I’m a Saver Married to a Spender. HELP!

Money, bills, and finances. GULP!

The #1 reason why couples argue and the #2 reason many get divorced—finances.

My husband took the kids to Target and came back with a new Lego set, a new t-shirt to add to his collection, some candy, all the junky cereal, and the wrong type of vegetable that I needed for dinner. Ummmm….? 😣 I’ve learned a lot of things about this amazing man of mine over the past nine years, but if there’s something I’ve learned when it comes to finances, it’s that he buys what he wants when he wants. The total opposite of me!

For one, he’s impulsive, whereas I obsess over something for months before buying it (and only, then, when I have a coupon code!). He doesn’t ask permission, yet I tell him every purchase I make. Are you starting to see a trend here… opposites really do attract. 😉

Through all of this, we’ve overcome our fair share of hurdles, had many setbacks, fought about bills, but over the years we’ve learned a lot about how to compromise and work together as a team. With a little help from our favorite book, The 5 Love Languages, we’ve developed many ways to help us stay on track and live happily ever after.

1. Keep a good line of communication.

I can’t stress enough how important it is to communicate with your spouse. Good communication will create balance and result in a successful financial situation.

“When my husband and I first got married, we never discussed money. We over-spent on things we didn’t need, and we never took into account what we were bringing in versus what was flying out the window every month. Before we knew it, we managed to get ourselves into a big hole of debt that caused a lot of tension and arguments. We realized we needed to communicate, stay on top of bills, and set goals for where we wanted to actually be. The day we finally came out on top was the day I actually felt like we were living.” – Bonnie

So, how do you communicate well, you ask? Here are some tips:

- Discuss money without yelling. Pick a good day to talk money when neither one of you is stressed. Maybe even go to a cafe or a public space that’s comfortable for financial discussions, but is also a place you’d feel embarrassed to raise your voices in.

- Don’t keep financial secrets. If you and your spouse are going to cover all grounds and have a positive outlook on your finances, you both need to know where the pennies are falling. This means no hiding secret credit cards from the other half and making sure everyone’s on the same page regarding any and all owed debts.

- Write it all out. Writing out all of your bills, debts, and monthly dues together can be eye-opening for both parties, especially if opposites attract. There may be a variation – and one of you may spend more than the other – but seeing what’s typically left over at the end of each month will force you to reevaluate your spending and bill paying.

- Don’t place blame on one another. Chances are, if one of you feels like you’re getting constantly blamed for how you spend or budget, talking about finances may not result in a positive conversation. Try your best to be patient and understanding with your spouse so that you can get through this together.

2. Marry your incomes.

You’re married. Now, marry your money! I’m not talking every single dollar here, but enough that your monthly bills are covered. After all, you don’t need to share everything, but the bills always need to be paid. Whether you want to combine every dollar or just a set amount to cover shared expenses, setting up a joint account can help with paying monthly mandatories such as your mortgage or rent, car payments, cable, phones, utilities, and any other bills you have together.

“My husband and I have had a joint account since way before we were married because he used to forget to pay bills (for months at a time). So I handle all of the finances, but we also have play accounts, which are our own PayPal accounts that we can do anything we want with. He has a video game obsession, and I spend too much on my daughter, so it works out well for us. We earn money in various ways to add to those accounts: he buys and sells video games, and I’m a consultant on the side. Then we sell stuff around the house that we don’t need. If anything, having to ‘earn extra’ has made us more frugal because we tend not to buy things we won’t actually use/need, and we’ve gotten rid of a lot of stuff around the house just to pay for fun extras.” – Chelsey

Even if you’re not yet married, you can still manage some of your combined expenses like Emily does with her boyfriend. We even love her technique for dining out, too! LOL! And if you don’t eat out often, we love how Amber organizes her meal planning and saves hundreds when she shops!

“My boyfriend and I have an unspoken approach to how we split paying for food. Anything consumed inside of the house (groceries, wine, etc.) is paid by me. Anything consumed outside of the house (dinners out, coffees, happy hour, etc.) is paid for by him. It works out really great for us since it has forced me to be smarter about my grocery shopping. Plus, we eat at Chipotle at least 3 times a week, so I think I’m the one getting the better end of the deal! 😉” – Emily

Are wedding bells in the air? Make sure to check out our money saving tips for your big day!

