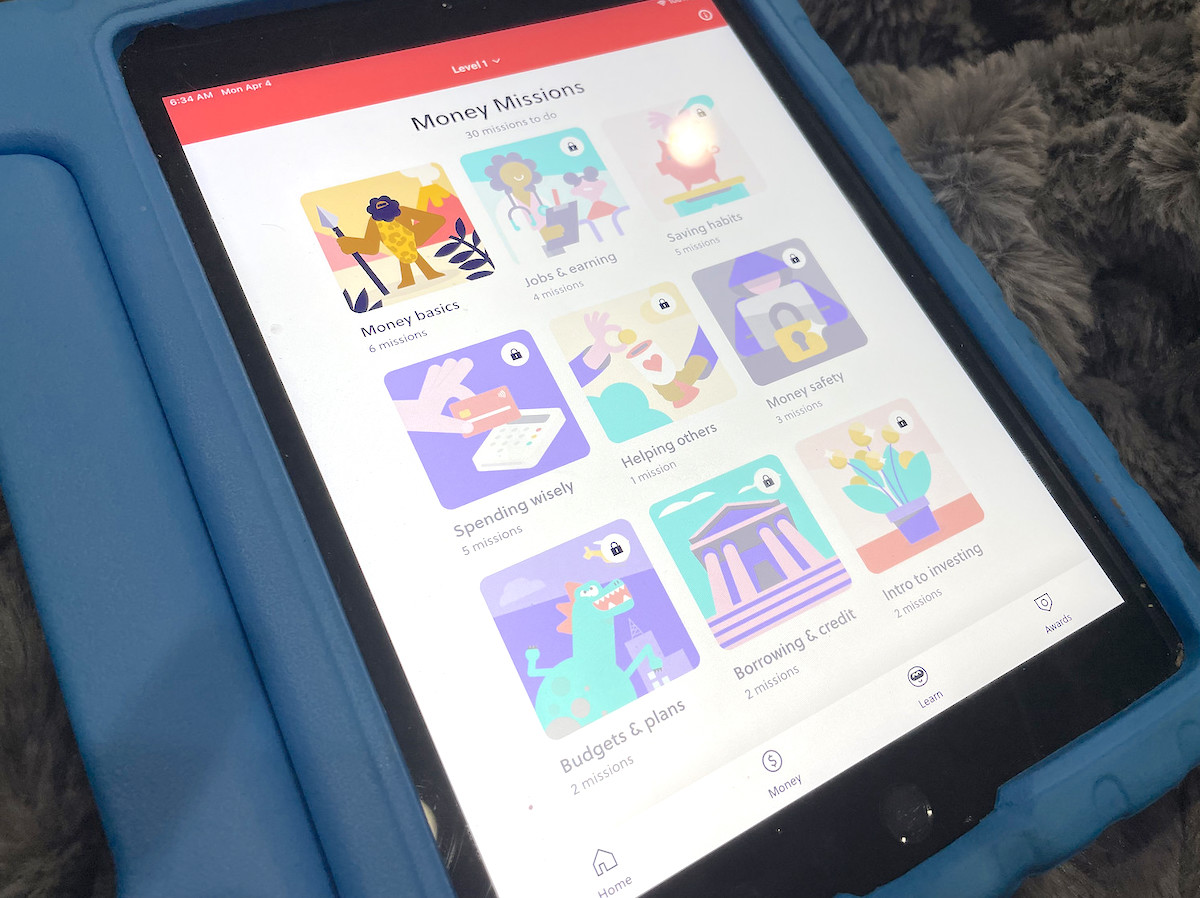

In the app, kids can watch videos, take quizzes, and earn points and badges while gaining money skills they’ll have for life. The missions cover money basics, investing, saving, compound interest, borrowing, giving, and SO much more! Best of all, my son does the missions and earns points all on his own.

Essentially, it’s creating financially independent kiddos in the simplest way possible. 🙌🏻 I’m sold!

As a parent, I love that I can add chores for him to do on the app. The visual aspect creates a different mindset for him to learn how to make his own money…and well, that it doesn’t grow on trees. 😏

Best of all, I can choose specific days he’ll get paid for doing his chores to motivate him to do them in a timely manner. So cool!

Here’s why I think you should try GoHenry with your kiddos too:

- It’s perfect for the whole family. GoHenry has companion apps for kids, teens, and parents so there’s something for everyone. Plus, it’s tailored to your child’s age and money skills.

- Kids learn about money in more than one way. Kids continue to learn about personal finance with their own debit card, tasks, and completing Money Missions.

- They’re more motivated to do chores. Since kids get paid after the chores are complete, they’re more motivated to do the tasks and chores you set for them in the app.

- Customize their debit card. Choose from 45+ card designs—and personalize them with your child’s first name. So cute!

GoHenry has plenty of perks for parents too:

- Plan their paydays. Plan a day they get their allowance, set up a savings plan, or easily set up weekly transfers on repeat so payments are automated. Set it and forget it!

- You still call the shots. Block & unblock cards, flex parental controls, and get notified every time your kids spend money in real-time. Plus, decide where and how much kids can spend.

- Features for parents. Use the convenient allowance manager, flexible parental boundaries, and so much more.

The fun is only just beginning once their debit card arrives! You’ll link your child’s new GoHenry card with your existing bank account, so transferring funds is simple. Whether they’re scheduled or just one time, transactions using GoHenry couldn’t be easier!

Your family and friends can send money straight to your child’s GoHenry card with Giftlinks!

Perfect for birthdays, payments for chores done for neighbors, or just because. 🎉 Each link is totally secure, free of charge, and gifters can add their own personal message so they know who it’s from. Even cooler, kids can write thank-you messages straight from the GoHenry app!

It’s so nice to know that my son has a big head start on learning about money and is building life skills! I truly feel like GoHenry has made such an impact on him and simplified daily tasks like completing chores in our home.

Comments 0