13 Ridiculously Easy Ways to Save Money This Year

We’d all like easy ways to save a little more money, right?

I don’t think I’ve ever met someone who said they were saving TOO much money. There are little expenses that add up every day – a latte here, a Target Dollar Spot find there, an unused gym membership (🤦♀️ guilty as charged on that one). And then there are those times we don’t even realize we’re paying too much.

I’ve rounded up some ways to cut costs in your household that take minimal effort and time, so read on for some easy ways to save!

1. Cut back on subscriptions or get them for free.

Are you really using your Netflix or Spotify subscription to justify paying $120+ a year for it? If not, consider cutting ties. If you can’t part ways, see if family or friends would like to share accounts or split the cost in a family plan. With Spotify family, you can add up to 5 accounts and pay only $15 – that’s potentially 70% percent off the price of paying for it on your own.

If you’re more of a print fanatic, slash your cost on magazine subscriptions by checking out Mercury Mags for FREE subscriptions to popular titles. And/Or just check the magazine section on Hip2Save often! 😃

2. Use open-source software.

Microsoft is pretty synonymous with word processing software, but it comes at a cost. Similar programs like Apache OpenOffice or Google Docs are available for FREE! If you’re a Mac user, Apple has its own suite of business software available for free on the app store.

3. Negotiate your cable & internet services.

I would be crazy to try and convince someone to cancel their cable or internet service, but it’s worth giving those bills a second look. Bryn, one of the Hip2Save sidekicks and Collin’s sister, decided to give her provider a call and ended up saving hundreds! While we can’t guarantee you’ll have the same outcome, it might just be worth 5 minutes of your time to see if you’re eligible for any discounts.

In my area, when a new cable company bought out our old provider, I was able to lower our bill AND get faster internet speeds – it was a real win-win!

You could even consider alternatives to cable, such as Netflix, Hulu, Sling TV, or the new YouTube TV. If you have an Amazon Prime membership, take advantage of Prime Video, which has some of your favorite shows, movies, and even their own original series – all available to watch for free with your Prime subscription!

4. Open a new checking or savings account.

Is your experience with your bank just meh? Check out other banks nearby to see if they’re offering promotions to switch (like prize drawings or cash incentives). Be sure to check the conditions of the bank first, like monthly checking account fees or minimum balance requirements. You don’t want to end up paying more than you are at your current bank.

5. Make use of saved money.

Unfortunately, there’s no interest accrual from your piggy bank. If you don’t think you’re getting a high-interest yield where your money is currently stored, shop around for an account that offers a higher interest rate. There are plenty of online savings accounts offering higher interest rates due to lower overhead expenses. You may also want to check out investment options, whether it’s your 401k, traditional IRA, or Roth IRA.

