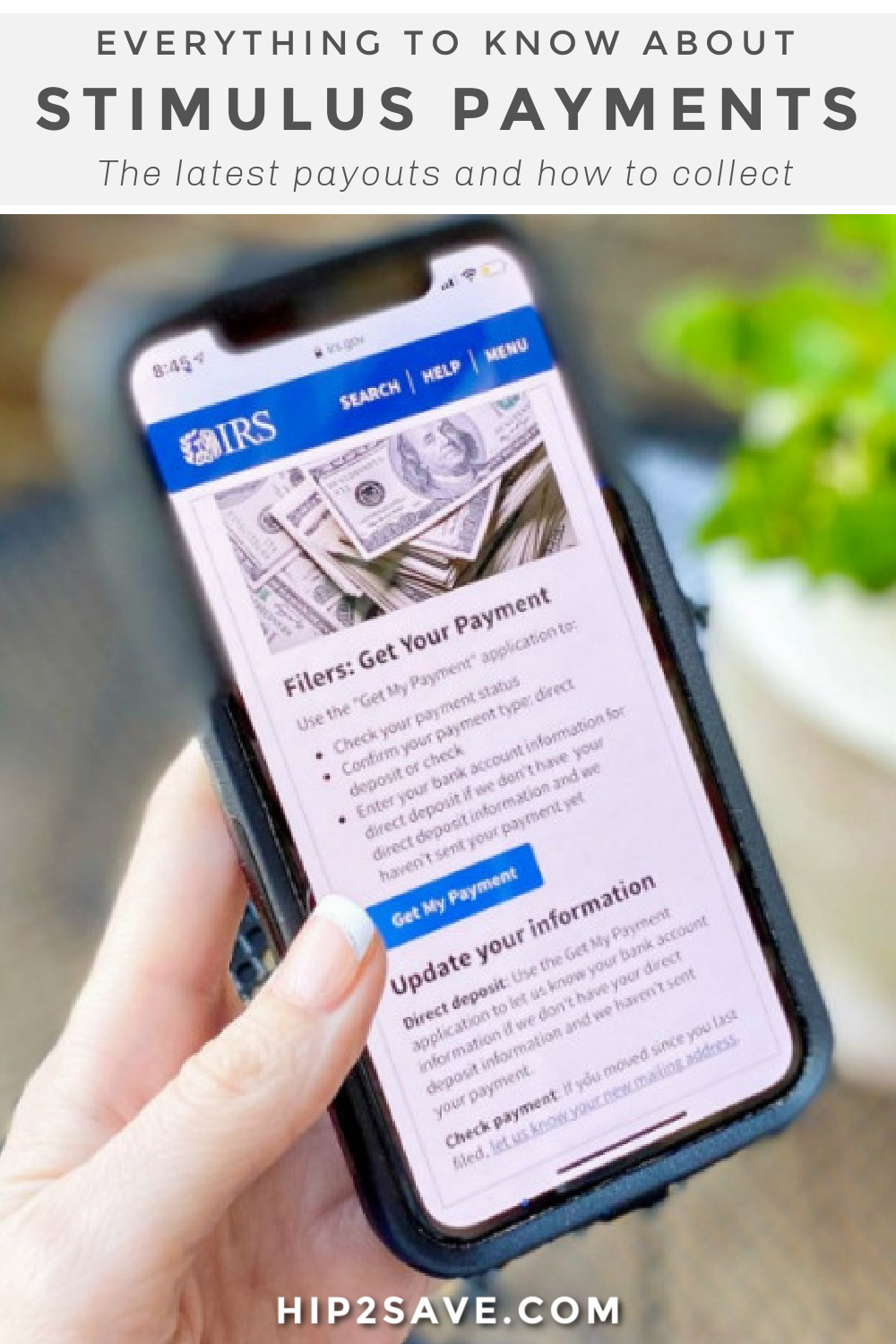

Several States Are Sending Out A Stimulus Check in 2022 (Are You Eligible?)

A state stimulus check might be headed your way in 2022.

Some states are providing economic relief via tax rebates.

Though the federal government probably won’t send stimulus checks in 2022, you might be receiving some help from your state. In the latest attempt to combat inflation and stave off a recession, well over a dozen states have decided to send income tax rebate checks to their residents. Most of these refunds are for small amounts (so don’t get too excited) but we do have the scoop on who qualifies and when to expect a payment!

Find your state below and see if you qualify for a stimulus payment:

California

Who qualifies:

- Single taxpayers who make less than $75,000 annually or couples who filed jointly that make less than $150,000 annually will receive $350 per taxpayer and an additional $350 if there are dependents.

- Single taxpayers who make $75,000 – $125,000 annually or couples who make $150,000 – $250,000 can expect $250 per taxpayer and an additional $250 if there are dependents.