3. Track your money making and spending.

Each week, have a day when you can touch base with each other to discuss bills that need to be paid and the current status of all your spending accounts. Knowing what you both have left will give you a better visual for what you should be buying or not buying and will give you confidence that you’re both staying on track.

“My husband and I have always had our money together since we got married in 2005. I have always been the bill organizer, payer, and budgeter; we have one bill slot of paid bills and another slot for bills that are in the queue. However, we check in with each other a lot. After each payday, I let him know how much spending money is left over after bills are paid, and he keeps track of our online accounts. We also do our banking online so that’s fairly quick and easy. We make sure to touch base with each other for any purchases over $50, and every six months we go back over our bills to see where we are spending and how we can improve on saving. Tax time is also a great starting point for us to reevaluate our income and savings.” – Amber S.

“My husband and I don’t fight about money often, and I truly think it’s because early on in our marriage we decided that one of us was going to be the CEO and one of us was going to be the Secretary of our finances. The CEO focuses on all the long-term money related things (retirements, investments, etc.) and the secretary focuses on all the day-to-day items (bills, budgeting, etc). Now don’t get me wrong; we for sure cross into each other’s ‘lanes’ at times and make sure we’re both not spending too much, but this has worked so well for us, and then nothing gets missed or forgotten about!” – Amber R.

4. Build defined goals together.

Hopefully, this is something you discussed before you got married, because if you don’t have the same goals, you may not see eye-to-eye on your financial future. Maybe you want your dream house by the time you’re 30 or to put all your kids into private school one day. Regardless of your dreams, create a plan together that lists your short-term and long-term goals so they can become a reality. Also, discuss retirement so that you both end up with the lifestyle you want to achieve.

Not all goals happen overnight, and sometimes our greatest goals end up coming from our biggest failures – which we learn from tenfold. Like Lina says, there’s no shame in failing.

“We have been through it ALL! We lost everything in the housing bubble after remodeling a home that was worth less than half of what we paid. We went through personal bankruptcy, and I thought it was the biggest failure EVER at the time… I have always been really open about our struggles because my husband and I matured a lot during it all. We became closer, and in the end, it was a lesson in humility and gratitude. Ten years later, we’ve made it out alive and on top, and I will never take anything for granted. We appreciate our home and life even more. I’ve learned that it’s okay to make mistakes because that is how you learn!” – Lina

5. Make a budget and stick to it.

Budgeting is going to be your number one way of staying on track and making sure you both meet your overall financial goals. Figure out how much you owe in monthly bills, decide what you want to save each month, and think about what you should set aside for shopping, eating out, and entertainment.

Do you find it hard to budget and stick to it? Check out these free budgeting apps or keep our 5 practical budgeting tips in mind when creating a budget.

“Hi! I’m Alana, and I’m a shopaholic. To save our bank account and our relationship, we agreed on a budget that I can spend with no questions asked. Normally my spending consists of Target clearance, dollar spot items, and other nonsense! At first, I was annoyed, and I’m pretty sure I yelled, “You’re not my Dad!” (LOL!!!), but now it totally makes sense for us and I love it.” – Alana

6. Make room for freedom and fun money.

Speaking of a budget, some of you may need to budget for a little extra spending money. Are you married to a constant spender or someone who can’t miss that next sale at Target? We totally get it, sometimes those deals are too good to pass up…every single time! This is when “fun money” comes into play. Whether you’re spoiling yourself with new clothes, have a hobby that needs to be fulfilled on the daily, or you just like shopping, we think it’s best to allow your other half to have that freedom, but with limits in mind so both of you – the non spender and the spender – are happy.

“For me, I know that my husband is less stressed when he knows I’m going to be spending money on something, rather than going out, spending the money, and then letting him find out the next time he checks our accounts. We’re both happier people when bills are paid, groceries are in the fridge, and gas is in the cars, and we know just how much money each of us has at the end for ‘fun stuff’. It also makes these purchases more enjoyable when we know the other person won’t be worried about the next time we (mainly me 😏) go shopping since we have a budget for it.” – Lisa

“My husband used to forget to give me receipts for unsolicited purchases. At the end of the week, when I balanced our account, I found tons of small transactions. He basically ‘nickel & dimes’ our account. It started getting ridiculous where I would be hundreds of dollars off each month. Finally, we set up his own account, and now we have automatic direct deposit with a set amount from his paycheck going into it. He uses this as his ‘fun money’ to nickel & dime himself. 😅 He likes to use it to take care of all his pit stops for soda, snacks, gas, etc. and any other fun activities his heart desires. Overall, this has really helped our finances stay on track!” – Jennifer

7. Save money when you can.

Men and women tend to have very different perspectives on saving money. Some may think just saving part of their paycheck is all that’s necessary, whereas others may tend to clip coupons or find deals before purchasing something at the store—similar to that time Collin’s husband bought that costly printer with no sale or coupons!