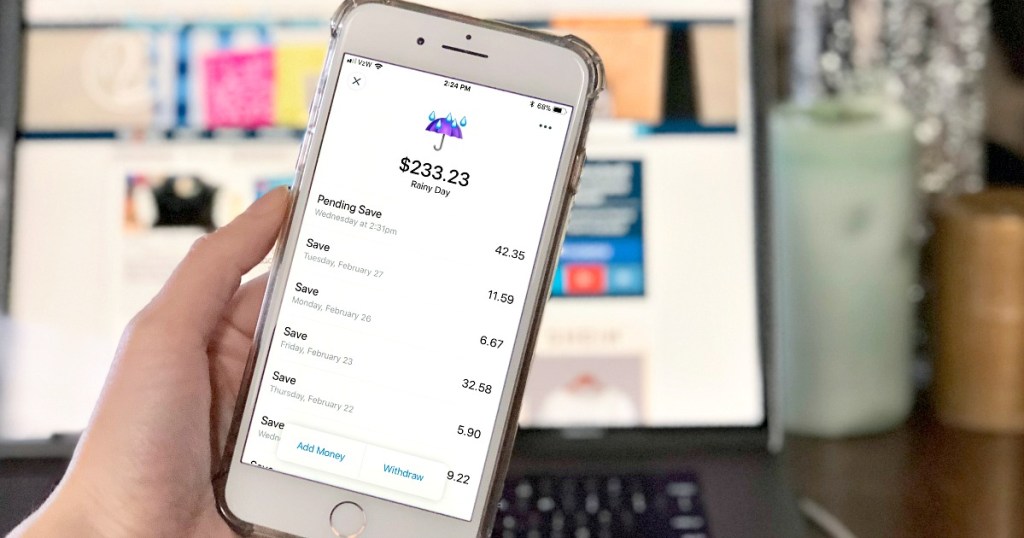

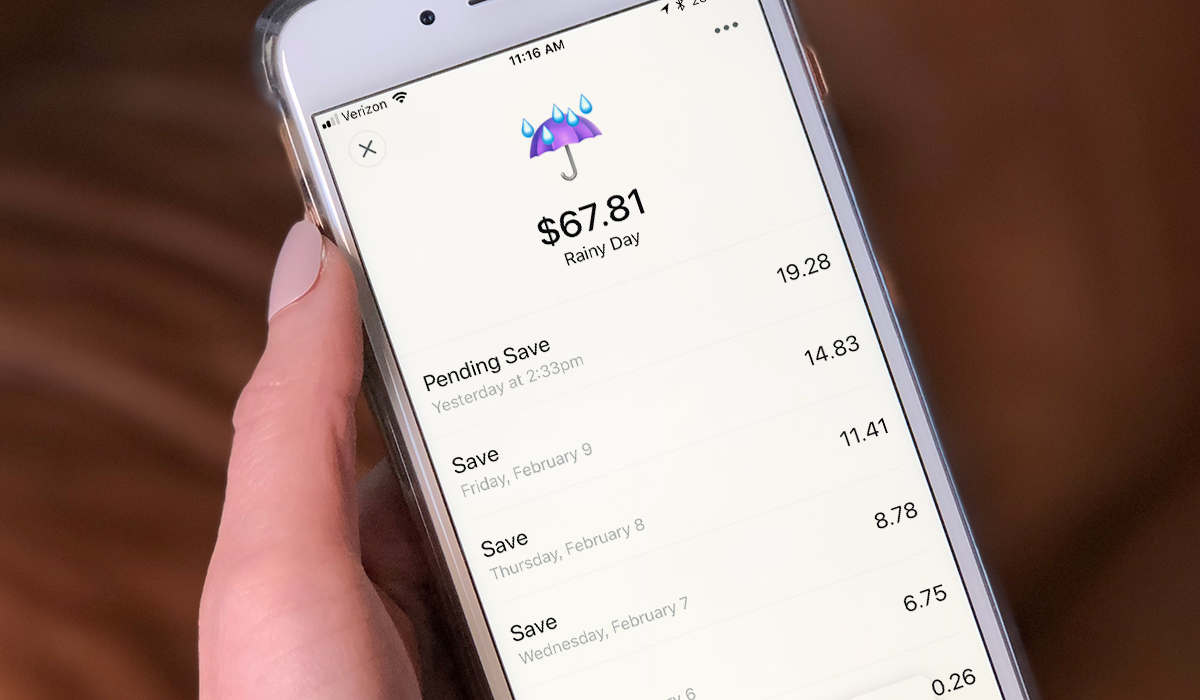

6. Save your money without knowing it.

Download a budgeting app like Digit that saves your money behind the scenes. After connecting your bank account, the app assesses how much money it can transfer into savings based on your spending habits to ensure it never transfers more than you can afford.

I’ve been using it for a month now, and I’ve already saved around $230! Even though I can withdraw the money at any time, the app is slowly teaching me how small transfers really add up! It’s important to note that while the app is free for the first 90 days, it costs $2.99 per month after the trial.

HIP TIP: Check out some other savings methods we love, like the envelope budgeting method.

7. Sell, buy, or swap clothes on resale sites.

Take a good, long look at your closet. Is it packed with clothes and shoes, even though you wear the same stuff all the time? If so, it might be time to evaluate which pieces are essential and which can go. For never-worn or lightly used garments, snap a few nice pics and upload them to Poshmark, Swap, or ThredUp. Make sure it’s something that has value, and be honest in your listing for any defects. And seriously? Keep an open mind about negotiating – your clothes make you literally $0 just hanging in your wardrobe.

You can also trade your clothes with other users if you’re looking to infill your wardrobe with new pieces. All you pay for is shipping, and that’s a hard deal to beat!

8. Freshen up your jewelry for next to nothing.

If you’re looking to get a refresh on your accessories at no cost, consider hosting a jewelry swap with friends and family. Everyone brings the items they don’t wear anymore, and you could end up walking away with a whole new look at no cost!

When you do need to purchase something new, forgo the traditional jeweler and check out the unique (and CHEAP!) options from World Market or scour the fashion jewelry department at Walmart. Collin comes across adorable pieces every week in the Walmart Wednesdays series!

Also, be sure to take advantage of jeweler mailer offers. Collin received a $50 off $50 purchase and ended up getting a beautiful sterling silver ring from Helzberg Diamonds for FREE! Sure, some mailers can be more trouble than they’re worth after reading the fine print, but her experience shows there’s always a chance for an awesome steal!