- Single taxpayers who make $125,000 – $150,000 annually or couples who make $250,000 to $500,000 annually will receive $200 per taxpayer and an additional $200 if there are dependents.

When: First payments will go out as soon as October in the form of a direct deposit or debit card.

Colorado

Who qualifies:

- State residents who filed their 2021 returns by June 30 qualify.

- Individual filers will receive $750 and joint filers will receive $1500.

When: If filed on time, expect a check by September 30, 2022. Those who filed an extension will see a check by Jan 31, 2023.

Delaware

Who qualifies:

- State residents who filed their 2020 and 2021 tax returns qualify and can expect $300 per adult.

When: Checks will be sent out from May 2022 through the end of Summer 2022. Adults who did not file timely may also receive a check after October 17, 2022.

Georgia

Who qualifies:

- Full-time state residents who filed their 2020 and 2021 tax returns timely. If you filed an extension, you have until October 17, 2022. Part-time residents will receive a proportional refund.

- Single taxpayers will receive $250, heads of household will receive $375, and married couples filing jointly will receive $500 together.

When: Payments began going out in May 2022.

Hawaii

Who qualifies:

- Single taxpayers and heads of households making under $100,000 will receive a $300 return.

- Married taxpayers filing jointly and surviving spouses who make under $200,000 will also receive a $300 return.

- Individuals who make above $100,00 and couples who make above $200,000 will receive a payment of $100.

When: Payments will come via direct deposit or paper check beginning at the end of August 2022.

Idaho

Who qualifies:

- Full-time residents who file their 2020 and 2021 tax returns by December 31, 2022, are eligible for a payment of $75.

When: Payments started in March 2022 and were sent out via direct deposit or paper check. You can track your rebate payment on Idaho’s State Tax Commission website.

Illinois

Who qualifies:

- Individuals who earned less than $200,000 in 2021 (and were full-time residents) will receive a $50 income tax rebate.

- Couples filing jointly who earned less than 400,000 in 2021 will receive, together, a $100 tax rebate.

- Those with dependents can collect $100 per dependent with a maximum of up to 3 dependents.

- Illinois residents may also qualify for a property tax rebate or other economic relief under the Family Relief Plan.

When: Payments begin starting September 12th, 2022, and will be sent in the same method that your original tax refund was sent.

Indiana

Who qualifies:

- All state residents that filed their 2020 taxes before January 3, 2022, will receive a $125 taxpayer refund.

When: Payments should be received by September 1, 2022, and will come in the form of a direct deposit or check.

Maine

Who qualifies:

- Full-time Maine residents who filed 2021 tax returns (and are not listed as dependent on anyone else’s return) qualify for a payment if they file by October 31, 2022.

- Single taxpayers who make less than $100,000 qualify and will receive a payment of $850.

- Heads of households who make less than $150,000 qualify and will receive a payment of $850.

- Couples filing jointly who make less than $200,000 qualify and will receive a single payment of $1,700.

When: Payments started in June 2022 for those who filed timely.

Massachusetts:

Who qualifies:

- If relief is approved, individual taxpayers who made more than $38,000 but less than $100,000 in 2021 will qualify for a $250 payment.

- If relief is approved, couples who filed jointly and made no more than $150,000 in 2021 will qualify for a $500 payment.

When: If implemented, your stimulus check will be issued before September 30, 2022.

Massachusetts previously provided relief for eligible low-income workers. If you had a household income at or less than 300% of the federal poverty level and did not collect unemployment, you should have received a stimulus payment of $500 earlier this spring.

Minnesota

Who qualifies:

- Frontline workers who were employed at least 120 hours in Minnesota between March 15, 2020 and June 30, 2021. Review the eligibility guidelines and apply for the payment before July 22nd, 2022.

- Frontline workers with direct COVID-19 patient contact qualify if they made less than $175,000 or $350,000 if filing jointly.

- Frontline workers without direct COVID-19 patient contact qualify if they made less than $85,000 or $185,000 if filing jointly.

When: Payments are anticipated to be sent in Fall 2022.

Gov. Tim Walz has also proposed an income tax rebate that is yet to be approved. His proposal is for a $1,000 relief for individual taxpayers making less than $165,000 and a $2,000 relief for joint filers making less than $275,000.

New Jersey

Who qualifies:

- New Jersey residents qualify if they filed the NJ-1040 in 2020 and have at least one dependent.

- Individual taxpayers who made less than $75,000 are eligible.

- Surviving spouses, heads of households, and couples filing jointly who made less than $150,000 qualify.

When: Checks began being mailed on July 2nd, 2022. New Jersey residents might also qualify for property tax relief which will be a separate payment.

New Mexico

Who qualifies:

- Individuals filing separately qualify for a $250 rebate if they made less than $75,000 in 2021.