I love that my husband and I are so very different – he’s definitely the spender while I’m the saver. We are constantly learning so much from one another due to being complete opposites. I sure envy his laid-back attitude and spur of the moment, let’s go on an adventure outlook. He definitely brings lots of fun and laughter to our family life! ❤️ – Collin

“I about fell over the time my husband and his friend were putting together some new gym equipment in our basement. In the midst of the assembly, they realized they needed a specific tool that we, of course, didn’t have, so off to the store they went! Fast forward a few hours later, and my husband is bribing me with a dozen donuts, because who could possibly be in a bad mood when looking at freshly baked donuts?! Afterward, he told me he brought home the most expensive treadmill the store had, a TV (for the treadmill 😏), and an entire rubber mat flooring for the gym. WITH NO COUPONS OR SALES! If there’s one thing my husband isn’t, it’s frugal. LOL! If there’s one thing to be said about all of this, it’s that we were able to cancel our monthly gym membership to save money, so there’s that.” – Sara

“Play to each other’s strengths. I am the worst about paying bills on time, but I can find a deal on just about anything. My husband and I know these things about each other, so he pays all of our bills (and has for over 10 years). Most purchases fall in my lap though, so even when my husband went to buy a new car, we did it together since I’m able to negotiate a better deal and more easily resist all of the unnecessary add-ons than he is.” – Stacy

Is saving money a weakness that both of you tend to struggle with? Check out 13 ridiculously easy ways to save money this year and download our favorite budgeting app that’s Hip2Save tested!

8. Live a debt free life.

We’ve all heard it before: “If you can’t afford it, don’t buy it!”. And as Dave Ramsey says, you only really need credit cards to get yourself into more debt, therefore you should be asking yourself why you actually need them at all.

“It’s very scary how fast 90K or more can add up when you have cars, student loans, etc. My husband and I did Dave Ramsey’s program in 2008 and paid off over $90,000 in debt, including our second mortgage, car payments, credit cards, and student loans. We cut up all of our credit cards and never looked back. To this day, we do not own a credit card, and everything we purchase is paid via debit or cash. Additionally, we’ve never had any issues renting cars, paying for hotels, and traveling outside the country among many other things. Becoming debt free has been life-changing for our marriage and lifestyle!” – Michelle

Often times after marriage, you move into a new home together, see the neighbor’s spendy cars, endless amount of sports that their kids are participating in, and you suddenly feel the need to keep up with it all! Be cautious of these lifestyle inflations and spend money within your means. Besides, you don’t want to end up a divorce statistic like this staggering debt and marriage stats that we found.

9. Plan for the unexpected.

While we can plan all we want, sometimes life and unexpected happenings get in our way. Unforeseen circumstances like unemployment, family illness, and a home or auto disaster are just a few examples of how your finances can take a turn for the worst if you’re unprepared. Building an emergency fund for these un-predicted times will set you up for peace of mind in the worst of situations.

“Plan for the unexpected. My husband was laid off a few months ago, and it was tough! Thankfully, we were able to rely on our emergency savings funds. We basically split our income into 3 groups: Necessity, Savings, Entertainment. The entertainment wasn’t too difficult for us since we live an hour away from L.A., and we always take advantage of the free events in our area like kids workshops, summer park concerts, movie screenings, etc. (My husband HATES to use coupons, so I’m the Cheap-o who will put in the extra work to find these cool frugal events for us to enjoy.). Funny story… word spread around with my husband’s military buddies that I was one of those coupon ladies, so they made me a shirt that says, “I have a coupon for that”. – Alyssa

How do you and your spouse tackle finances?

Share in the comments below!

Wow – I think this all the time 🙂 I’m the couponer and saver and my dear sweet hubby is the spender. We’ve been married over 10 years now. He still likes to splurge on things that definitely aren’t a necessity, but now he talks to me about it first so I can watch for coupons and sales. Fun article to read and while I’ve heard most of the tips in your article before it’s still a good reminder. Thanks!