9. Enact a 24-hour rule.

Do you REALLY need another new sweater or trendy accessory? When approaching any purchase, sleep on it or give yourself 24 hours before you act. If you lose interest, you’ll be happy you didn’t waste your time AND money. If you can’t stop thinking about it, then, by all means, treat yourself.

But what happens if you purchase something, realize you don’t love it as much as you thought, and can’t return it? It’s eBay to the rescue! The online marketplace has hundreds of thousands of goods listed just waiting to earn their owners some cold hard cash. Get in on the action and sell those purchases that were made just a tad too impulsively.

10. Be flexible with travel dates.

Most people want to travel on the weekends, which is why most flights are the most expensive during those times. Whenever you can (and I know it’s easier said than done), book flights for mid-week when less people are traveling. Also, try booking flights around 7 weeks before your desired travel date since travel analysts say prices tend to be at their lowest during this time. The money you save can go toward your vacation in other ways!

HIP TIP: Here are 5 more ways to save on travel.

11. Plan around freebies.

If you enjoy getting out of the house for dinner and activities, scope out places that offer incentives when you join their loyalty program. While restaurants like Red Robin, IHOP, and Famous Dave’s offer free meals for your birthday, they often also give you freebies just for signing up to receive emails! Once you’re in, you’ll get email notifications with promotions throughout the year.

If you’re feeding a whole family, check out My Kids Eat Free for a list of restaurants in your area that honor free meals for kids on certain days.

12. Re-shop your auto insurance.

If you like your insurance provider, ask if there are any ways you can save money on your current policy. Factors like drivers passing the age of 25, completion of online driving courses, or a change in vehicle usage (like using a car solely for personal use rather than commuting) can all play a role in scoring a discount on your insurance. I recently saved $25 per car when I had my insurance company remove hidden charges for optional emergency towing!

After that, if you still think you’re paying too much, call around or shop insurance company websites for an online quote – just be sure you’re still getting the same amount of coverage.

13. Sign up for Hip2Save emails!

If you haven’t already, subscribe to the FREE Hip2Save Newsletter to get email updates on the latest and greatest deals, DIYs, recipes, coupons, freebies, money-saving tips, and so much more! Even better, we often host contests exclusively for email subscribers!

Want to learn more ways to keep some extra cash in your pocket?

Check out our 10-Week Financial Boot Camp! In this series, you’ll receive weekly emails featuring money-saving challenges, helpful tips, and even budget-friendly meal ideas to keep a little more cash in your pocket.

All the stuff I don’t use I sell on Mercari.. easiest app ever. If anyone is interested in a referral code leave your email!

Thank you! traveller456 at gmail dot com

chrissygoff30437 at gmail I would like to try out Mercari

Thank you! marlanafranzel at gmail dot com

Brooklyn021002 at msn dot com

I emailed you all, enjoy and thank you!

I love Mercari too I’ve been using it for a bit now and have already made a ton!

I’ll check it out. janellb22 at hotmail dot com

melspe@yahoo.com

gjmolina1@gmail.com

Tiffanymccrery@yahoo.com Thanks !

sanatauseef at gmail dot com. Thanks

I’d use a referral code. Heathershaw820@gmail.com

Thank you!

Please send me a referral. mollie010464@aol.com

Please send me the link

Katherine. Petillo@verizon.net

Yes please. Shirleylents @gmail.com

Discover checking? or I think it was savings account offers really good rates! They had an opening promo where you deposit xx and get $200. Don’t think they have the promo now but they’re rate is like 1.4% which is like 100% better than the traditional brick and motar banks. 🙂

Holy cow, that IS an impressive interest rate! Thanks for the great tip, Sophia!

We just opened a checking account at US Bank, and if you direct deposit $1000 or more within 60 days of opening the account you receive $200 deposited directly into your account. Available through April 30, 2018! Free $200!!

SWYR points- If you have a Kmart or Sears, play their Xtra and Sweeps game daily. I place $25 orders 2x a month shipped to my home for free. I haven’t paid a cent for most necessities in my home (including many free clothing items and umbrellas). I’ve also donated well over $3k worth of merchandise to charities over the past two years.

Shop an occasional garage sale- I’ve found many brand new in package items to gift, to donate, for resale or personal usage at $.25-$1.

Purchase quality and resell when done- I’ve purchased a Crane humidifier, used it for two years and resold for a profit. I bought a Dyson refurb in 2005 for $220. The vacuum is still going strong 13 years later. I’ve picked up Ralph Lauren boy’s clothing at Macy’s on steep discount. I took care of the items and resold for what I paid for the clothing or made a profit.