- Married couples filing jointly, heads of households, and surviving spouses who made less than $150,000 in 2021 are eligible for a $500 tax rebate.

When: Payments for relief above begin in July 2022. New Mexico also offered two other separate stimulus checks. One was mailed in June 2022 and another will be sent in August 2022.

New York

Instead of income tax relief, New York has issued property tax relief for homeowners.

Who qualifies:

- Those who qualified for a 2022 School Tax Relief (STAR) credit or exemption are eligible for up to $1,050 provided their 2020 income was less than $250,000 and their school tax liability for 2022-2023 is less than their 2022 STAR credit.

When: If you qualified, your stimulus check was sent out starting in June 2022.

Pennsylvania

Like New York, Pennsylvania has issued property tax relief for homeowners.

Who qualifies:

- Homeowners who applied to the MyPath program and fit the eligibility requirements listed below.

- Homeowners are eligible for a maximum rebate of $650 if they make less than $35,000 (or are a renter who makes less than $15,000) and are seniors above the age of 65, have a disability and are at least 18 years old, or are a surviving spouse age 50 and above.

- Seniors in need may qualify for additional relief.

When: Check the status of your rebate using the “Where’s My Rebate?” tool.

South Carolina

Who qualifies:

- Any state resident who paid taxes this year is eligible for an income tax refund.

- Those that paid $800 or less will receive a full refund.

When: Payments are expected to be sent in late November and December.

Virginia:

Who qualifies:

- Only taxpayers with a tax liability last year are eligible.

- Individuals filers will receive $250 and those who filed jointly will receive $500.

When: Payments are expected to be sent via direct deposit or stimulus check starting in late September 2022.

New to Hip2Save? Be sure to browse the site. We post so many legit freebies, ways to make money, lots of frugal tips and hacks, all the hottest deals, and so much more. Get started here!

Not yet, not in a situation where we need it yet, but thanks for letting is know. Always good to keep an eye on our accounts

It sure is! You’re welcome!

Not here..Do you know when the 17-year-old cut off is? We have not filed this year’s taxes and if they go by last year’s taxes our daughter was still 16. She just turned 17 in March .

I think you would get it for her then, if she was 16 last year.

Not yet

Not yet…

My X-culig did.

Recieved oura today via deposit.

Yay!

Where are you located? Just wondering if certain areas are getting them first. Thxs

We got ours and we live in Massachusetts.

Yes. It was in my account this morning.

SWEET! 🙌

Did u actually recieve ur money or it jus says pending on the 13th?

Nope not yet

Sad I did not get mine yet cross my fingers it will be soon.

IRS created a tool for non filers to get a check,will they have to pay money back

Nothing today

not yet!

Nope

No

Ours is pending – whoop whoop!

Can you check on status

We’re you guys located I’m in Washington

Minnesota. It hasn’t actually hit our account yet – I just see it as pending in our bank account.

In WA state and ours was direct deposited on the 14th. We are not low income or ss. We are single income and filed in march.

Not yet — Thankfully hubby and I are able to still work (from home) during this time. We are so grateful.

No, but I did see that my income tax refund is pending in my account 🙂

I need to update my direct deposit info, but they still haven’t made that option live yet. This past tax year the refund amount we received was too large to be made as direct deposit (we always had in years past), so they insisted it had to be mailed in a check. I have a feeling we will end up waiting for a check again before they ever get the payment info section of the site up.

I also need to uptake my direct deposit info as well since I switched banks since last year.

I read that this was going to be available starting April 17th. So keep checking this week!!

Same here! I need to update my direct deposit info.

Not yet. Hopefully soon. Were still working but its definitely helpful

Yes, ours was in our acct on Sat.

Not yet are they going by order or something or just randomly distributing them?

Priority given to low income Americans and SS beneficiaries according to a USA Today article.

Not low income and do not get Social Security but we got ours today. 🤷♀️

We did not file using direct deposit, already received our refund. Is there a way to get the stimulus check through direct deposit?

You are not alone. They are supposed to be establishing a website where you can give them your banking details.

Yes its pending for 4/15

Did you see it “pending” when you logged in to your account or did you contact your bank and they told you that?

Mary, I would think each financial institution is different. We looked yesterday and nothing was pending, but woke up this morning and saw ours pending deposit.

Nothing yet. For those who got it, what state are you from? Maybe it’s going day by day by States? Just trying to get a better idea.

Im in Tennessee and got it

In reply to Eve My bank shows pending (probably releases tomorrow) I live in S.C. Filed in February received refund direct deposit

I’m in Michigan. I had e-filed my 2019 taxes in early February if that helps.

I’m in PA and we also filed our taxes early Feb. I wonder if that has something to do with us getting it this soon.

haven’t received mine yet and I filed in early Feb. 2018 wouldn’t have qualified me but 2019 does.