Well I am the spender (although always up for a good deal of course) and my husband is the saver! Thank goodness. I just left the store buying this book and so funny I find this post after buying the book at my lifeway store (which it’s free with a coupon with any purchase if you are signed up for their emails, so of course I got something on sale to get this book! And only spent $1.44). Thanks for this article!

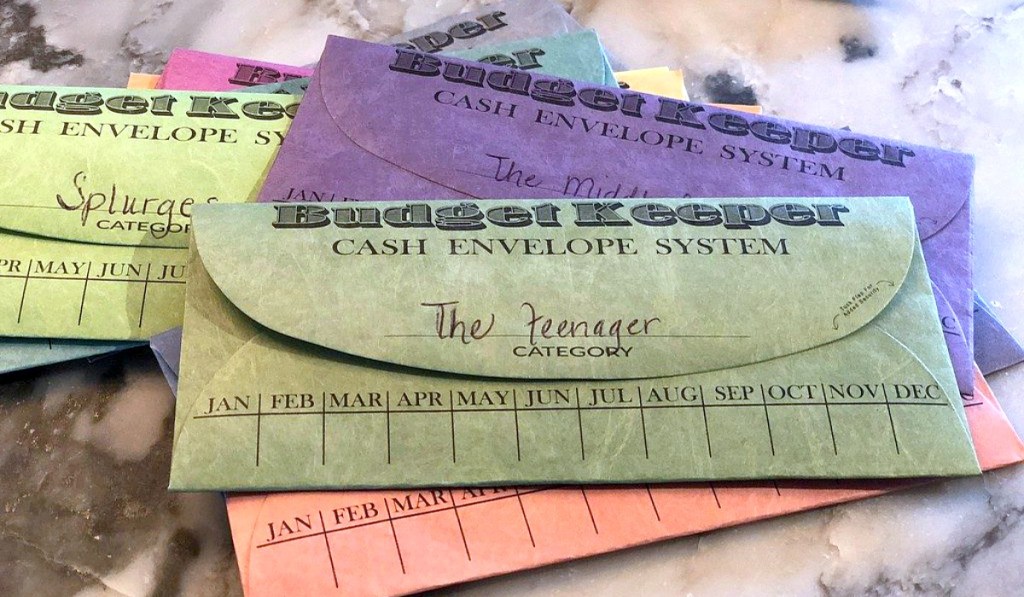

Out of curiosity, where can I find those budget envelopes? Lol. So cute! I like!

Budget Envelopes – 96-Pack Cash Envelopes, Cash Envelope System, for Money Savings, Budget Keeper, Personal Finance – 12 Colors, 8 Each, 6.7 x 3.3 Inches https://www.amazon.com/dp/B079CB9R71/ref=cm_sw_r_cp_apa_i_1EjwCbQWX4EZK

Been married for almost 14 years. I think for us, not having kids has been HUGE. We could not afford to have them when we were younger and frankly, our marriage was a giant mess. Bringing kids into our dysfunctional marriage, particularly when we were not making much money, was the last thing on our minds. It took about 9(!) years for us to finally work through all of our marital issues. In that time, our salaries have steadily increased, and I really emphasized living below our means while maximizing our retirement contribution. For the first 9 years of our marriage, that meant couponing/watching sales like a hawk, not having cable, not buying new furniture EVER, going on cheap/free dates (hikes, walks), only getting takeout pizza in the rare event we dined out, no smartphone until 2014, driving 10+ year old cars (my car was dented up and levers and buttons did not work, but my car still got me from Point A to Point B), no home renovations, and no vacations. I grew up poor, so I was used to watching EVERY penny. Hubby grew up in middle class, but he did not watch every penny, particularly on low-cost items. Early in our marriage, I used to be furious at him if he bought stuff at regular price at CVS. But he would shrug it off and say “I bought it because I happened to be at CVS, and I needed this item. I am paying for the convenience. The time I saved is well worth the extra money I spent.” After this scenario played out about 20 times, he learned to ask me to buy things for me instead of buying things himself. He would say “I need some deodorant” or “I am running low on sunscreen.” Then I would watch for sales on the items he needed. It was a system that worked well. Fast forward to today, and now our retirement balance is at a point where we no longer need to contribute anything, so we don’t. That freed up a lot of fun money for us. Now we are late 30s/early 40s, and we own 3 homes, 4 vehicles and can pursue expensive hobbies and we can FINALLY enjoy our money. We donate 11% of our gross income to charity every year, which we actually started to do about 4 years into our marriage. I think it’s important for both spouses to share the same financial/lifestyle goal, and lead a lifestyle that you can ACTUALLY afford (which includes having children). For us, we were both willing to sacrifice some luxuries during our younger days so that we can enjoy our money now. We worked out a system where I do ALL the shopping, which I like because then I know I got the best price I could find. I’m not going to lie ~ not having kids makes things so much easier for us, financially. The issue of having/not having kids is a very personal one. We chose not to have kids because it made most sense to us, all things considered.