I love Ally Bank. I’ve used them for years. My savings account makes 1.45% and I can transfer back and forth between my bank of america account for free. And their customer service is fantastic should you need anything, which is seldom since their mobile app is so user friendly!

Good to know, Alesia! I’ll have to check that out myself. Thanks!

I do like Mercury Mags for free magazines and also use ValuMags.com quite a bit and they seem to offer a good variety pretty often (both print and digital). Lots of fitness and health mags that I like and plenty for the guys so I’m pretty happy with them and check them daily. Right now it looks like lots of free women’s mags if anyone is interested.

Ooo! I love ValuMags.com — Thanks!

I’ve found several free ValueMags magazine deals on Hip2Save!

If you have spectrum you can get 1 box and as long as you have spectrum internet you can get the roku!! Its amazing and now you dont have to pay a montly charge for additional boxes and remotes

Does spectrum provide the roku or is that something I would need to purchase? Sorry I’m not hip with technology!

You would need to buy but the basic is 29$ but if you think about it better than paying for the box and remote

What’s roku?

Wow I need to switch my savings asap. Missing out on $500+ interest a year!

Anyone have ideas for best kid savings accounts?

One of my local credit unions (Knoxville TVA Employee’s Credit Union) has an education savings account. It can’t be touched until they are 18 and the interest rate is much better than a regular savings account. I’d suggest asking around your local places.

We use CapitalOne360 for savings accounts and I absolutely love them!

cut the cord and get online streaming services!

Mercari has a low rating. Do your research. BBB complaints

I’ve been using it for years and made over a thousand dollars. No complaints on my end.

The reviews on Mercado are horrible!!!

Sorry MERCARI

I love Mercari and have been researching” for years by buying and selling on there!

Mercari has restructured some since they first started. There have been many updates and upgrades lately so some of the reviews and complaints may be from earlier on. Anyway, I’ve been listing for less than a year and have been pretty lucky! Feel free to use this code and get $10 off your first order to try it out!!

I suggest the online savings bank Smartypig. They have up to 1.30% interest rate. You can make different goals, time frame for the goals, set up direct deposits and even share your goals with family and friends. We have three different goals set up (two college funds and emergency) with direct deposits made when we get paid. So we save without thinking about it!

I’ve been spending more time at the gym than deal shopping. Also avoiding my fave discount stores and “half off” day at the thrift store has been really helping save money – and impulse buys too!

Yes! That half off day always gets me!!!

If I want to save money, I should probably stop clicking on this app 3-4 times a day 😉😂

Right. 😂

😉

Ha! So funny! Same here!!!

USAA offers its own alternative to Digit. Just a thought for members who might be looking into it.

I just opened a new banking account on Saturday with PNC. They never mentioned the promotion which entitles me to $300. I just emailed the bank about it and am hoping they honor the coupon.

Thank you.

Check out your local credit union. We just got a letter in the mail for 4% interest on CD for one year! That’s really a great rate compared to other banks.

which credit union is that? that’s unheard of good rate.

I just called our cable company & got our bill reduced by 50 dollars. Calling our internet provider tomorrow. I also do swagbucks to earn a little extra as well. https://www.swagbucks.com/refer/mamboys2

My referral link is above. I usually average about $75 a month for swagbucks.

i use the Overdrive app for my local library. I can read books and magazines (even current ones) for free on my i-pad, or kindle.

Overdrive is the best!

Is this a universal app? I’ve never heard of it but it sounds amazing! Thanks for sharing!

If you go to your library website it will tell you if they are on overdrive or not, and then you can download the app and enter your card info.

So cool! Great to know!

I use both Poshmark and Mercari for selling clothing and have had the best luck with Mercari as their shipping prices are a bit better which gives me the opportunity to offer free shipping. The shipping labels are created when you sell an item. All you have to do is package the item and attach the shipping label.

Another way I save money for Christmas is with the Chase Freedom credit card with revolving 5% cash back categories and a great sign up bonus. I keep all of the cash back rewards for the year and use them at Christmas time. If interested please feel free to use my referral code below!

Earn a $150 bonus with Chase Freedom. I can be rewarded too if you apply here and are approved for the card. Learn more.

https://www.referyourchasecard.com/2/8CL2O3VHSF

I also forgot to mention Chase Pay mobile wallet which is also giving a bonus points when you pay using Chase Pay and your freedom card.

I have this card and still don’t know where I can use chase pay at. Kinda frustrating. Have they announced next month’s category yet?