Ours is pending

Nope.

Ssa will get check?

Since a lot of people are wondering. This might be helpful. https://www.dailywire.com/news/heres-when-americans-can-expect-1200-in-stimulus-cash-to-hit-their-bank-accounts?utm_source=facebook&utm_medium=social&utm_campaign=dwbrand

Thank you, Bbbsarah24. That info was very helpful!

It’s pending according to my bank. I live in Georgia. I checked with friends and family and they haven’t gotten it yet, so I don’t know how they determine who gets it first

Lot depends on your bank how fast an ACH deposit shows up…u have BB&T now Sun Trust and. They are slow as molasses in deposits. .

IRS said they start with lower incomes first. Like 0 to 10k then 10 to 20, and so on..is this true?

Yes, I do! I am surprised it was so fast.

Mine has been showing pending in my account since Saturday and that it will clear on or by 4/15.

Nope

I am soc sec recipient wheres my $$$$ I have dir, dep.

Ours is showing pending for 4-15 which is our SS payment day. I don’t know if that Has anything to do with it or not. We have not filed our taxes yet for this year. We file in NY

Yes, we got it this morning! We live in Illinois, and we filed our taxes early February.

Not yet. I still haven’t gotten approved for unemployment yet. Hoping it comes in soon!😭 (in GA)

Same but I’m in PA. I’m much more worried about my unemployment 🙁

Not yet

Got ours today in ga

Not yet, but I heard they were starting to deposit them so I’ve been checking daily. We should get our tax refund back soon too.

Not yet. ಠ︵ಠ

was surprised it was already in my account.

Additional information released. Tracking tool Website to update info And timeline. Looks like it’s based on income. But I know since people that make more that the income timeline listed in this article that show theirs pending for Wednesday. https://money.yahoo.com/coronavirus-stimulus-checks-irs-tool-lets-you-track-the-money-to-your-household-145659731.html

Not yet, but I can’t see pending transactions through my bank, so should be there before the 17th since we filed our taxes end of January.

Pending in my account now

Not yet, we are in Washington state. We filed in February. Still need to pay our taxes so going to wait on that money to give it right back to them and then add a bit more from our end.

I didn’t file 2018 yet Accountants working on it Wonder if I will get a check?

I think it would be helpful if maybe people gave the first letter of their last name to figure out if maybe they are going alphabetically?

It’s all about your bank and when they post it. Most locally owned banks rolled theirs out this past weekend to post today or tomorrow. National banks are waiting until the 15th.

If banks have this money, then why are they holding it? People are hungry.

Banks cant hold onto your money. There is a date to release the money. ACH typically happen a day or two before the actual post and banks are told when to release the funds.

No its not alphabetical. The above link to the article explains the process.

Called my bank, mine is set to post on the 15th. 🙂

This might sound a st*pid question, But do we have to repay this? A friend of mine said that we will repay this next tax season

No, hip2jen. Do not repay at all.

I’ve read it will come out of our returns for next year.

Technically not “repay” but it’s like a loan against your tax refund next year. Let’s say you are single no kids and getting the $1200 and you should have a $1200 tax refund next year. You would then get $0 tax refund but it would never put you negative. Hadn’t heard anything for past next year so in theory if your income stays similar you could withhold less and get the return way down so you wouldn’t lose out.

Not true. My understanding is that an offset will be included in the tax calculations to offset it and it will be a wash. If you didn’t receive the $1200 and you were entitled to it, you will be able to get it in with your tax filing.

Not sure where you heard that but it’s 100 percent not true. My Congressman also said this stimulus money is not taxable either.

It’s not taxable income, that’s different than what we’re saying.

That’s how I was explained it as well. No, it’s not a taxable income, but that’s now what we’re saying.

Are banks really placing 2 day holds on this money? 😡

They shouldn’t, Marie. I believe (at least at my bank) the hold amount was for checks above 3000, but our bank even upped that to 5000 due to this health crisis. I would assume each financial institution can set their own limits.

Banks can’t place a two day hold on it.

If you need to give the IRS your banking details to get your stimulus check, look at this IRS webpage. In mid-april they will be adding a link for you to do that.

https://www.irs.gov/coronavirus/economic-impact-payments

Mine is pending in my account for the 15th. I also just got my taxes back on April 3.

I don’t if it’s true or not but I heard the money they give us now will be deducted from our tax return next year in 2021

Not true.

That is not true. I also ready an email from my Congressmann that said this stimulus money is not taxable either.

It is a child tax credit so, yes, your regular child tax credit (when you file your taxes in 2022) will be less the amount you receive ahead of time. You can choose to opt out if you would rather wait. I have looked this up with Turbo Tax and the IRS. Not sure where other folks are getting their info.