There is no price tag on the joy children bring to your life. Not commenting for your sake because you have already made that decision but for people currently or someday making those choices. There is always a way to provide for your children if you work hard and are mindful of your spending. How sad it would be if someone wanted to but chose not to have children because they thought they couldn’t financially.

Courtney, I am not taking offense to your comment since your comment was not directed at me and you are a stranger on the internet, just like I am to you, and I am 100% secure in my life choices. That said, your statement “There is always a way to provide for your children if you work hard and are mindful of your spending” is not only false, but it is a GIANT slap in the face to those parents who still having trouble providing for their children despite working very very very hard.

Enjoy other people’s children and then give them back when done! Way to go, Merry Cherry. Agree with and respect your decision. Children are not for everyone. A tiny bit similar, it’s kind of a decision I’ve told my parents — while I love them to death, I am NOT a caregiver and I’ve told them I cannot/will not care for them when they get old. It is not that I do not do things for them on a daily basis — it’s the long-term issues I cannot and will not do… that is how elder abuse happens (similarly, child abuse). Again, applaud your decision. Enjoy the fruits of your labor.

I guess I should have said being mindful of your finances, not spending, as in having a stable income/employment before getting married/having children

Nope. Even with your revised statement, to say “There is always a way to provide for your children if you work hard and ARE MINDFUL OF YOUR FINANCES” is still a MASSIVE slap in the face to hardworking parents who still struggle to make ends meet and provide for their kids. There are A LOT of people that bust their tails working HARD at lower-paying jobs. Or they have higher paying jobs, but LIFE throws curveballs at them. As a result, even if they are mindful of their finances AND work hard, they still struggle to get by. There are many Hip2Savers who are in this very situation ~ I know because I’ve read their comments on previous posts. There is NO SHAME in working hard at a lower paying job. There is also NO SHAME in dealing with life’s curveballs the very best one can. That said, comments like yours are discouraging to hardworking parents who simply can’t provide for their kids no matter how hard they try, or how “mindful” they are about their finances.

You are missing my point. Of course there is no shame in working hard at any job! My main point was that if you are considering children to keep in mind there is no amount of money/houses/cars/assets in the world that can compare to the unconditional love and joy they bring.

I made the decision not to have children, but I understand if people want to have children. Everyone needs to make their own decision based on their personal situation and preferences.

I am with Courtney. Children are the greatest wealth in this world. Yes, this is a personal choice, to each their own. However, those without children do not understand what their life is lacking. I want to be surrounded by my children and God-willing grandchildren when I’m old not by the money in my bank account!

Courtney, I agree with you 100 percent!!! Money doesn’t buy you love or visitors/caretakers when your old… love and help if you lose a loved one, on and on…. People nowadays are so materialistic and worried about things versus life!! Good for you for speaking up!!

I agree totally thanks so much Courtney I needed your comment

There is a way to provide no matter what. I’m a “single” mom, never have been married, but have been with my boyfriend for 9 years. My 10 year old knows what it’s like to stay at Grandma’s house over night a few days a week while mom pulls a double. I still got to enjoy being a mom and provide for her while working full time and going to college. Now I have a double Masters and have worked my tail off to provide for her. I was the first one in my family to graduate from college. I paid for it all on my own. I own my house, have a nice paid off vehicle, and Max out my retirement. I make 40k a year and we live comfortably. You can’t tell me that it’s a slap in the face for people bc they STILL can’t make ends meet! You do what you have to do. Period. You can’t be buying junk all the time. I’m not legally married, but we do split everything like we are married. I get more benefits not being married in all reality! Again it’s all perspective.