I shop at Goodwill on 50% off sales. I also do e-rewards for surveys and I buy e-gift cards for Macy’s. Kelloggs Family Rewards for r JC Penney gift cards for Christmas shopping. I have been saving up Microsoft Rewards for Toys r us gift cards. I plan on using these for my 2 nephews Christmas presents. Hopefully they do not close before then, but I can switch over to something else.

Check the day! It may be today, I’m trying to look into it as well.

We have a goodwill outlet. I love it. My brother is addicted to it though. You pay by the pound and when you get over 2 lbs it even goes lower. The heavier items have a lower weight than the clothes etc and any electronic item is $3 to $25 dollars. Saw flat screens walk out the door for $25 and they prove that they work. Love it.

I use the ibotta app to unlock virtual coupons when I go grocery, clothes, traveling, electronic shopping that go into an account that I can cash out at any time. So far I have earned $897.62 in cash!! Right now they will give you $10 for trying their app by unlocking and using your first coupon! This is my favorite savings app! I use it the most at Target where I can use my car wheel and this app for a “double dip” in savings!Here is a link:

https://ibotta.com/r/zzjjzj

I saw something about today being the last day to use giftcards! I have one too.

If you or your child has a student email account, you can get Spotify Premium + Hulu subscription for $4.99/month!

How?

When I want to earn a little extra cash, I do a few surveys on Swagbucks or complete the Swago board. You can earn so many bonus points on Swago by earning spins; plus it’s kind of fun. My kids love spinning the wheel! If you’re interested, try out it out: https://www.swagbucks.com/refer/eminem16

You should add to #7 eBay! That’s the only site that I use for buying and for selling my stuff!!

I use southwest to fly home for free often by using points. If you use this link to apply for a southwest credit card and then spend $2000 in the first three months, you get 50,000 points. If you use my link, I receive extra points, too. However, I wouldn’t recommend if I didn’t love the airline and their point system.

https://www.referyourchasecard.com/223/LYUN1MB7J9

I second the cable point..it’s worth a shot. We called the year before last and got our cable bill reduced. They were pretty accommodating, more than I expected. Was happy cuz I love cable 😉

EBay…I know there have been lots of posts about Mercari, but I LOVE EBay because you can sell just about anything and make some serious money! 🙂

Do you have to have a seller account? What are the fees involved?

I use the OfferUp and Letgo apps to sell stuff around my house without the hassle of a garage sale. They are also local buyers so you don’t have to worry about shipping either.

I agree with the 24 hour rule – it works!

Creaclip for cutting your own hair and your kids as well. tons of youtube clips that show you how to do it. Cut hubby’s hair also having learned on youtube. Also figured out how to have an iphone (older one of course) but only pay $12.50 a month from tracfone for service. Magicjack for a landline for only $35 a year. Yes cut that cable and go to streaming, red box etc…Saves so much money! The tips are endless but it feels good to live on less and with all the savings I’m paying down on my house like crazy.

Jessica, can you send referral code for “Mercari”

meenatwo2@yahoo.com

I sell online and sell all of our unused clothes too. I sell on eBay, Mercari and Poshmark. Poshmark is easiest in terms of listing and shipping (they ship the label to you, no weighing or choosing shipping methods). However, the layout is confusing when you first signup. Poshmark takes a flat fee of 20% commission. Mercari stakes 10% and eBay & PayPal roughly takes 14%. Poshmark is clothing, shoes and new makeup only. Mercari & eBay are everything.

Use natural daylight in indirect sun to take photos. Measurements are helpful and be 100% honest with description. I take photos of tags and material content.

If interested in Poshmark, my referral code gives you $5 and me ; Rubybeach

Be careful about calling your cable provider by making sure you are in a spot where you can pay attention to them 100%. I called to get a discount (I guess the plan I was on wasn’t live anymore) and they said I needed to get on a plan to lower my bill. I was paying $98 on my current plan and and they said they would lower my bill. They lowered it to $115. I am not kidding. I wasn’t paying attention cause of the kids running around and they got me.

Take pictures of your gas receipts and get cash back! So easy! And they give you $3 to start! trunow app. Referral code 17PTE2. Verify gas prices and also get money!!!

Before I make any purchase, I always use my ebates! It’s cash back for your purchases. I use it for everything and have earned quite a bit back! I can email you a referral code if you send me your email!

I like the FETCH app! All you do is snap pics of your receipts, earn points and redeem for gift cards!! Sign up and get 2000 points to get started!

A2XPE 😀

For free digital magazines check your local library. Our small town Library offers over 60 magazines through Flipster free with you Library card. Also free ebooks and audiobooks to download.