Oh Courtney, I’m with you. I’m so thankful we have the freedom to make our own choices. At the end of my life I will be so happy to think back and remember the feeling of my little ones arms around my neck and their tiny hands in mine. I hope I’m not checking the balance of my 401k or remembering what happened to my cars. I want to remember the first day of kindergarten, the day they graduated from high school, college, got accepted to medical school. I wouldn’t have wanted to miss the hours of homework, the first homerun, all the touchdowns, driving lessons, proms, Christmas mornings, family dinners, first jobs, the weddings and so many more things. Any of you mamas could keep adding to this list. I have no need for 3 homes or expensive hobbies, the best thing about my life has been and still is my 4 intelligent, hilarious, kind, time consuming very expensive children.

O, everything you said resonates with me … there is nothing better than being a mom Thank you for such a lovely post.

I’m with everyone above. My children are priceless to me and there is nothing, and I mean nothing in this world that could take their places. There’s no car, no house, no cash pile that could replace the many special precious moments we’ve had together. When I leave this earth one day the money I have saved hopefully will make their lives a bit easier as well as my future grandchildren. Also if you don’t have kids what’s the point of saving? You aren’t leaving a legacy to your kin so you might as well spend as there is no tomorrow. Live it up.

Yes to this! You don’t know true unconditional love until you have had a child.

We have a lot of kids and they really aren’t that expensive. We use hand-me-down clothes and yard sale toys and eat at home. We (I especially) stopped traveling for the most part and simplified our (especially my) lives and now have a nice, peaceful, cheap, happy existence. Plus, the teens end up getting jobs and making quite a bit of money if they want too. I don’t really get the downside to having kids.

Way to go!!! Congratulations on all your accomplishments! I just have to add that having kids or not having kids is a choice everyone has to make on their own! I know if you have kids you always figure out a way to make ends meet somehow. I have a 1yo daughter now and we love her to death!!! However my husband I wanted to wait until we had a foundation built. As a couple and financially! I grew up hearing my parents argue about money and other things a lot!!! I dont think there is anyway to explain how much that hurts children! So I see both views! Its a choice each couple has to make on their own and neither choice is wrong! 💗 Blessings…

Well said Merry Cherry. Thanks for your input. I don’t see anything wrong with anything you said. You said so yourself it is a personal choice to have or not have children and some people of course took offense.

Merry Cherry, you life is goals for me! I am 30 and my husband and I have chosen not to have children. We are working towards everything that you have listed and in about 3 years we are half way there–I couldn’t be prouder. I am always happy to see people that have similar lives to what I live, it makes that part of me feel better, that part that always has to answer why I don’t want to have children. But children aside, my life is everything that I want and we have worked so hard to get here. The sky’s the limit!!!

I love this post! Thankfully my husband and I are both very frugal and mostly agree on our financial goals!😊 Its amazing how much you can accomplish when you both work together! My parents have a lot of marriage problems and 90% of the time it’s because of finances. So I was super paranoid of finding a frugal husband…and I did!😊 When we got married we decided we want to pay off our house (it’s nothing fancy at all) before we have kids so we put our hearts into it and together we did it! In 6 years! Now we need to set another goal ha ha. But my point is..its amazing what you can accomplish when you work together! Neither of us could have gotten where we are on our own!💕 You’re always stronger together!

I drive a nissan sentra, he drives a mercedes 550. We live in a 4000 sq foot house. I hate it because it’s too big and expensive but I do appreciate the growth in value is better than a small home. I have 0 credit card debt. He has $50000. I want to go out 2 eat only when it’s heck a cheap every other money. He wants to spend any amount of money on a good dinner. I am saving for retirement. He is not. We keep our finances separate so we get along great. He buys designer clothes, I buy target & walmart and maybe ralph lauren when they have the very cheap sales and gap because of the quality. Opposites attract.

I think that would drive me nuts. It would always be in the back of my mind that one day his debt would become my burden. I don’t like to see family and friends overspend and let them know it’s a better way. I’m okay with their choice not to live like I do because it doesn’t affect me. But my husband’s choice not to be on the same page means I might have to carry the load on some future big items that we both want. It’s not that I wouldn’t carry that load, but I’d think it was unfair that I sacrificed while he lived more carefee or fancy. People are different so I’m glad that your situation works for you.

Hi Lisa – just curious, how to do handle groceries, utilities etc. with everything separate. Looking for some ideas for my relationship.

*sorry – how do you handle…(typo)

Reading this, my husband and I have separate accounts. I am frugal, he is a spender (has minimized in the last two years). He has his account, I have mine but I have another account which is suppose to be “joint” for the bills. Every time he gets paid, he asks me how much I need and I deposit it in our “joint” account. Our bills do get paid..when we want to go out, my husband pays or I pay…it’s never been an issue but I pray every day for wisdom on our finances and we are on the right track.

Elle, my husband and I (happily married going on 26 years) have always had separate accounts. We are on each other’s accounts — to have access to each other’s accounts should the need arise. Finances has never been an issue/argument for us (hard to believe!). What we do is if a bill comes in, whoever can pay it, pays it, but (we always have our 6-8 months emergency fund) in addition to ensuring our IRAs are fully funded. We have always lived BELOW our means. When we get a raise, we try to increase savings. While we do not sit there and 50/50 everything, it’s just a simple matter of we’re in the relationship together — mutual respect is all anyone needs — oh, that and communication! Good luck to you and yours.

We also have separate bank accounts and this works well for us! I give pointers on how to save money on deals but I don’t lose my cool if something wasn’t bought on sale. I understand wanting the convenience over a sale sometimes!

Couples generally fight over money b/c it represents security to some (savers), and freedom to others (spenders). Both of these are valid approaches to have, but conflict usually comes about when people don’t respect one another’s view of what money actually represents. At the end of the day though, every healthy relationship is built on communication and compromise, not anger and judgment.

I dated a spender and he drove me crazy. he even bought a medical device for his car so that he could help somebody having a stroke on the road. LOL

Great article! I’m the saver and do not impulse buy. He is the total opposite yet is cheap when a necessary home expense comes up. The different mindset is difficult and for me breeds resentment.

Interesting article! I would think couples would have a finance talk right along with anything else.I guess hubs and I did pretty good having that chat right off. He used to be a spender. Now technically I am the spender since I buy all or most of the groceries/ home items/necessities. Now with kids and a house neither of us makes a big financial decision without telling the other. We’re both really good about watching sales too….most of the time.😉

The 5 love languages was the best book I read. There is a quiz to take to find out your #1 love language. Once you find out what each other’s #1love language is you can understand,communicate and fill that love language. I am happily married and highly recommend this book. Thanks for posting.

I love when I listen to Dave Ramsey how he says when you get married it needs to be “we not I” and that money should be put together because you are married now. As hard as it is at some point you have to get on the same page because whether you have children or not life comes fast at everyone sometime or later. My kids are almost grown and the one thing I can attest to is that if you both get on the same page you’ll thank your younger selves so much for getting out of debt sooner rather than later. We were just saying this morning that when our kids get married we want to put them thru financial peace university as it’s priceless.

We have divided our responsibilities like daycare groceries I will pay , mortgage gas internet water bills he will pay and we talk to each other for financial decisions . He was spender before getting married . He is now saver too .

The best advice I ever heard (for couples with 2 incomes) is to equally divide the expenses, contribute to financial goals and savings. Then, whatever each has left over, they can do with as they please. Neither spouse can comment on what the other does with their left over money. This way, the savers feel secure because all of the needs are taken care of, and the spenders know they can freely enjoy at least some of their money.

It felt unfair that I was the saver and my spouse was always spending but over the years of him seeing my amazing deals he’s come around….somewhat lol

Love that wallet pictured!!! It looks like it holds a lot!! Where can I find one like that? Who makes it and where can I find one too??

Thanks!!!

Hi Mary! That wallet has enough room to hold 36 credit/debit/ID cards, your mobile phone and more! It also has RFID blocking technology. You can check it out here.

Awesome post. Our goal was to have a large family. I lost my Dad when I was 16 and my sister and I were what kept my mother going. Now, her 5 grandchildren do. My husband and I had already been dating a year before losing my dad so we knew when the time came we wanted a large family to go through all the good and bad life throws at you, together. What a blessing our family is. By doing several of the things you have listed and then some, we’ve been able to purchase land, build our home and enjoy our life with our children without the worry of financial debt.

I love the post the info presented is very valuable and i appreciate it- the ppicture of the couple are hhot couple and highly relevant tysm tysm

I can’t imagine that too many people on their death bed think, “I’m so glad I never had children and I’m so thankful that I lived debt free.” Life isn’t about things and yes money is in fact a thing. It’s not about a 2 week vacation that doesn’t create a lifetime of memories or experiences, nor living in a home (thing) that’s paid off. My family is invaluable all three of my living, breathing and wonderful children for they could never be replaced by someone else’s paid for debt free things. Being a great Mom is my best accomplishment. I would never expect anyone who isn’t one to comprehend Mom Life. I was 34 when we finally decided to have kids. Best decision ever!